Since sustainable (“green”) bonds were first introduced, the fixed-income market has seen the confluence of three events: increased demand from asset owners looking for sustainable strategies; more data showing improved risk/return characteristics for sustainable bonds; and increased interest by issuers. Today, these bonds have become more mainstream.

Exceptional Growth in Green Bonds

Since early 2019—when we first discussed opportunities for fixed-income investors in sustainable investing strategies—the green bond market has seen significant growth. Indeed, growth in green bond issuance has been nothing short of exceptional.

In February 2019, the Bloomberg Barclays MSCI Green Bond Index had 323 constituents comprising $252.4 billion of outstanding debt. By the end of 2019, the index had 453 constituents and $361.1 billion outstanding. And by the end of 2020, it had 597 constituents representing $547.4 billion outstanding.

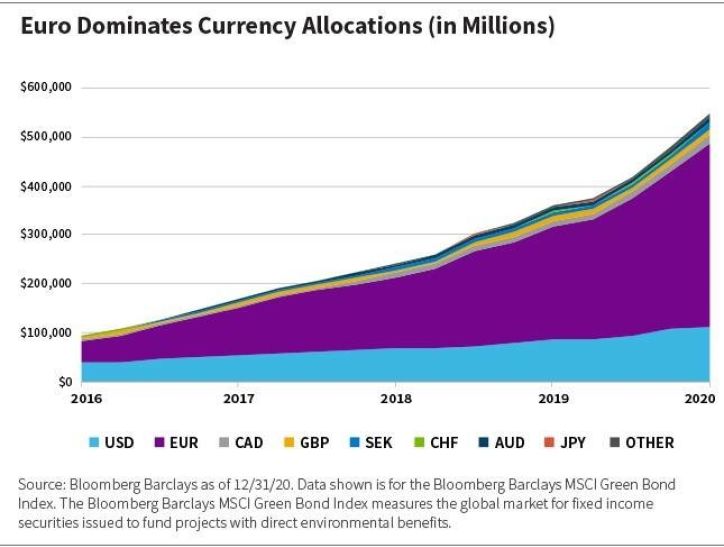

This growth is not an isolated phenomenon. The 50% growth rate in the Bloomberg Barclays MSCI Green Bond Index in 2020 is consistent with the growth rates shown by other sustainable index providers. In the charts below, we summarize the growth and composition of this index.

First, as shown, the euro market was an early adopter of green bond investing and continues to lead global green bond issuance. But the U.S. dollar market has seen steady 30% growth over each of the past few years.

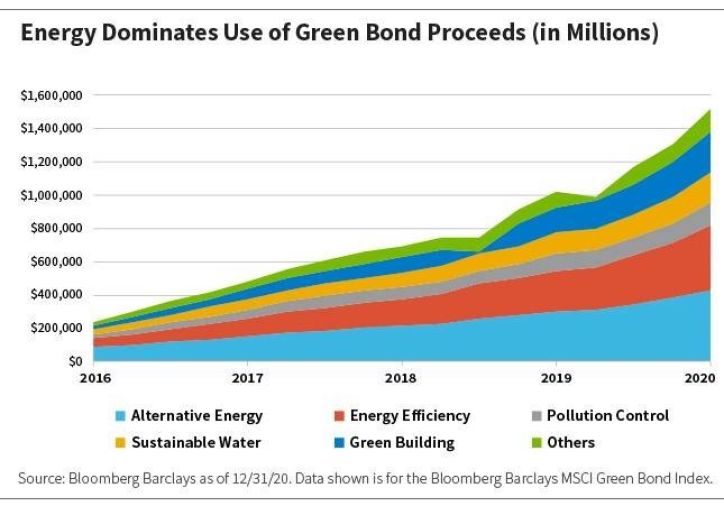

Additionally, consider the growth in the Bloomberg Barclays MSCI Green Bond Index sorted by use of proceeds. Issuers often declare multiple uses of bond-issuance proceeds, so the numbers do not match those from the previous chart. But it is notable that energy-related themes continue to dominate the declared uses, although the market has seen consistent growth in the other categories as well.

According to J.P. Morgan, environmental, social, and governance (ESG) funds have grown by 300% since 2015 and are expected to grow to more than $3.0 trillion by the end of 2020. J.P. Morgan forecasts that ESG funds will outnumber conventional funds by 2025. Given this continued growth in demand, issuers have clearly taken note.

Innovation in Fixed-Income Issuance

The nature of green bonds is also changing. Over the past couple of years, the bond market has seen innovation in this type of issuance.

We have seen an evolution from “green” bonds to “sustainable” bonds to “sustainability-linked” bonds.

For example, we have seen an evolution from “green” bonds to “sustainable” bonds to “sustainability-linked” bonds, the latter of which make pricing/coupon adjustments if the issuer does not meet certain predefined sustainability targets by a specified date.

The COVID-19 pandemic also changed green bond issuance by exacerbating global social issues. This inspired many companies to begin issuing “social” bonds, whose proceeds are dedicated to socially oriented goals. While the “E” part of “ESG” has not taken a back seat, today issuers and investors alike are more focused on the “S” part of the ESG equation than they have ever been.

We have also seen issuance of sustainable bonds in the structured products segments of the markets, with asset-backed issuers becoming involved. We see this as a positive. Innovation and growth in this market—in addition to corporate and sovereign bonds—allow fixed-income investors more options to build a fully diversified investment portfolio.

Green vs. Conventional: What is the Difference?

The market has seen some pricing advantage for issuers of sustainable bonds (lower risk premium leads to a lower coupon/cost to the borrower).

But data has suggested that investors can benefit from sustainable bonds as well. Specifically, they appear to have had lower volatility in down markets. The COVID-19 pandemic gave us a real-time, extreme-market scenario in which we could test this thesis, and it has played out that way in our process/portfolio.

When comparing green and conventional bonds from the same issuer and with comparable maturities, we saw the spread premium increase significantly in the early days of the pandemic (around the middle of March 2020), when the crisis started to affect bond-market liquidity.

In the bonds that we followed, trade data showed that the spread on conventional bonds widened more than that of the green bonds. In some cases, the short-term outperformance by green bonds was greater than 50 basis points, indicating that green bonds can help reduce portfolio downside in a market sell-off.

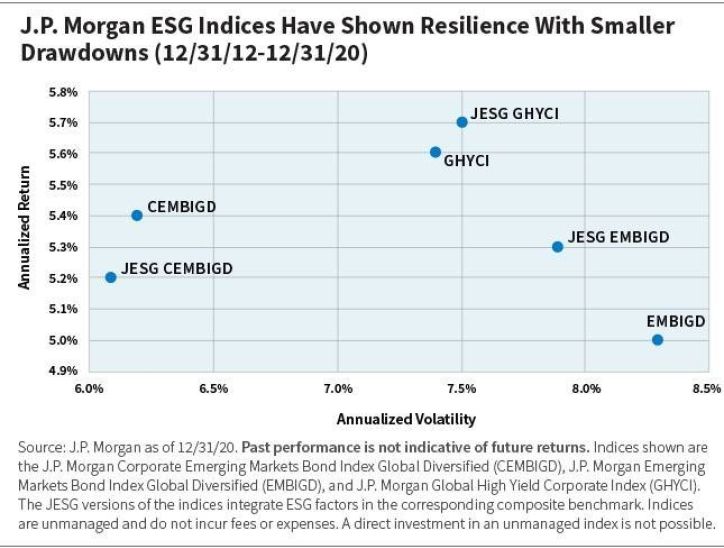

At a broader level, J.P. Morgan publishes a series of ESG indices (called the JESG indices) that parallel the firm’s traditional bond indexes but include filters and overlays for green/ESG-related bonds. These indices have been more resilient than their corresponding conventional bond indices, with smaller drawdowns during risk-off markets.

The following chart—which shows three J.P. Morgan indices and their corresponding JESG indices—illustrates. Two of the three of the JESG indices had lower volatility, while the third showed comparable risk. Additionally, only one of the three indices earned a rate of return less than its conventional counterpart.

The Future Is Green

With a seemingly persistent pricing benefit combined with growing demand, issuers are clearly interested in tapping the green-bond investor base.

We see more issuers engaging with fixed-income investors. During the pandemic, we participated in a number of virtual roadshows with issuers from a variety of industries, including financials, utilities, and industrials. Most of these engagements were with companies looking to issue their first green bond.

As the market has evolved, most green bond issuance has been from first-time issuers. But given the continued growth in demand and the success of this market as a funding source, we believe the issuer base will broaden, augmented by previous issuers returning to this market as an ongoing source of funds.

When it comes to investing, gimmicks are a dime a dozen, and fads come and go. So when green bonds were first introduced, many questioned their efficacy. However, now that years have passed and we have seen multiple innovations in the market, I believe we can safely say that the green bond market is here to stay.

Todd Kurisu, CFA, is a portfolio manager on William Blair’s Fixed Income team.

The J.P. Morgan Corporate Emerging Markets Bond Index Global Diversified tracks the total return of U.S. dollar-denominated corporate bonds issued by emerging markets entities. The J.P. Morgan Emerging Markets Bond Index Global Diversified tracks the total return for U.S. dollar-denominated debt instruments issued by sovereign and quasi-sovereign entities. The Global Diversified versions of the indices limit the weights of index countries. The J.P. Morgan Global High Yield Corporate Index tracks the total return of U.S. dollar-denominated global high yield corporate debt. Index information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2021, JPMorgan Chase & Co. All rights reserved.

Environmental, Social and Governance (ESG) strategies may take into consideration factors beyond traditional financial information to select securities, which could result in performance deviating from other strategies or benchmarks, depending on whether such factors are in or out of favor in the market. ESG strategies may rely on certain values based criteria to eliminate exposures found in similar strategies or benchmarks, which could result in performance deviating.