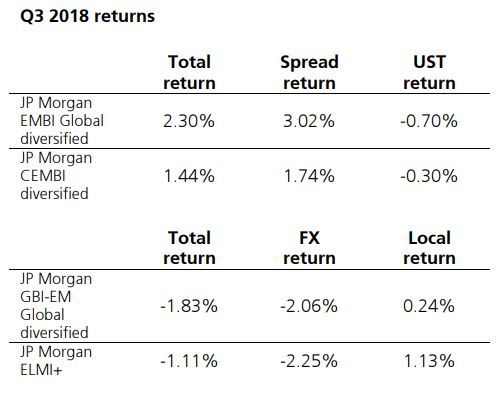

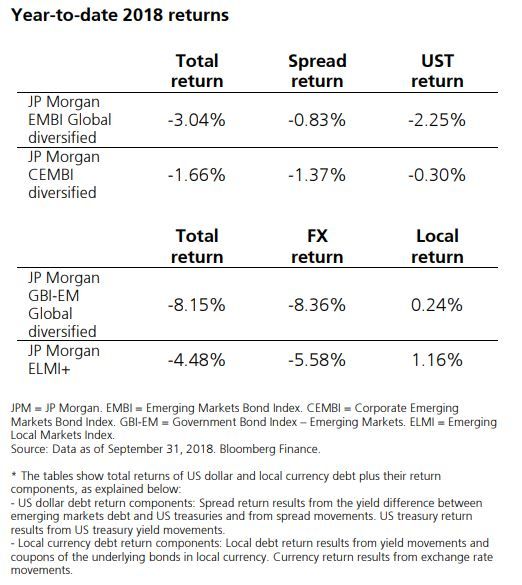

Sovereign (corporate) credit spreads tightened 34 (11) basis points (bps) to 335 (321) bps over US Treasury yields. Sovereign (corporate) credit returned 2.3% (1.4%) on account of tighter spreads as the UST curve continued to widen (20bps). Local emerging market assets continue to perform markedly worse than credit, delivering a -1.8% return in Q3.

However EM debt experienced a return rollercoaster during Q3, as did UST yields. The quarter started on a positive note with strong returns in all asset classes in July, after a poor Q2 and June in particular. Local debt returned 1.9% while sovereign (corporate) credit spreads tightened 42 (25) basis points producing a 2.6% (1.5%) return in the July. However the situation in August took a turn for the worse on the back of sharply worsening conditions in Argentina and Turkey, surprisingly negative polls in Brazil, treats of sanctions in Russia and discussions on potential land grabs in South Africa. As a result local debt sold off dramatically, returning -6.1% in August, with Argentina and Turkey returning -35% and Brazil, Russia and South Africa -11%. Sovereign (corporate) spreads widened 43 (34) bps in August, more than offsetting the tightening of July but delivered only -1.7% (-1%) returns as UST yields rallied. September delivered positive returns in all asset classes once again as the situation in most countries improved at the margin.

Unsynchronized growth in a de-globalized world

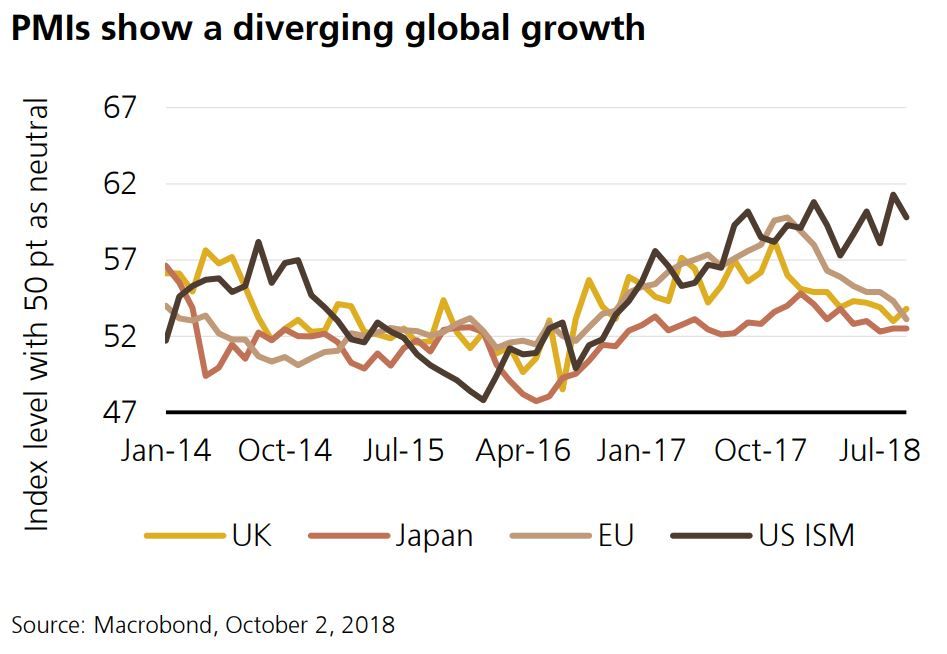

Global growth has decelerated from the very strong numbers in Q4 2017 and Q1 2018. Furthermore growth divergences among developed countries have increased – the US is still going strong with Europe and Japan are stabilizing – while EM has slowed down. This is a feature of the current juncture that will affect emerging market economies and drive returns going forward.

Furthermore, inflation in the US has normalized and is increasing everywhere else, compliments of higher oil prices. This situation calls for further normalization of rates in the US and, at some point, normalization in developed Europe and Asia. However, the notable divergence in global monetary stances will continue to be a feature of the current juncture affecting USD and UST levels. In an environment in which the US continues to report strong growth figures – compliments of sustainable supply side effects brought about by lower corporate tax rates and de-regulation but also by possible unsustainable demand-side fiscal impulse – into early 2020, when most effects die down, we expect USD to strengthen but UST to trade in a well-behaved range in the next 3 months.

A third feature that may affect returns going forward is the potential impact of US-driven protectionism on the world economy. Although the NAFTA dispute has come to an apparent end with what we believe to be an unequivocally worse treaty for Canada and Mexico (assuming Congress ratifies the new USMCA) and no reprieve on aluminum and steel tariffs, the confrontations between the US and China on the trade front are far from resolved. During Q3 the US upped the ante by imposing tariffs on additional USD 200 billion of Chinese exports to the US. With this latest measure, about 50% of Chinese exports to the US are now subject to higher tariffs. The world took this development with surprising calm because the tariff was only 10% as opposed to the widely advertised 25% and also because of China's measured response. However, the trade dispute between the US and China is far from over and has the potential to disrupt global growth and trade in 2019 if it escalates further into a trade war. The US has indicated that it is prepared to increase tariffs to 25% on the USD 200 billion in early 2019, absent a resolution to its demands. Furthermore, it appears that the US is prepared to impose such tariffs on all Chinese exports to the US if China does not agree to address the US demands. Whether this is just a negotiating tactic or a decision is yet to be seen.