e-fundresearch: "Mr Alexander Farman-Farmaian, you are the fund manager of L-Select Fund (Luxembourg SICAV IV) (ISIN: LU0304955437) fund."

Farman-Farmaian: "Although I am the designated portfolio manager for L Select, Edgewood’s 6 member Investment Committee makes all the investment decisions for the L Select Portfolio."

e-fundresearch: "Since when are your responsible for the fund management?"

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...Farman-Farmaian: "Since 1997. I initially was the investment manager for L Select during my tenure at another firm. Subsequent to my joining Edgewood, L Select hired Edgewood as the investment manager for the US Select Growth sub-fund."

e-fundresearch: "Which benchmark do you adhere to?"

Farman-Farmaian: "S&P 500."

e-fundresearch: "Are you also responsible for other funds at the moment?"

Farman-Farmaian: "Yes."

e-fundresearch: "What is the total volume that you manage in all your funds?"

Farman-Farmaian: "Edgewood Management LLC’s AUM was approximately $7.0 billion (as of 3/31/12)."

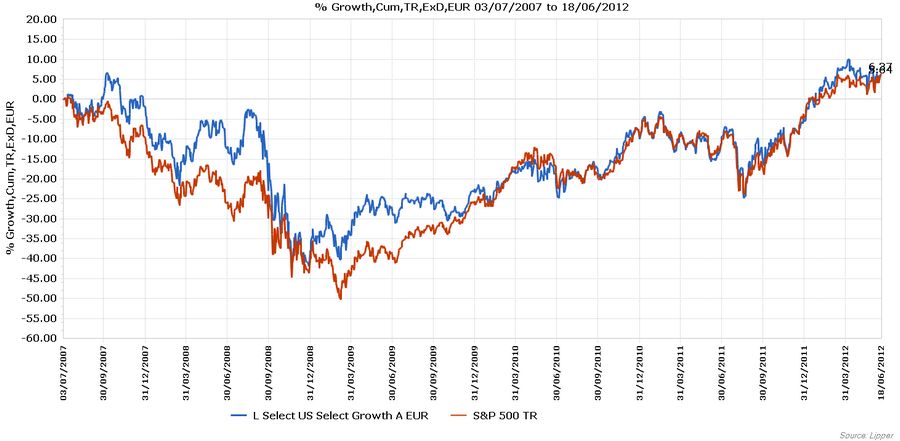

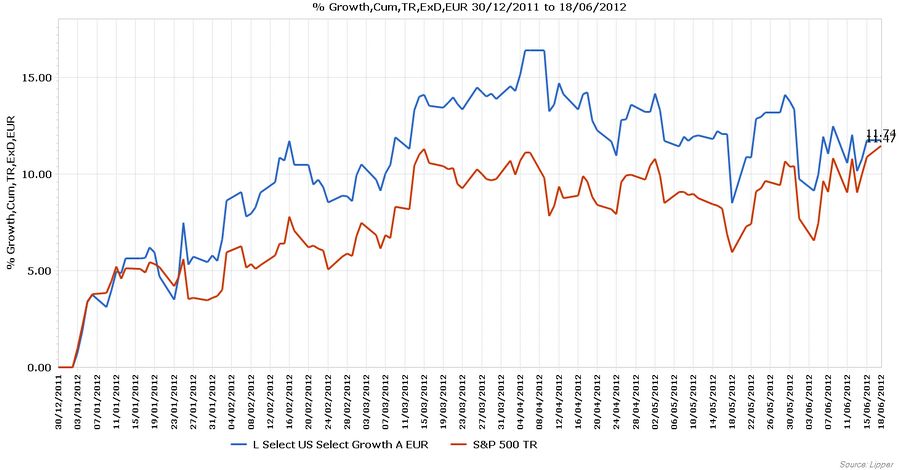

e-fundresearch: "Regarding the performance: which performance did you achieve since the beginning of the year and in the years 2007-2011? Absolutely and relatively to the relevant benchmark?"

Farman-Farmaian: "Since the start of the year 2012, and up to end of March 31st 2012 the L Select US Select Growth Class I USD share class was up +17.0% versus the S&P 500 benchmark of +12.6%. For the period January 1st 2007 to December 31st 2011 the L Select – US Select Growth Class I USD share class was -1.9% cumulatively, versus -1.2% for the S&P 500 Index in the same period."

e-fundresearch: "How content are you with your own performance in the last years and this year?"

Farman-Farmaian: "We are very content with the performance, although I believe it will get better as investors start to choose high-quality U.S. Growth Stocks (which is what the Fund is invested in) now that global economies are slowing down a bit."

e-fundresearch: "How are you able to deliver added value for your investors with your performance?"

Farman-Farmaian: "Our team does a lot of in-depth research in a target company and we then apply a disciplined valuation approach to each stock to determine if it is cheap to buy."

e-fundresearch: "How long have you been a fund manager already?"

Farman-Farmaian: "Since 1987."

e-fundresearch: "What were your biggest successes and your biggest disappointments in your career as fund manager?"

Farman-Farmaian: "The biggest successes came when the Fund came out as the best U.S. Fund in France for our French clients. The biggest disappointments came in 2008, when clients got scared and sold cheap stocks rather than being patient."

e-fundresearch: "What kind of capital market situation do we have at the moment? How do you act in this environment?"

Farman-Farmaian: "We seem to have nervousness. That means that we should be careful in picking steady growing companies in which to invest. That is what Edgewood’s Investment Committee attempts to do for the Large Cap Growth portfolio."

e-fundresearch: "What are the special challenges in this environment?"

Farman-Farmaian: "The Special challenges are to take advantage and buy cheap stocks when the Macro fears make the market sell-off as other investors get scared."

e-fundresearch: "What objectives do you have till the end of the year and in the mid term for the upcoming 3 to 5 years?"

Farman-Farmaian: "Edgewood’s objectives are to be up mid to high 20% for the year and to double client assets in the next 3 to 5 years."

e-fundresearch: "Do you model yourself on someone? Any ideals?"

Farman-Farmaian: "There are many great investors, all are examples for me. I read and follow many like Peter Lynch, and Warren Buffett."

e-fundresearch: "What motivates you in your job?"

Farman-Farmaian: "Doing well for my clients. It is what makes me proud and able to help them do what they want, for instance charities that help the world need to see their capital appreciate with time."

e-fundresearch: "What else do you want to achieve or do you have any further aims as a fund manager?"

Farman-Farmaian: "I would like to continue doing well in performance and specially after seeing U.S. large capitalization stocks underperform as a class for 10 years, I want to be able to harvest the outperformance I expect in the years ahead. I would like to grow the Fund in Austria, as I have friend there and I love visiting the country. I am very impressed at the high level of technical expertise I see in the entrepreneurs and business people I have met there."

e-fundresearch: "What other profession would you have taken interest in, apart from becoming a fund manager?"

Farman-Farmaian: "I very much like being a student and also teaching. Much like in Fund management we have to study our companies and also explain that to clients clearly and precisely...like a good professor. We are not always right, but if we can be so mostly, then we will have achieved our aim."

e-fundresearch: "Thank you for the interview!"