Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest? (ISIN: LU0394780216)

The LOF Convertible Bond Asia fund (the fund) invests in convertible bonds issued by Asian (ex Japan) issuers, with a focus on balanced convertibles (delta between 30 and 70 and an attractive bond floor). Our approach combines “top-down” economic analysis with “bottom-up” stock selection.

The team follows an unconstrained high conviction approach with a capital-preservation sensitivity, based on in-depth fundamental and technical research.

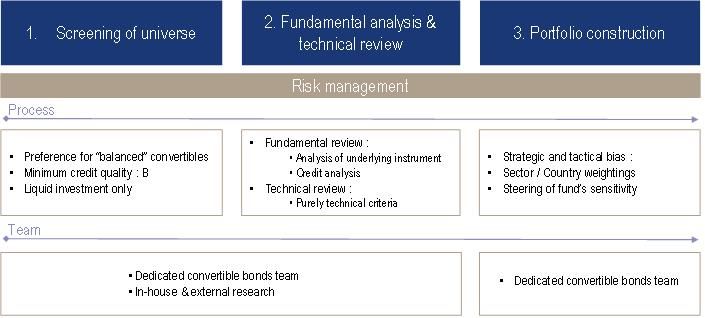

The investment process can be summarized as follow:

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...Figure 1: Investment process

The investment process starts with the screening of the investment universe to focus on convertibles that meet specific criteria that are:

- Credit risk (we focus on good credit, and never invest in securities with a rating lower than B)

- Adequate liquidity (a minimum size of issue ($150m) which guarantees, in our view, a minimum level of liquidity in the instrument)

- Style (we invest almost exclusively in balanced convertible bonds)

Figure 2: Screening of universe

Following the initial filtering (liquidity, credit and balanced nature of convertible), the fund managers and analysts proceed to a top-down analysis based on the Lombard Odier internal strategic views and most importantly, on the convertibles team’s strongest convictions regarding regions and sectors.

In this respect, the fund managers and analysts apply their analysis of fundamentals:

- Sector, country biases

- In-depth work on stock-picking ideas

- Technical choices (convertible bonds with best risk/reward profile)

This process allows for the construction of the major part of our portfolio (between 50 and 70 securities).

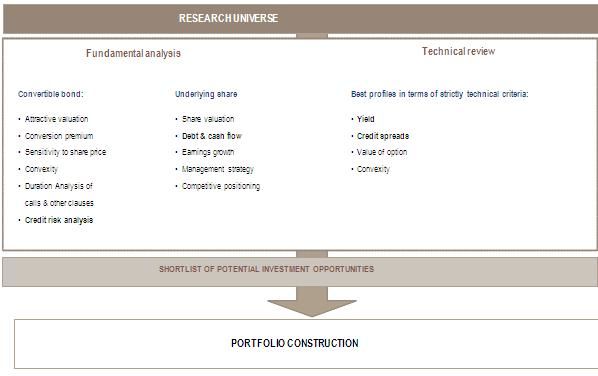

The team also filters the existing convertible bond’s universe based on purely technical criteria, in search of the most attractive profiles:

- Interesting spreads

- High Gamma (high sensitivity to Delta)

- Attractive pricing, etc.

This parallel process must of course never contradict the fund’s investment philosophy. Its purpose is to identify interesting securities on the margin of the core portfolio.

Figure 3: Fundamental and technical review

The team follows a non-benchmarked approach, with a capital-preservation sensitivity. However, we are using the UBS Asia ex Japan Convertible index (USD) as a reference. As we follow an unconstrained approach, the convertible holdings, country and sector weightings can therefore be very different from this index.

Team leader: Nathalia Barazal

Other Portfolio Managers: Giuliano Mazzoni, Jérome Hémard, Arnaud Gernath

Performance Review 2009

Nathalia Barazal & Team: "2009 was an exceptional year of rebound for Emerging Markets. The MSCI Asia ex Japan index was up 72%. The Fund has a disappointing performance compared with equity markets because of our very defensive positioning adopted after 2008 crisis. The Fund’s volatility in 2009 was 3.9% whereas it was 26.7% for Asian equities."

Performance Review 2010

Nathalia Barazal & Team: "Asian equities were up 19.6% in 2010 (MSCI Asia ex Japan, USD). The Fund succeeded in capturing 75% of this performance thanks to a good high conviction stock/credit picking, and with a fraction of equities’ volatility (6.3% vs. 17.6% for Asian equities)."

Performance Review 2011

Nathalia Barazal & Team: "In 2011, Asian equities tumbled -17.3%. The Fund registered 55% of the downside, respecting the asymmetry of the asset class. Our underweight position in Property sector weighed on performance as the sector outperformed in 2011. Again, volatility was smaller for the Fund (7.4% vs. 23.7% for Asian equities)."

Performance 2012 - Year-to-Date

Nathalia Barazal & Team: "The Fund is outperforming equity markets (MSCI Asia ex Japan +1.9% as of 08/06/2012), with a fraction of its volatility (4.6% vs. 16.4%)."

Performance since 2008

Nathalia Barazal & Team: "Because of our underperformance in 2009 due to huge rebound of Asian equities, we only registered 43% of equities’ performance because we did not fully participate in 2009 rally (Since 15/12/2008, Asian equities were up 74.1%). However, from 31/12/2009, we largely outperform Asian equities (MSCI Asia ex Japan +0.8% vs. our Fund is up more than 6%)."

Nathalia Barazal and Giuliano Mazzoni have been working together since December 2004. Jérome Hémard joined the portfolio management team in January 2008 and Arnaud Gernath in December 2011. There are 4 Portfolio Managers in the team and 4 analysts dedicated to Convertible Bonds: Maxime Perrin (joined the team in November 2007 / Product Specialist and Equity Analyst Europe & US), Sandra Remtoulah (joined the team in June 2010 / Equity Analyst Europe & US), Larry Pun (joined the team in November 2010 / Equity Analyst Asia, based in Hong Kong), Lori Woodland (joined the team in December 2011 / Credit Analyst)