Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

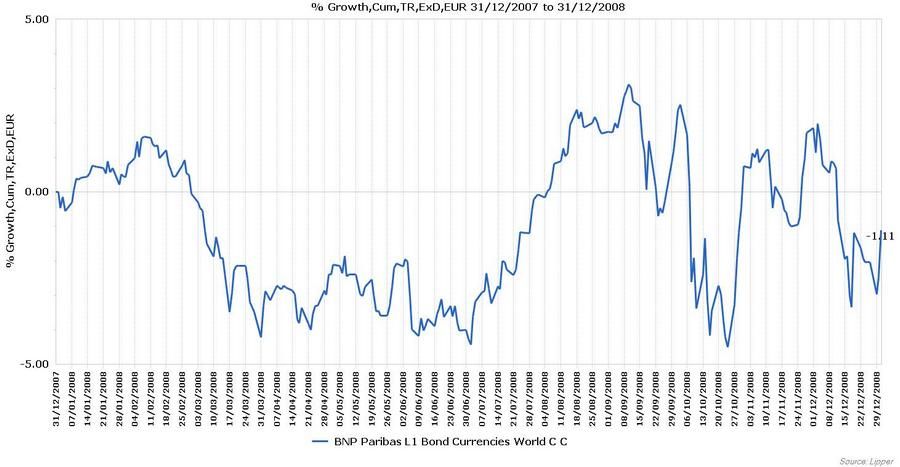

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...Guy Williams: "The fund underperformed its benchmark in 2008. The main reasons of the underperformance were our long overall duration position in April as the market started to believe the Federal Reserve aggressive monetary easing was over and that the credit crunch was behind us. The fund also underperformed in December as its low duration stance impacted performance in a month where bonds markets rallied strongly as economic data continued to come on the weak side."

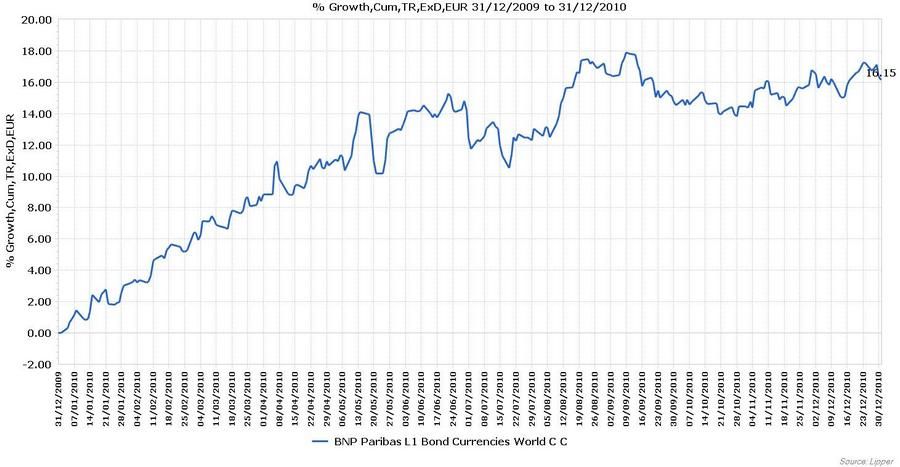

Performance Review 2009

Alex Johnson: "The fund performed very well year-to-date as risky asset continued to perform well in Q1 2012. Weakness in emerging fixed income markets has manifested itself across the globe, but most clearly in Latin America in general, and Argentina and Venezuela in particular. The Argentina 33’s have crashed through a series of supports, including that of the last sustained risk-off trade in the autumn of 2011 when they reached 65.00. They have traded through the lows of 2010 and now with a price at time of writing of 58.50, we are looking to 2009 levels. Venezuela has not performed as poorly, but the reference CDS is trading at around +950. Here the issue is less the absolute level – which was similar as recently as January – but the rapidity of the sell-off, from a low of +680 at the beginning of the month. Venezuela is very specific situation, with good liquidity meaning it is an easy risk proxy, but with a highly volatile political dynamic and a exposure to oil, itself perhaps the purest way of expressing the RORO trade, which readers will know has also dropped like a stone to a little over $83/bbl currently. Argentina is facing a number of problems, not the least of which is sharply slowing growth. Yet we are seeing pricing similar to that of the aftermath of Lehman. An unstructured Greek exit could be worse, but it has not actually happened, and it is few investors’ central scenario: the market may be running ahead of itself. That leaves our preference to be very close to home in fixed income in duration and country exposures. “Risk off” widens bid-offer spreads and makes trading costs high, and we express caution – but it seems premature to be pricing the end of the world. Our cautious stance has been reflected in a basket of currency underweights, which have performed well."

Performance since 2007

Alex Johnson, Co-Head of Global Products

Alex is the Co-Head of Global Products for FFTW and is responsible for performance, growth and development of global products firmwide. Prior to his current role, Alex was Head of Portfolio Management at FFTW. He is based in London.

Prior to his joining FFTW, Alex was a Senior Portfolio Manager at Fortis Investment Management. Before joining Fortis Investment Management in 2008, Alex was on the Global Fixed Income team at BlackRock. Prior to this, Alex spent four years at FFTW where he was the Market Specialist responsible for short-end interest rate strategies across the major currency blocs. Alex came to FFTW from Paribas Asset Management, where he worked as a Portfolio Manager for UK and European funds. Alex has 16 years of global fixed income portfolio management experience.

Alex has an MA in Law from Balliol College, University of Oxford and an LL.M in Law from the University of Virginia. He holds ISMA and London Business School Investment Management Program diplomas.