Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest? (ISIN: LU0172581844)

Our team uses a top-down approach to allocate capital across companies of varying sizes depending on the overarching economic conditions. This is then combined with a bottom-up stock picking approach that leverages the key expertise of our team to create a high conviction portfolio of gold equities. Effectively investing in gold equities requires an in-depth understanding of gold supply and demand dynamics, as well as an ability to critically evaluate company fundamentals using highly detailed models. However, to really add value in this investment area it is crucial to effectively assess mine reserves and fully understand geological data. Our team’s extensive background in the field of geology provides a key edge over competitors, as their mining knowledge enables them to effectively evaluate and judge ore deposits at an early stage. This forms part of a five step investment process that assesses the strength of management, the location and any potential risks, the geology as mentioned, metallurgy, and engineering including equipment and labor assessment.

The portfolio construction process is bottom-up with a top-down overlay. The bottom-up process searches for companies that exhibit one or more of the following characteristics:

1. organic growth

2. value

3. potential for acquisition, and

4. strong management.

For the Fund’s portfolio construction process, the two core allocation groups are:

• Medium- to large-cap gold companies, and

• Small-cap gold or silver producers.

In general, approximately ten positions will be medium- to large-cap producers with a position size of 3.5% to 9% of the portfolio or approximately 50% in total. The other core allocation group consists of 20 to 40 positions in small-cap gold or silver producers with position size varying from approximately 0.5% to 2%. This part of the Fund constitutes 10% to 40% of the overall portfolio. The remainder will be allocated among other medium- to large-cap gold, Platinum Group Metals or other metals producers. These figures may be subject to change.

The top-down process primarily adjusts weightings to match the gold price outlook. With a positive gold outlook, gold beta is increased by allocating more to un-hedged producers, high-cost producers and junior mining companies. In the event of a negative gold outlook, gold beta is decreased by allocating more to hedged producers and large-cap stocks.

Our team conducts its own research, based primarily on a proprietary database of gold-mining companies. The model tracks mine production and costs, reserves and resources, financial data, cash flow, new projects, capital needs, hedge commitments, and capital structure. The models also contain measures of a company’s growth potential, asset quality, financial health, and leverage to changes in the precious metals price. Another key aspect of the research is regular meetings with company managements and site visits to mining properties.

The fund benchmark is the FTSE Gold Mines Index. However, the fund is not subject to any constraints relative to the benchmark as the strategy is entirely bottom up. We have chosen this one in particular as it is a widely recognized, geographically diversified and easily investable benchmark.

The fund manager is Joe Foster.

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...In October 2011, the Fund was transformed in a single-manager product solely managed by Van Eck’s Joe Foster. Previously, the Fund was structured according to a multi-manager approach. Joe Foster has always been the core manager of the Fund.

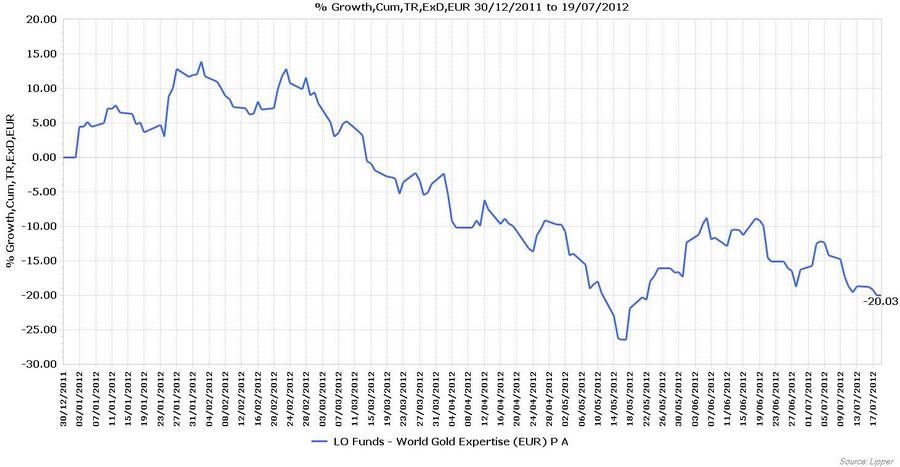

Performance Review 2011

Joe Foster, Van Eck Global: "Gold had a strong start in 2012; however, beginning on February 29, gold resumed its course of consolidation, trading as low as $1539.57 on May 16. On June 29, positive news from Europe pushed gold to $1597.40, for a year to date gain of 2.2%. Despite a higher gold price, gold equities, as represented by the FTSE Gold Mines Index, finished the first half down 19.4%. The LO World Gold Expertise Fund ended the half down 19.3%. Amongst the fund’s top positions, Royal Gold (+16.3%) outperformed, while Osisko ( 28.5%) underperformed. The junior stocks continued underperforming in 2012, with the Market Vectors Junior Gold Miners Index declining 24.8%. We believe we are still in a bull market for gold, and given historically low valuation levels, we expect gold equities to appreciate from here."

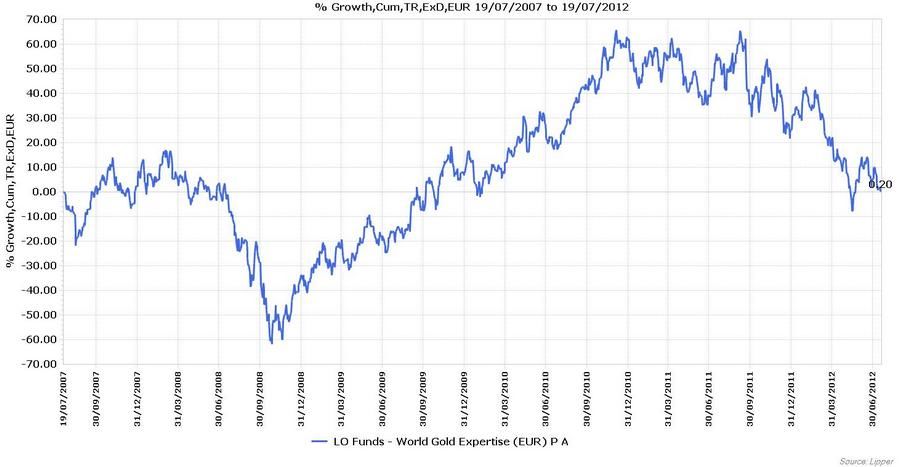

Performance since 2007