Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest? (ISIN: LU0111494059)

Investment universe

- Parvest Equity Euro Small Cap is invested in smaller-sized companies across the Eurozone with a market cap between €250 million and €3.5 billion. The wide investment universe, roughly 1500 companies, offers a large number of investment opportunities.

- Our process seeks to understand a company’s business model in order to have a critical view of its strategic plan and value it correctly. We focus on setting a target price and pay special attention to liquidity: the less liquid the stock, the higher the expected upside should be.

- We also seek to exploit the market’s increasingly short-term investment horizon by investing in companies when their attractive, long-term investment attributes are masked by short term momentum, fashion or random noise.

- Most of our ideas come from our numerous company visits. We also use a proprietary quantitative screening that narrows down the universe and uncovers potential candidates for our portfolios.

- Key elements in our fundamental research are the analysis of cash flows and returns on capital employed: the former should be stable or growing and the latter on a positive trend. The company should have one or more differentiating features such as a unique proposition, a first mover advantage or be a niche player with a technical or marketing advantage.

- When calculating our target price, we assess the confidence level and analyse the risk/reward scenario.

- Risk management is crucial at every step. We focus on construction and have well-defined diversification guidelines.

- Selling discipline: when the target price is reached, we review our investment case to see whether the stock still has upside potential or whether it should be sold. Underperformers are systematically analysed to differentiate between changes in fundamentals and a contrarian view.

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...

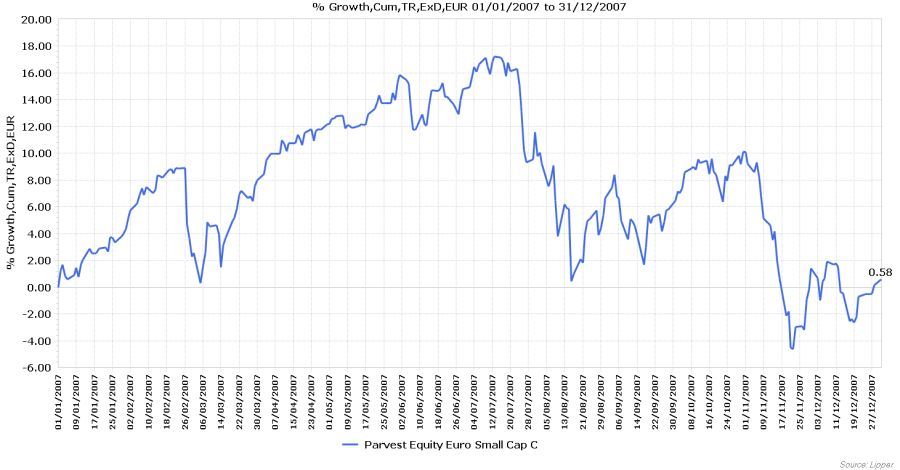

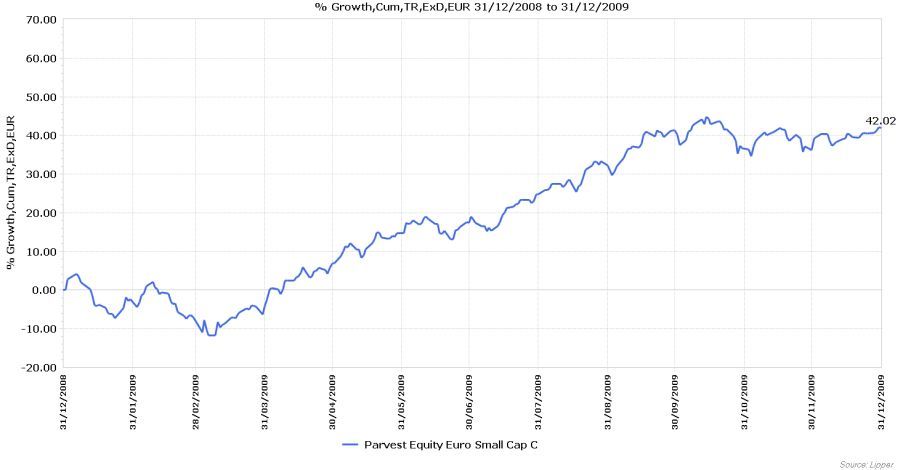

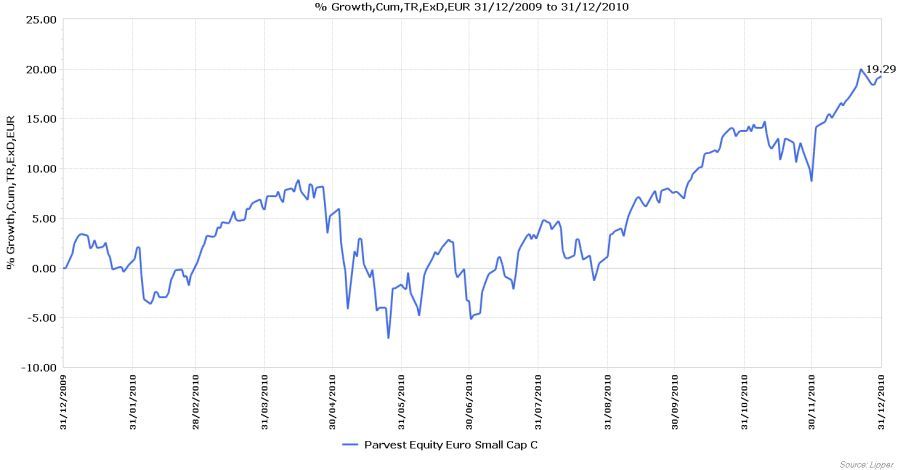

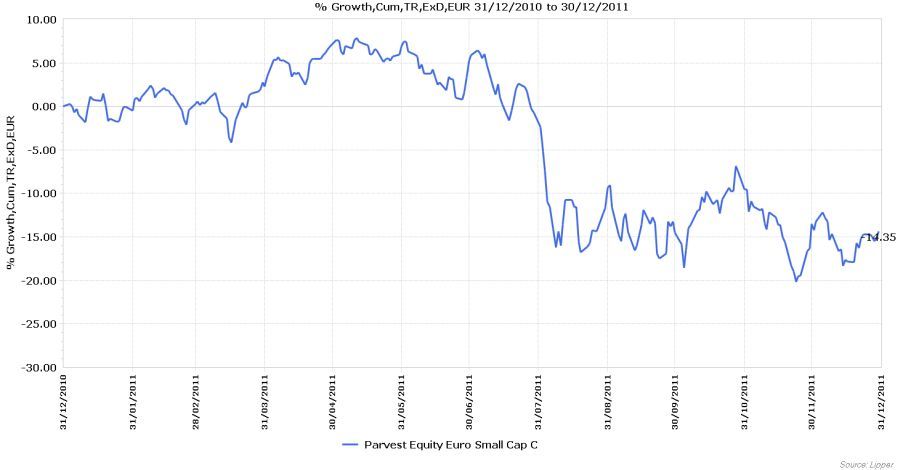

Eve Bouard: "Since 2007, European equity markets recorded high levels of volatility with a strong rebound in 2009 and sharp falls in 2008 and 2011. In the Eurozone area, the situation remains tense with great uncertainties about sovereign debt crisis and economic outlook.

Over the period, the fund’s return is -26.22% (as of 11/06/2012, net of fees), outperforming the benchmark indicator by + 1629 bps, which is down -42.51%. The outperformance is mainly due to relative underweight position in cyclical sectors as well as good stock-picking in growth companies with strong balance sheet. We have capitalized on the volatility and markets decline to buy stocks whose potential seemed undervalued. The fund has also benefited from M&A deals and relevant profit-taking at the right time.

In this environment, we remain confident about the prospects of Euro SmallCaps. The sector should be supported by increasing M&A activities, and we still believe the fund should benefit from investments in growing companies, with a solid track-record and a healthy balance sheet."