e-fundresearch: "Please comment on the current market situation and your outlook for the global economy for the next 12 months."

Velot: "We are entering a period of sub-optimal growth in most developed markets, as a result of a lengthy process of deleveraging of the banking sector, whilst government balance sheets have already being used to stimulate growth through a set of unconventional policies. Emerging markets are also suffering from lower demand from developed markets to where they export, whilst they are progressively building up their internal demand as overall wealth is progressing.

Markets are currently concerned over the political uncertainties surrounding the resolution of the Euro crisis, whilst lower growth is increasing the challenges for governments in implementing fiscal consolidation policies."

e-fundresearch: "What is your outlook for the Euro Credit market?"

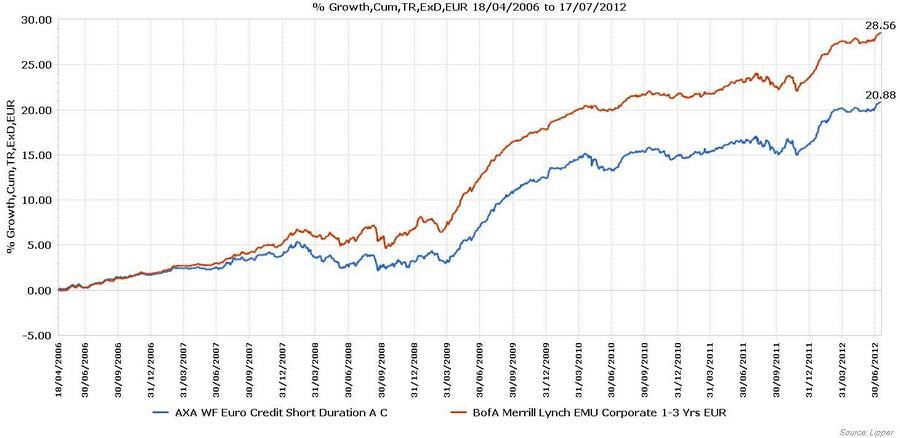

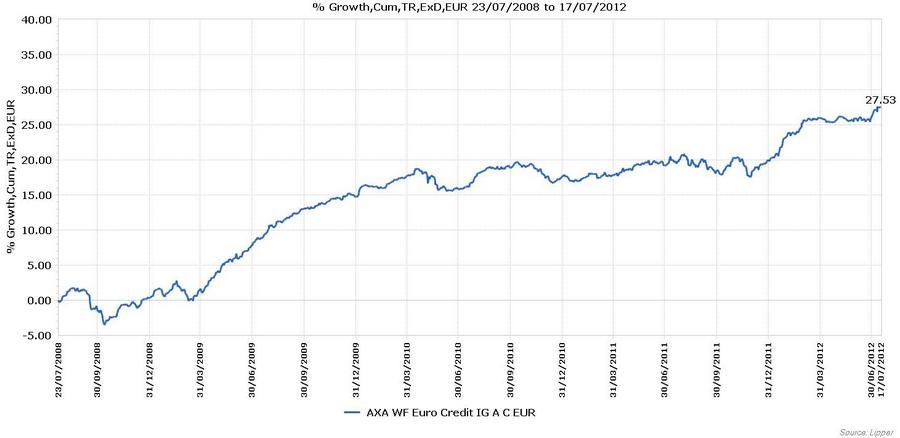

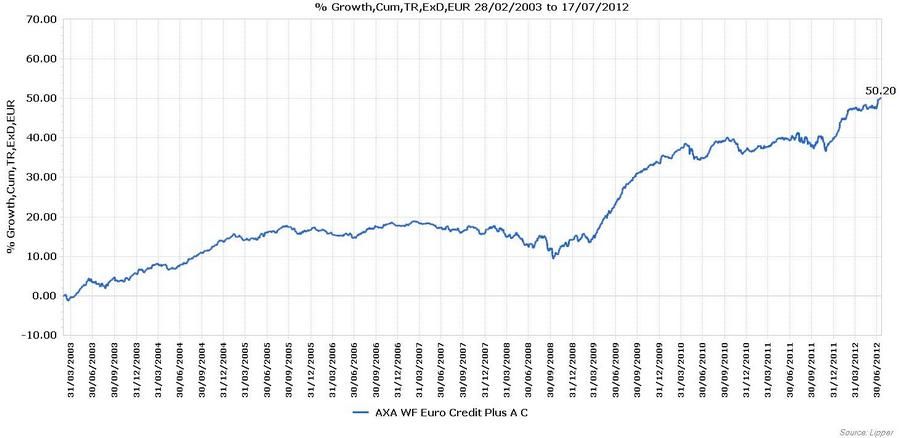

Velot: "Fundamentals in the Euro Credit market are very resilient, with corporate managing their balance sheets very conservatively and financial institutions working hard to set aside more capital whilst lowering their level of business risk, which is supportive for bondholders. Valuations are attractive and the structural demand is strong on the asset class as it has exhibited limited volatility since the banking crisis started in 2008, together with acceptable returns. Overall, the volatility of a European credit index between January 2008 and March 2012 has been around 4% with its annual total return close to 6%. The market is subject to periods of volatility around the sovereign crisis, and the improvement in risk premiums is not expected to be linear, but this still offers attractive opportunities."

e-fundresearch: "Will there be inflation or deflation in the Euro zone in the coming 1-3 years?"

Velot: "The set of monetary policies that have been put in place is more biased towards creating a potential uptick in inflation, but the trigger of inflation is not simply dictated by monetary policies."

e-fundresearch: "What is your strategy in volatile markets?"

Velot: "We have been more active and more agile in our positioning on the financial sector and the peripheral countries. We were extremely defensive on the financial sector in 2008, then more offensive in 2009. We were very defensive both in our peripheral exposure and our financial exposure in the second half of 2011, then started to unwind our positioning from December, when Mario Draghi was proposing to support the banking sector in exchange for a long-term commitment to fiscal discipline. In mid-March we reduced again our level of risk, whilst the Spanish situation sounded more challenging, whilst we have been adding risk selectively from June, as the European political response showed signs of further cohesion."

e-fundresearch: "What is your view on European companies? Please comment on their current situation, revenues, balance sheets, relation to banks etc."

Velot: "European companies have a broad range of profiles and operate along a wide range of sectors. They current credit profiles are very conservative with limited leverage and ample liquidity on the balance sheets. Their revenues are broadly diversified with “only” 43% of their revenues generated in the Eurozone."