Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest? (ISIN: LU0068578508)

Amundi International SICAV’s investment philosophy is to preserve capital over time by following a benchmark agnostic fundamental bottom-up approach focusing on companies with quality businesses that the fund’s management team believes have above average sustainable profitability and that are trading at significant discounts to their intrinsic values.

If the Global Value Team can find those opportunities it will invest in equities, corporate bonds and/or convertible bonds. When equity and equity-like investment opportunities seem less attractive, the team may decide to hold cash and cash equivalents (short term government bonds) until markets offer more attractive investment opportunities in equity and equity-like securities. The team also invests in gold mining shares and ETF’s as potential portfolio insurance to achieve the goal of capital appreciation over time.

The Global Value Team defines risk as the permanent impairment of capital, and seeks to avoid that result by investing with a “margin of safety” created by the discount to intrinsic value.

Identifying companies with quality businesses, selling at what the Global Value Team believes is a discount to their intrinsic value, requires us to focus predominately on areas that are temporarily out of favour. These include countries that are in, or are about to experience an economic downturn, industries in turmoil or individual companies that have temporarily disappointed investors. These companies are identified based on extensive reading of both news and industry reports as well as third party research.

The Global Value Team seeks investment opportunities among all capitalizations bands and in all developed markets. The Global Value Team also seeks opportunities in some less developed markets on a limited basis. The team avoids systematically stocks from companies with high gearing, with highly leveraged businesses and stocks from companies located in countries where accounting rules are not in line with OECD standards.

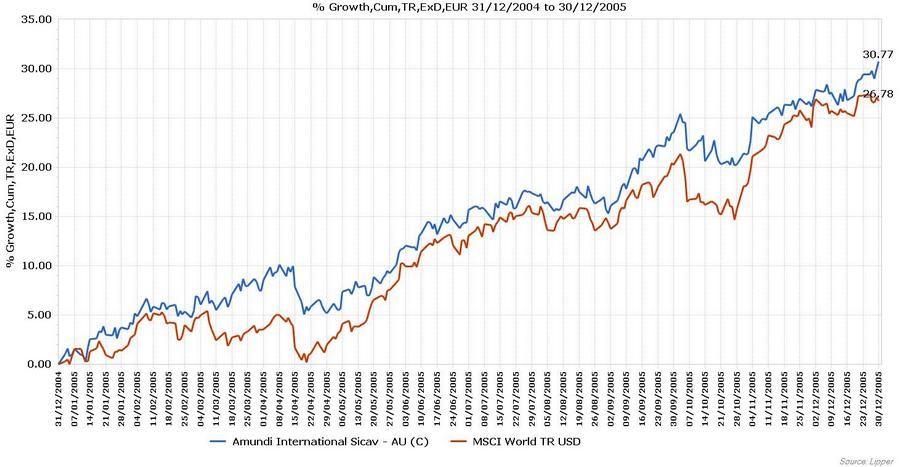

Performance Review 2005

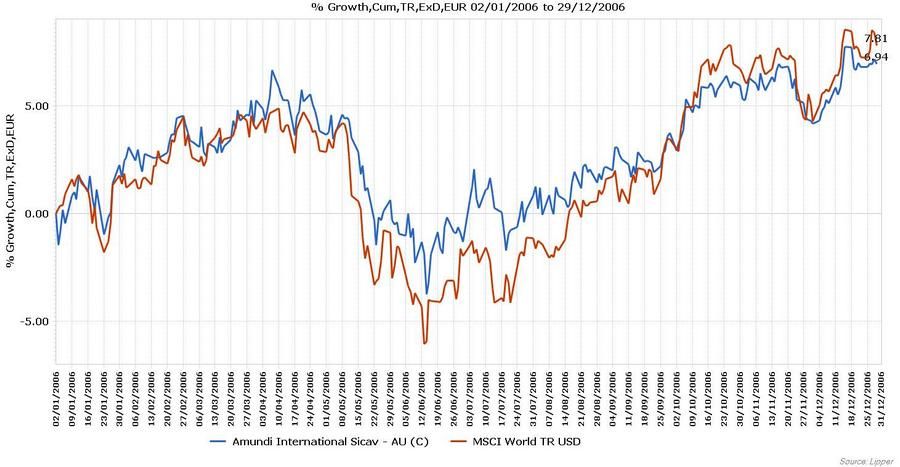

Matthew McLennan:"The net asset value of the SICAV rose +19.53% for the year 2006, while the MSCI World Index - Net was up 20.07% over the period. Stocks from a variety of industries and countries --most notably the United States, France and Switzerland—helped the Fund’s performance. Sodexho Alliance (corporate services, France), Nestle (food, Switzerland), Wendel Investissement (holding company, France), Toyota Motor Corp. (automotive, Japan) and Berkshire Hathaway (holding company, U.S.) were among some of the more successful individual stocks that added to returns. Corporate activity helped the Fund’s performance, in particular the takeovers of Associated British Ports (UK) and Elior (France) as well as the attempted takeover of KT&G (South Korea) and Enodis (UK).

As of year end 2006, the Fund was approximately 0% hedged against the Japanese yen, down from 10% last year as the yen weakened and as we believe Asian currencies should ultimately be revalued against the U.S. dollar. The Fund was also approximately 0% hedged against the euro, which was down from 15% last year, believing the latter to remain somewhat undervalued against the U.S. dollar.

Our biggest worry is that weak housing prices could at some point affect American households’ ability or willingness to spend. A related worry is that a U.S. economic slowdown could trigger slowdowns in many other countries, especially the Asian countries (including China) that export so much to the U.S., as well as the commodity producing countries (the likes of Canada and Australia, but also many emerging markets such as Argentina, Brazil and Russia) that, in turn, export so much to Asia. The old saying “when the U.S. economy sneezes, the rest of the world catches a cold” may still prove to be true.

Investors that practice asset allocation are faced with an unusual situation today when virtually every asset class out there (stocks, bonds, emerging markets, high yield, commodities, real estate, small and mid cap, art, collectibles …) have done very well. Where do we go from there? Will asset allocation provide the hoped for diversification and downside protection?

We believe that your expectations regarding medium term returns ought to be modest."

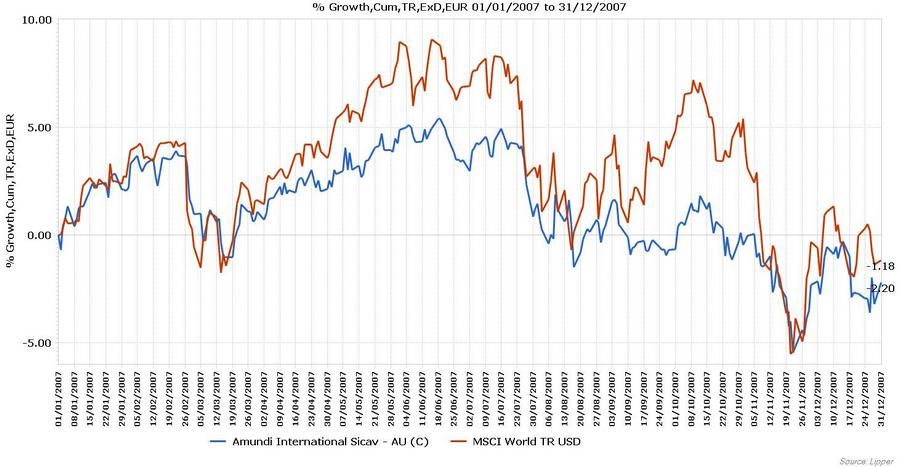

Performance Review 2007

Matthew McLennan:"The net asset value of the SICAV rose +8.24% for the year 2007, while the MSCI World Index - Net was up +9.04% over the period. Stocks from a variety of industries and countries --most notably the United States, Switzerland and Mexico —helped the Fund’s performance. StreetTracks Gold Trust (gold ETF, U.S.), Berkshire Hathaway (holding company, U.S.), Industrias Penoles (mining, Mexico) Nestle (food, Switzerland) and Apache Corp. (energy, U.S.) were among some of the more successful individual stocks that added to returns.

As of year end 2007, the Fund was approximately 50% hedged against the euro which is up from 0% last year, as we believe the euro may be overvalued against the U.S. dollar. We were also 10% hedged on the Swiss Franc and 44.49% hedged on the British Pound. The fund remained 0% hedged against the Japanese yen as we believe Asian currencies should ultimately be revalued against the U.S. dollar.

Since August, we have been faced with the so-called sub-prime housing problem, which is financial crisis no. 6 in only twenty years. No. 1 was the October 1987 crash, no. 2 the real estate debacle of 1990, no.3 the Mexican devaluation of late 1994, no.4 the Asian and Russian crises of 1997-98 culminating in the LTCM hedge fund collapse, no.5 the bursting of the technology-media-telecom bubble in spring 2000. In all five cases, the Federal Reserve flooded the system with liquidity, and the crisis came and went in a few months, without price inflation accelerating, thanks to a large extent to improvements in productivity associated with the technological revolution and to the low-cost Chinese economy becoming the manufacturing center of the world.

The odds may be good that crisis No.6 too shall pass in the next few months. However, sometimes, what matters is not so much how low the odds are that circumstances would turn quite negative, what matters possibly more is what consequences would be if that happened.

Therefore, we are on the side of caution, as indicated by stakes in gold (as potential insurance against “extreme outcomes”), in cash (so far in dollars, since we have large exposure to gforeign securities on an unhedged-yen or 50% hedged-euro-basis). As well, “value” stocks may be less vulnerable than other securities in difficult markets. At the same time, we remain alert toinvestment opportunities, as circumstances and prices change."

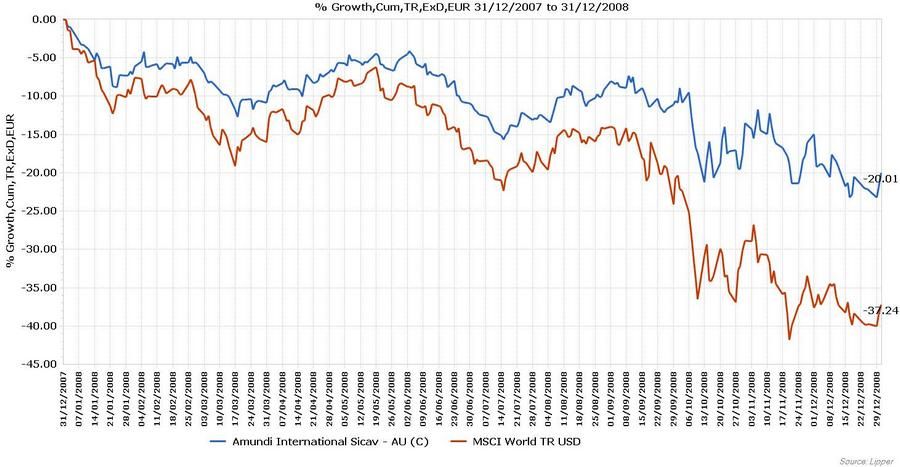

Performance Review 2008

Matthew McLennan:"The net asset value of the SICAV fell -23.54% during the year 2008, while the MSCI World Index was down -40.71% over the period. Stocks from a variety of industries and countries including South Africa, New Zealand and Sweden contributed to the Fund’s performance. Harmony Gold Mining (gold mining, South Africa), Gold Fields (gold mining, South Africa), SPDR Gold Shares (gold ETF, U.S), Vivendi (media, France) and Shaw Brothers (media, Hong Kong) were among some of the more successful individual stocks that added to returns.

As of year-end 2008, the Fund was approximately 60% hedged against the euro, which is up from 50% last year, as we believe the euro may be overvalued against the U.S. dollar. We were also 10% hedged on the Swiss Franc and 87% hedged on the British Pound. The Fund was 30% hedged against the Japanese yen which is up from 0% last year as we believe Asian currencies should ultimately be revalued upward against the U.S. dollar.

2008 was our worst year ever in absolute terms. Even though the fund proved resilient during the first half of the fiscal year, it was unable to withstand the relentless selling which gathered pace in the second half. The de-leveraging of the global economy which began to gather strength in March has had serious repercussions. Although we believe we avoided the permanent impairments of capital caused by losses in the financial sector; our general exposure to equities meant that we were exposed to the negative consequences caused by selling forced as a result of the unwinding of leveraged positions or selling associated with fears about weakness in the economy.

Although it was our worst year in absolute terms, it was one of our best years in relative terms. Not that it is at all comforting (we eat our own cooking...) but there is a difference between temporary mark-to-market losses and those caused by permanent declines in value. In our case, we believe it is possible that the losses can be erased over time. Had our losses been caused by exposure to financial stocks (like AIG, Fannie Mae...) we might never be able to recover the lost capital. This is the position in which many funds find themselves today and why we find at least some solace in our performance this year.

However, we remain wary over the longer term of the consequences of the massive global reflation effort currently underway. We can not predict the future but we do wonder if a potential outcome from the crisis is that authorities are too successful over time. Our gold position could provide some ballast should the paper currency standard lose its appeal."

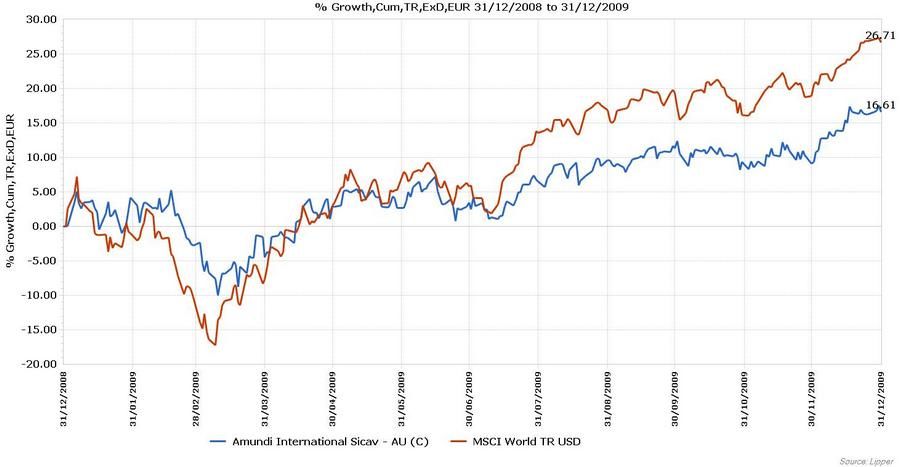

Performance Review 2009

Matthew McLennan:"The net asset value of the SICAV rose +19.53% during 2009, while the MSCI World Index rose +29.99% over the same period. Stocks from a variety of countries, including the U.S, Japan, France and Switzerland, contributed to the Fund’s performance. Specific stocks (and their industries and countries) that added to returns included American Express (credit cards, U.S), Industrias Penoles (mining, Mexico), Malaysia Airport Holdings (investment holding company, Malaysia), 3M (diversified manufacturer, U.S) and Berkshire Hathaway (holding company, U.S.).

As of February 28, 2010, the Fund was approximately 45% hedged against the euro, which is slightly down from a 50% hedge last year. We were also 31% hedged on the Japanese yen which is in-line with our hedge a year ago. During the last year we also initiated a 100% hedge against the exposure we gained to the Mexican Peso through our investment in Mexican securities other than the Mexican mining stocks in the portfolio.

Over the past twelve months the fund has evolved as we have deployed some of our deferred purchasing power and we have recycled capital from ideas approaching intrinsic value to those offering greater value. Today we own some good businesses at good prices, some mundane businesses at compelling prices, some gold as a potential hedge and hold a little cash in reserve. On the business front, many of the companies we own have no debt, they support world wide leadership positions in their markets, are run by prudent entrepreneurs and most importantly trade at single digit multiples of their pre-tax operating profit potential. These investments offer potential cash yields in excess of bonds and scope for long term participation in a growing pool of nominal world wealth. The price of gold is not as cheap as it was but with the epicenter of world monetary creation moving from the Western advanced economies to the Asian emerging economies, there are new buyers competing for this resource and reluctant sellers given the architectural challenges recently experienced in the advanced world financial system. Our cash level has varied being drawn down at the depths of the crisis as our allocation to equities went up and subsequently drifting up a bit as some ideas approach intrinsic value; the cash level is still well below historical peak levels where value was harder to come by."

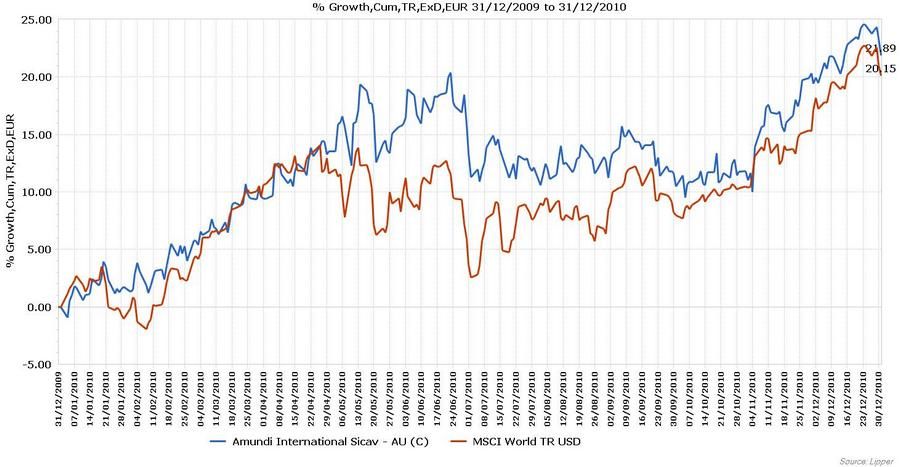

Performance Review 2010

Matthew McLennan:"In 2010, Amundi International SICAV outperformed the market represented by the MSCI World by 2.21% (net of fees, USD, AU-C retail share) by providing a 13.97% return when the MSCI World was up 11.76%. This excess return was mainly due to the funds exposure to more defensive stocks, to Japanese listed equities and to gold-related securities."

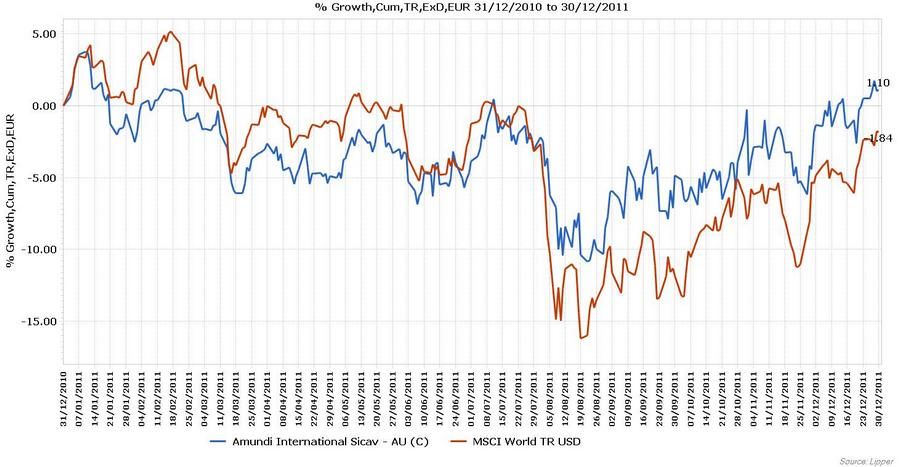

Performance Review 2011

Matthew McLennan:"In 2011 Amundi International SICAV (net of fees, USD, AU-C retail share) has registered a return of -2.18%, outperforming broad markets as MSCI World registered a -5.70% loss over the same period. After a 2 year rally on equity markets, the portfolio managers had been holding a cautious positioning for the fund (28% in cash & cash equivalent securities at the end of April 2011) as market valuations had been increasing steadily since March 2009. Being long term oriented, the portfolio managers are in deed willing to let the cash positions increase if investment opportunities offering a suitable margin of safety are more seldom in the market rather then overpaying securities and risking capital depreciation. With almost 28% in cash & cash equivalents and with around 10% exposure to gold-related securities, Amundi International SICAV provided a relative resilience during the strong market correction that has occurred during summer 2011. The conservative portfolio structure as well as the absence of the “big banks” are combined the main contributors to the fund’s relative outperformance in 2011."

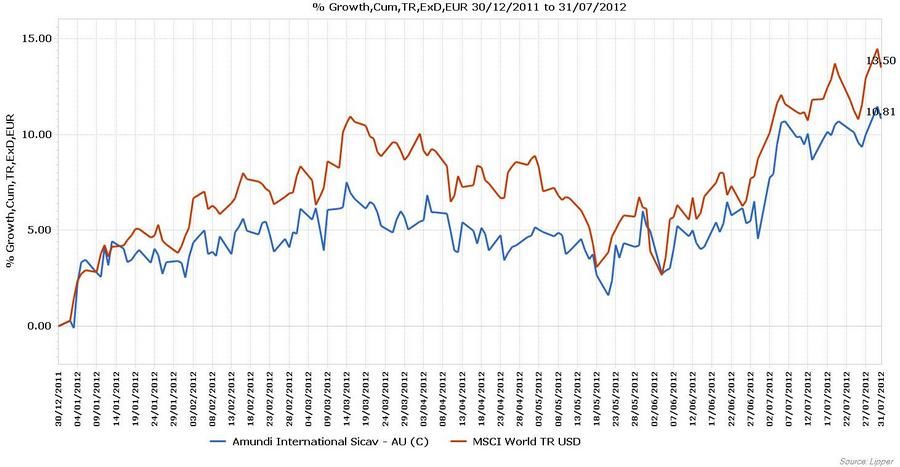

Performance 2012 - Year-to-Date

Matthew McLennan:"Since the beginning of the 2012, Amundi International SICAV is slightly underperforming the MSCI World. As of June 29, 2012, the fund had registered a +2.20% net return YTD while MSCI World was up 3.29% over the same period. This underperformance is mostly due to the defensive positioning of the fund (20% cash & equivalents in average YTD) but also due to the negative contribution of gold mining equities and technology stocks."

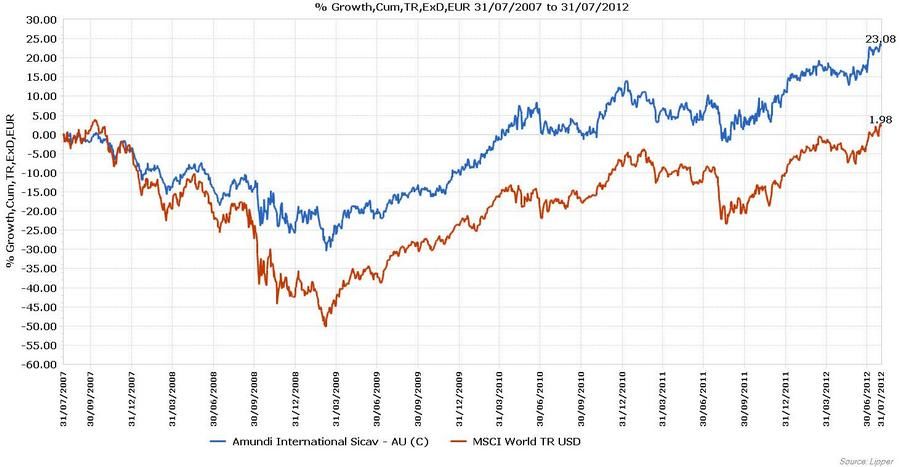

Performance since 2007

Matthew McLennan:"During its almost 15 years of existence, Amundi International SICAV has had only 3 years with absolute negative returns, in 1998, 2008 and 2011; hence illustrating its capital preservation objective.

The fund’s performance was in line with markets slightly underperforming the market in 2006 and 2007, mainly due to the decision of the management team not to invest in Emerging Markets, in financial companies with opaque balance sheets and in Commodity stocks (ex-Gold). This again was proven correct, as those themes recorded the most severe losses in value between end of 2007 and March 2009 following the subprime crisis in the USA. Symmetrically, Amundi International SICAV underperformed in 2009, as that years’ best performing stocks where those which had done worst in 2008. Amundi International SICAV outperformed the MSCI World both in 2010 and 2011 mainly due to the portfolio’s exposure to gold related securities and due to the absence of “big banks” in the portfolio. The stock picking in Japanese equities is also a significant contributor to the performance of the fund during that period. Since the beginning of the 2012, Amundi International SICAV is slightly underperforming the MSCI World, mostly due to the defensive positioning of the fund (20% cash & equivalents in average YTD) but also due to the negative contribution of gold mining equities and technology stocks."