Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest? (ISIN: LU0049112450)

The investment universe of the FF Pacific Fund can go across the breadth of the Pacific region, including Japan. The fund’s market index used for comparative purposes is the MSCI AC Pacific Free Index, but the portfolio manager, Dale Nicholls, is willing to seek investment ideas outside the market index universe.

Investment process

- Dale leverages Fidelity’s global research resources. He works closely with Fidelity’s 28-strong team of Japan equity analysts* based in Tokyo and is supported by 41 Asia Pacific ex Japan research analysts based in Hong Kong and other research offices across the region. They perform detailed bottom-up company research across all industries. It is very much a two-way process of understanding what the analysts recommend in the sectors they cover and how that marries with Dale’s own investment thesis.

- The majority of the stocks held in the fund are ‘buy’ rated (typically 80%), high-conviction stocks recommended by the analysts that support him across the region. Analysts rate stocks on a scale of 1 to 5 as an indicator of their level of conviction.

- Dale does not limit himself to the investment universe covered by analysts. Although he looks beyond the benchmark, the framework for company analysis remains the same. Typically one-fifth of the portfolio is invested off-benchmark, but Dale involves analysts in the research process.

- He runs a highly diversified portfolio of typically 150 to 200 holdings. Dale believes the on-the-ground research resources at Fidelity provide him with a competitive advantage, enabling him to search further down the cap scale. He looks for ideas off-the-beaten track, typically smaller companies that are generally growing faster and are less well covered. As a result, the portfolio tends to hold more names than its peers. Typical stock bets are around +/- 200bps, but could be larger if the story is compelling enough.

- He believes frequent company visits are the key to evaluating company specific risk. In addition, he frequently travels across the region with analysts and other portfolio managers, which continues to be the practice for investment professionals based in any of our Asia Pacific locations.

Current investment strategy

Dale’s current investment strategy focuses on companies with strong balance sheets and ability to fund growth. Some of the key themes in the portfolio include: rising internet penetration (which could lead to an increase in areas such as on-line e-commerce, gaming, travel and education); increasing domestic consumption (mainly in China, India and ASEAN where the middle class continues to grow); and capital spending in long-term infrastructure across the region (particularly in China). These themes are reflected in the fund’s overweight positions in the information technology and consumer discretionary sectors and selected conviction plays in industrial sector. The fund’s country allocation is a result of stock selection. Country-wise, the fund maintained key overweight exposure to China, South Korea and Indonesia. Sector-wise, Dale remains confident in the mid-term growth outlook for the consumer discretionary and information technology sectors given the solid demand in Asia.

The fund’s market index used for comparative purposes is the MSCI AC Pacific Free Index which includes a broad spread of developed and developing Asian countries and Japan. The fund is also able to invest in non-comparative market index stocks. Typically up to one-fifth of the portfolio is invested off the comparative market index countries outside of these markets but which derive a significant proportion of their earnings from those markets. This index is chosen because the fund invests principally in actively managed portfolio of equities in countries having a Pacific sea coast, primarily Japan, and South East Asia.

*Source: Fidelity as at 30 June 2012

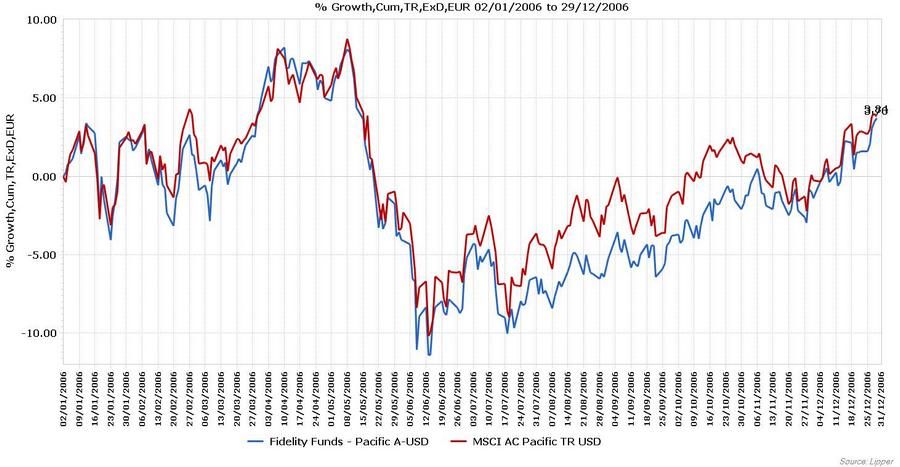

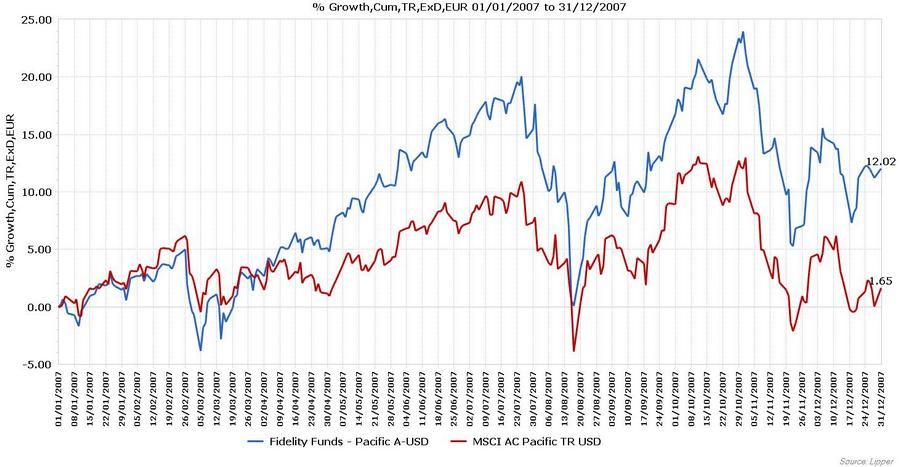

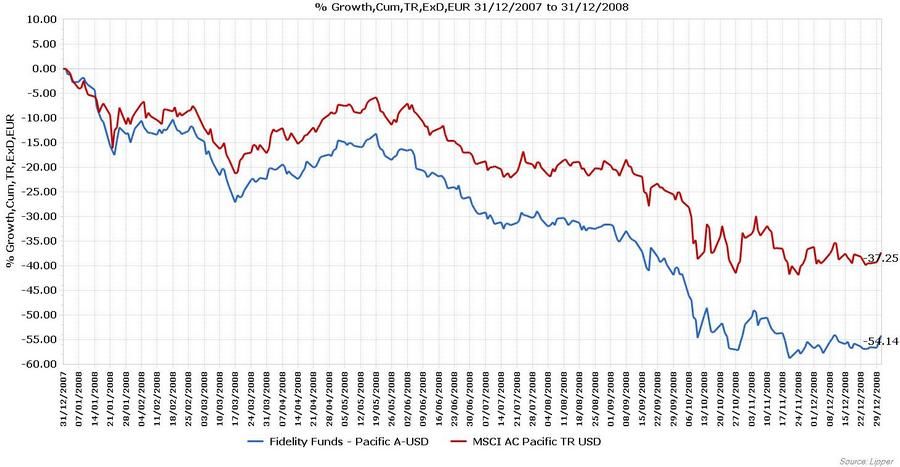

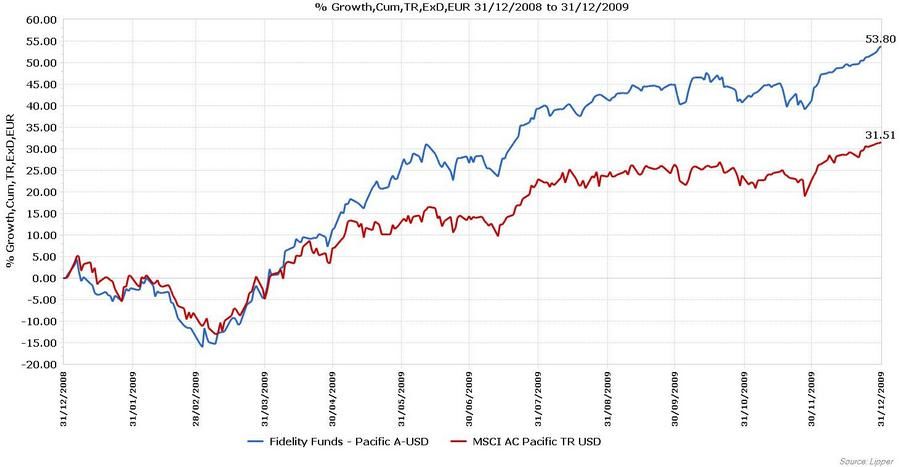

Performance Review 2006