Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest?

The investment universe for the LO Funds – Technology (USD) I A (ISIN: LU0209997484) (hereafter “LOF Technology” or the “Fund”) is the MSCI World Information Technology Index. The Fund is invested in equities issued by companies prominent in the field of information technology, e.g. semiconductors, software and telecoms, which are incorporated in, or have their main place of business in North America, Europe or Asia.

Investment strategy

The Fund follows an active long-only, bottom-up, high conviction approach, with the objective of outperforming the MSCI World Information Technology Index by seeking exposure to a diversified portfolio of global mid- and large-cap stocks in the information technology sector, thereby taking advantage of technology trends that present superior growth potential. Our proprietary valuation model is designed to identify companies that offer a favorable growth/valuation profile, and consequently profit the most from these trends.

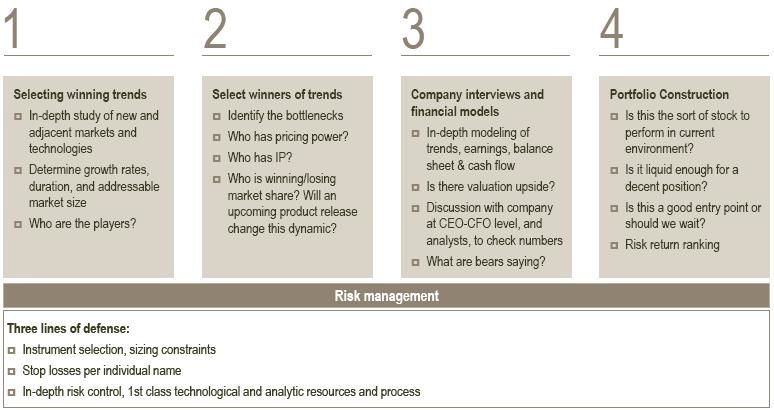

Investment process

Our fundamental, research-driven investment process follows a strong bottom-up approach with regards to stock selection.

Firstly, the universe is screened for interesting technology trends (e.g. surge in applications for LEDs, LCD TVs, IP-TV, etc.). This screening is done primarily by our market knowledge and experience and supported by our network of contacts.

After identifying technology trends which are likely experiencing superior growth, the fund management team selects those companies which are going to profit the most from those trends, by means of analyzing and fully understanding the ecosystems that surround the theme or trend. The last step of research is the due diligence, including company interviews and creating proprietary financial models which include a discounted cash flow valuation model. The output of this process is a short list of companies which have significant valuation upside.

Below a schematic view on our investment process:

The benchmark for this Fund is the MSCI World Information Technology Index; our investment universe differs from the benchmark in that we also look at companies which are not included in the benchmark (mostly smaller capitalizations) and/or that are not directly active in the information technology sector, but have a direct link to it such as med-tech companies, solar energy companies (link to semi-conductors), etc. We will invest in such companies, if we see opportunities which could fit in the portfolio.

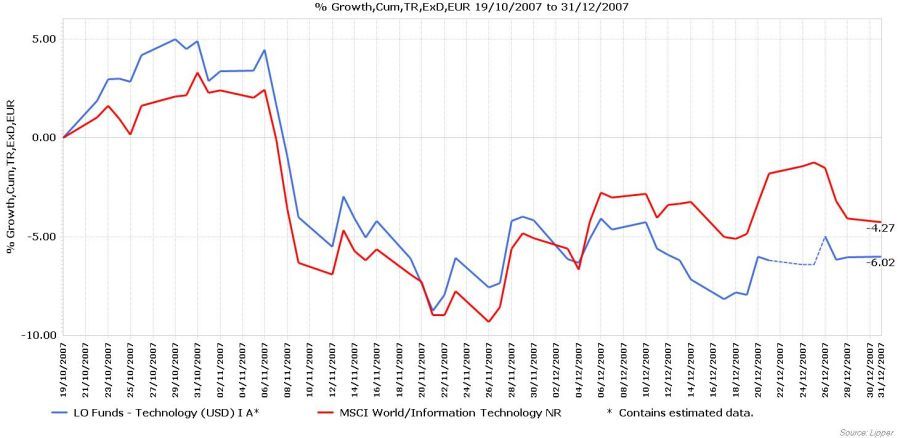

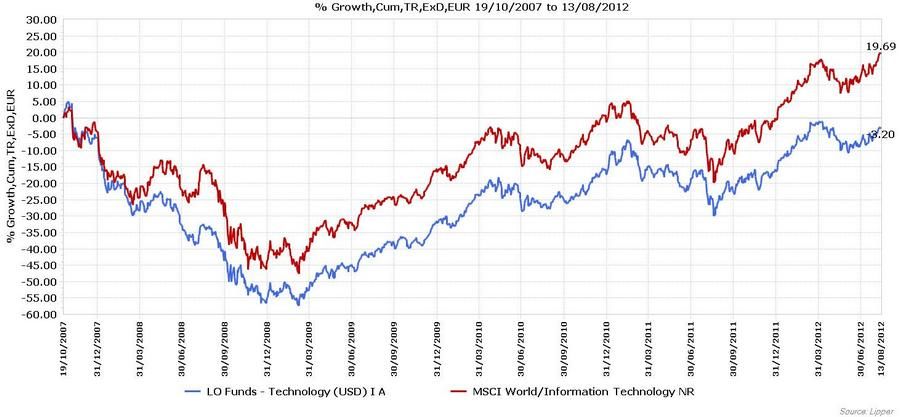

Performance Review 2007

Bolko Hohaus: "As the I tranche of the Fund was only launched in October 2007, a performance review is not relevant for the year 2007."

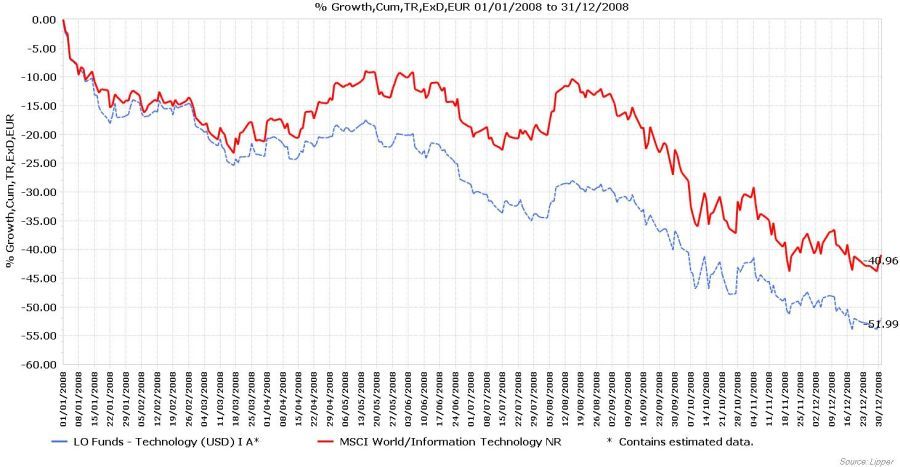

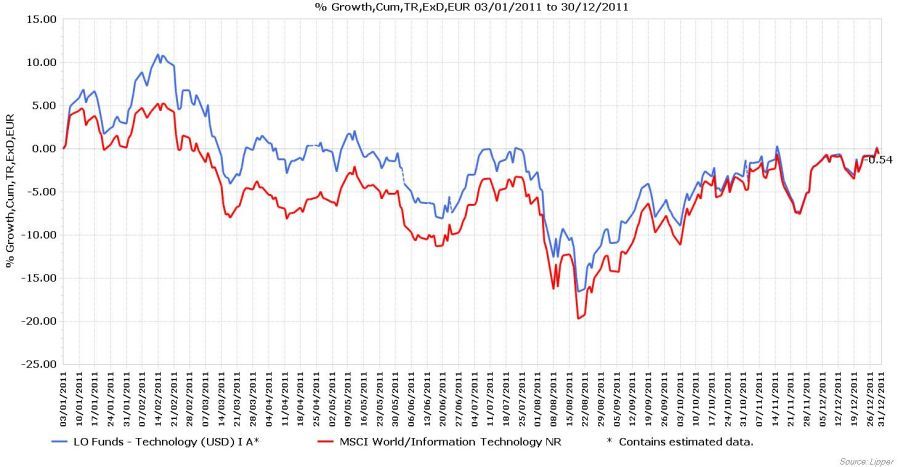

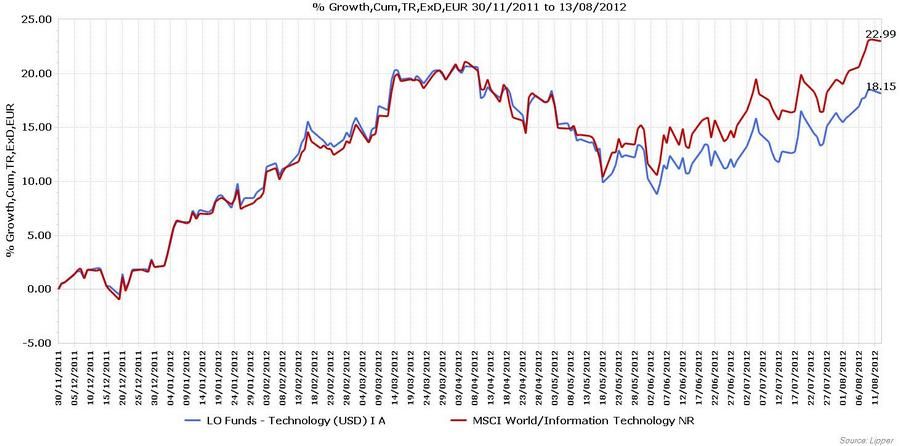

Performance Review 2008

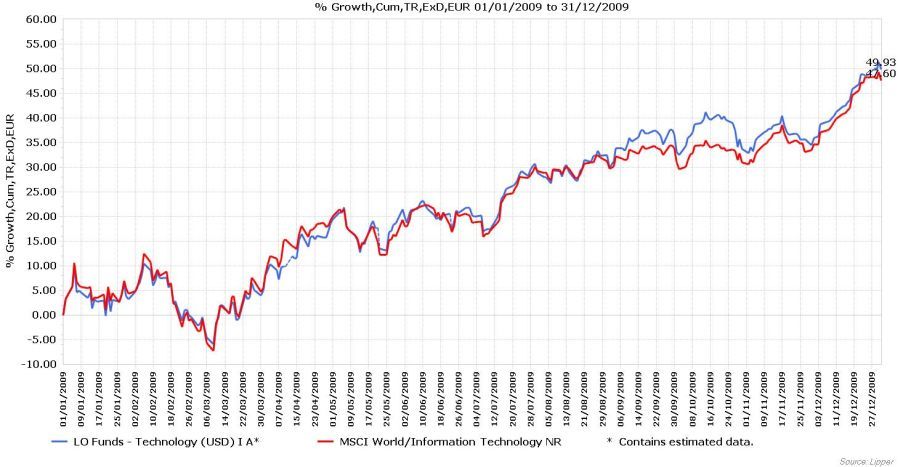

Bolko Hohaus: "The rolling 5 years’ performance includes 2008 which was a tough year for the market (see 2008 performance section), but since then the Fund’s performance is roughly in line with the benchmark. The performance suffered from Apple (approx. 18% in the benchmark) which cannot be replicated in the Fund due to UCITS constraints (max. 10%)."