Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest? (ISIN: IE00B0C18065)

The core focus of PIMCO’s Diversified Income strategy includes investment grade corporate bonds, high yield corporate bonds and emerging market debt; however, the strategy has the flexibility to invest outside of the three core sectors and will consider the entire universe of global credit instruments in search of the most compelling risk-adjusted opportunities.

PIMCO’s Diversified Income investment process begins during our Annual Secular and Quarterly Economic Forums, at which PIMCO investment professionals from around the globe gather with industry experts for discussions about the future of the global economy and financial markets.

Within this overall disciplined framework, the Diversified Income portfolio management team determines the appropriate asset allocation among a broad range of global credit sectors and other fixed income sectors. Once the desired allocation across global credit sectors has been determined, the Diversified Income portfolio managers will work with each of the individual sector specialist teams to identify the best investment opportunities within their respective fixed income sectors. This process ensures that the “top-down” asset allocation framework is married with the breadth of “bottom-up” best ideas generated by PIMCO’s specialist PM resources. The sizing of individual positions is then determined by 1) the three-screen credit research evaluation (top down, bottom-up and valuation) and 2) the contribution of the security to the portfolio’s overall risk factor exposures.

Our current strategy is to position the Fund defensively with a preference for income over price appreciation. We continue to focus duration in countries with healthier balance sheets and maintain an underweight to total spread duration. Within the credit sectors, we continue to rotate out of lower quality credits into higher quality credits where we expect to find attractive spread premiums in companies that will outperform in a weaker growth environment.

The benchmark of the Fund is an equally weighted blend of the following three indices: Barclays Capital Global Aggregate Credit Component, U.S.-Dollar Hedged, BofA Merrill Lynch Global High Yield BB-B Rated Constrained and JPMorgan EMBI Global Index.

PIMCO’s Diversified Income strategy is a multi-sector credit strategy that allocates across the full spectrum of global credit sectors. The strategy can be thought of as a complete expression of PIMCO’s secular and cyclical views as they apply to fixed income credit sectors, both from the top-down and bottom-up perspective.

In practice the strategy is not necessarily tethered to a specific benchmark in terms of the broad investment universe that it looks to utilize. We attempt to capture the best risk-adjusted return opportunities across global credit markets, and we make strategic and tactical asset allocation decisions as economic and market conditions change. The benchmark can serve as an indication of the potential volatility and return associated with a broad global credit allocation.

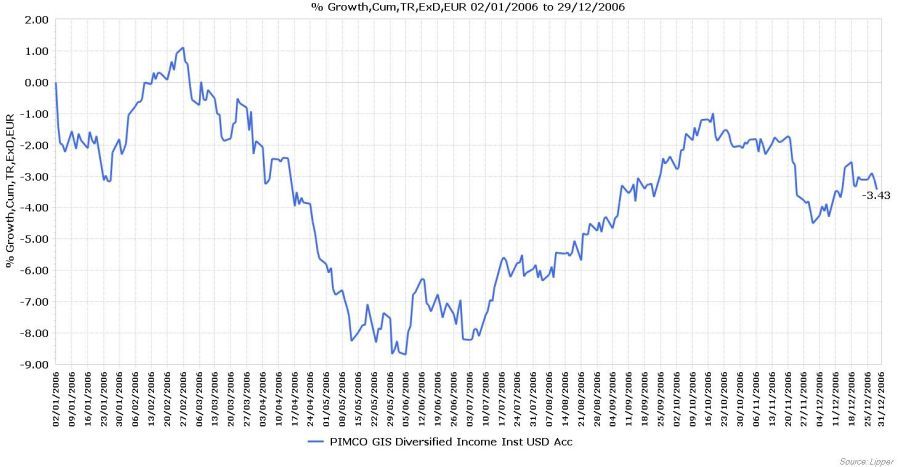

Performance Review 2006

The lead portfolio manager for the PIMCO GIS Diversified Income Fund is Eve Tournier. Eve and the Diversified Income portfolio management team are responsible for PIMCO’s Diversified Income strategies. They coordinate the team’s efforts globally ensuring consistency across portfolios and work in conjunction with the Investment Grade Credit, Emerging Markets, High Yield and Mortgage-Backed Securities teams in constructing Diversified Income portfolios that capture the most attractive risk/return opportunities across spread products. This is accomplished by using dynamic asset allocation and bottom-up security selection. Additionally, the team makes extensive use of PIMCO’s more than 40 global credit analysts, who provide research coverage on a broad range of credits, with an emphasis on independent, original research, as well as the analytics team who provide tools and support for the risk management efforts.