e-fundresearch: "Which fundamental factors are currently the most important ones when you assess biotechnology stocks?"

Where biotechnology is different from most other sectors is the all-important impact of “product quality” (in this case, the efficacy of a medicine) above anything else (brandings, distribution network etc). Medicines are not purchased for the fun, they are only used when they do contribute meaningfully to a patient’s health.

As a consequence, when investing in a biotech company which has no sales yet the clinical data of the pipeline products are of paramount importance (efficacy, ease of administration, side effect profile). The competitive positioning of the investigational drug compared to existing therapies but also compared to other experimental drugs also determinates the future sales potential.

Patient numbers worldwide (for many diseases, especially orphan diseases, this is not always easy to estimate) and the expected pricing of the new medicine are other major factors when guessing the future sales of a medicine. Furthermore, the size of the sales force that is needed to reach out to the physician community has a big impact on the profitability of a drug. An antidepressant or an epilepsy drug is often prescribed by a generalist doctor and thus such a drug needs to be supported by a big sales force. Multiple sclerosis or oncology are examples of therapeutic areas where a small sales force can easily cover the specialist doctors treating such patients."

product growth. Second, demand for health care products and services has historically been less cyclically sensitive than for other sectors, which tends to smooth out the fluctuations across an entire business cycle. For this reason, we believe health care stocks, particularly large-capitalization companies, may act defensively during times of market turmoil."

Paul Wagner, Fund Manager, "Allianz Biotechnologie - A - EUR" (ISIN: DE0008481862) (02.08.2012): "Certainly, the macro environment impacts the biotechnology sector and as sentiment fluctuates, volatility in the sector increases. Macro factors such as European fiscal constraints are effecting the sector as budget pressures drive greater drug pricing discounts resulting in revenue and earnings impacts for global therapeutics companies. In the US the Affordable Care Act (ACA) has been one of the biggest factors impacting US healthcare companies. While the effect is more pronounced for managed care companies and hospitals, therapeutics companies are also impacted, through the increased tax associated with ACA, offset to a certain degree by the eventual expansion of the enrolment of the insured, allowing more patients access to healthcare in the US."

e-fundresearch: "Which are the most important elements in your investment process?"

This is the most important work as the outcome of drug development is extremely binary: a drug works and gets approved by regulatory authorities like the FDA or it fails completely in oblivion. This obviously leads to a dramatically different investment outcome.

Competitive positioning, patent situation, patient numbers, severity of the therapeutic area and thus pricing round up the variables that in the end lead us to a sustainable sales estimate for the drug in question. This is the basis of our valuation which mainly uses EV/sales a criterion."

Please let me point out this: Significant daily price % movements are not that unusual, in fact, earlier in the year, the fund had daily changes of (+2.1% and +3.5%). Please keep in mind that this is a sector fund where above market volatility should be expected. With that said, we strive to manage to that volatility by taking a diversified approach by holding over 70 positions with different products and growth profiles, across the market cap spectrum and by conducting in depth, fundamental research. As with all of our funds, the biotech team takes a long-term perspective and many times, will take advantage of any short-term volatility by initiating or adding to attractively valued securities."

Paul Wagner, Fund Manager, "Allianz Biotechnologie - A - EUR" (ISIN: DE0008481862) (02.08.2012): "The key element of the investment process is fundamental research. Attending global medical meetings helps to keep me up to speed on the latest medical developments as well as giving me insights into prescribing physicians current thinking regarding utilization and positioning of new therapies. The Allianz/RCM Grassroots research network also helps to survey doctors and patients on usage of therapies in order to gain early insights into changing trends. Extensive face-to-face meetings with company managements are also key to understanding near and longer term strategies within the competitive landscape."

e-fundresearch: "Which over- and underweight positions are currently implemented in biotechnology funds?"

We also invest in those trends and companies but also continue to steer important investments towards earlier stage companies when we like their process and data. We still believe (and history clearly proves this) that the biggest alpha can be achieved once an investigational drug proves its worth and evolves from a concept to an approved and successful drug. This obviously requires a long experience and a carefully diversified portfolio. Of the bigger stocks, we recently upped our position in Celgene as the company stock suffered from some medical news flow and Celgene became very interesting given its strong growth potential (the recent results were excellent)."

Similarly, shares of Pharmacyclics, AP Pharma and Anacor Pharmaceuticals, each off-benchmark holdings, rose in value. Underweight positions in Regeneron Pharmaceuticals and Illumina helped relative returns as both firms saw share prices decline during the month.

In contrast, shares of Celgeneand Achillion Pharmaceuticals fell in value and detracted from performance for the month. Similarly, off-benchmark positions in Cell Therapeutics, Aegerion Pharmaceuticals, Anthera Pharmaceuticals, Transcept Pharmaceticals and Ventrus Biosciences hindered relative returns. An overweighted position in Gilead Scienced hindered relative results as the company’s shares increased less than the overall index. Meanwhile, positions in Alexion Pharmaceuticals and BioMarin Pharmaceutical contributed to absolute returns but hampered relative returns due to underweighting."

Paul Wagner, Fund Manager, "Allianz Biotechnologie - A - EUR" (ISIN: DE0008481862) (02.08.2012): "The overweights and underweights are generally stock specific although Orphan Drug and HCV companies tend to be more overweight in the portfolio. Given the regulatory hurdles to gaining drug approvals and the increasing scrutiny on pricing, companies that focus on developing therapies for unmet needs in smaller patient populations have the advantage of running smaller trials with the potential for accelerated regulatory review and more latitude on drug pricing."

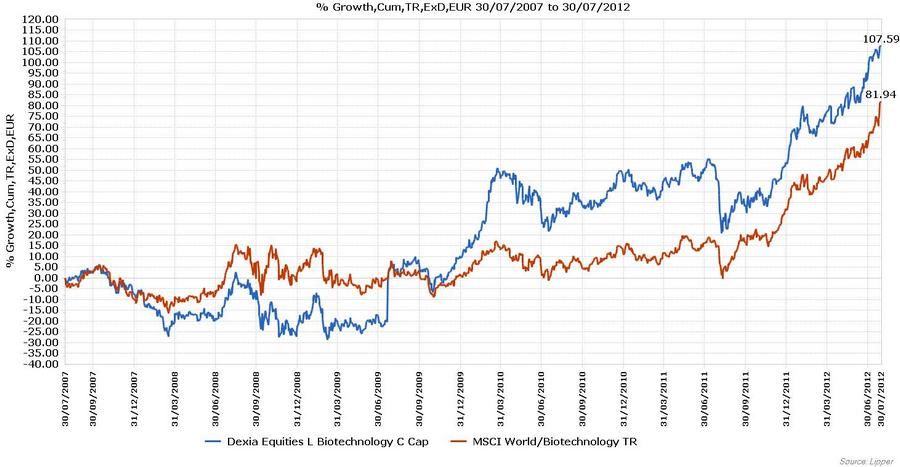

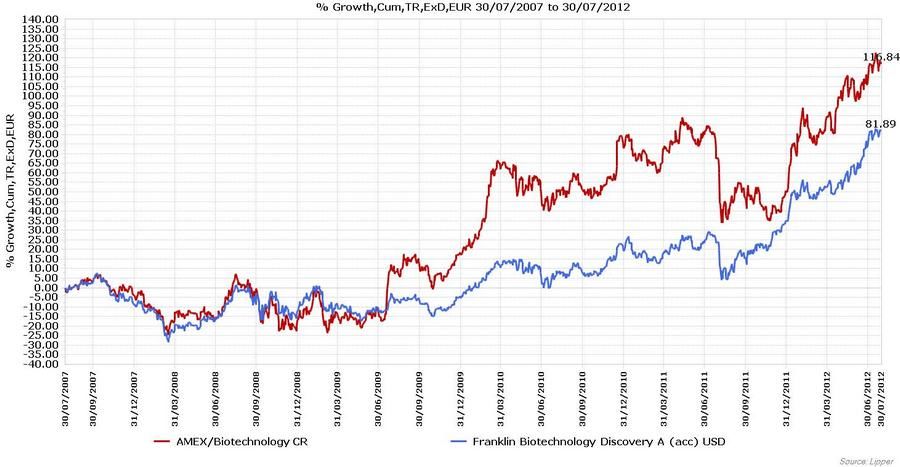

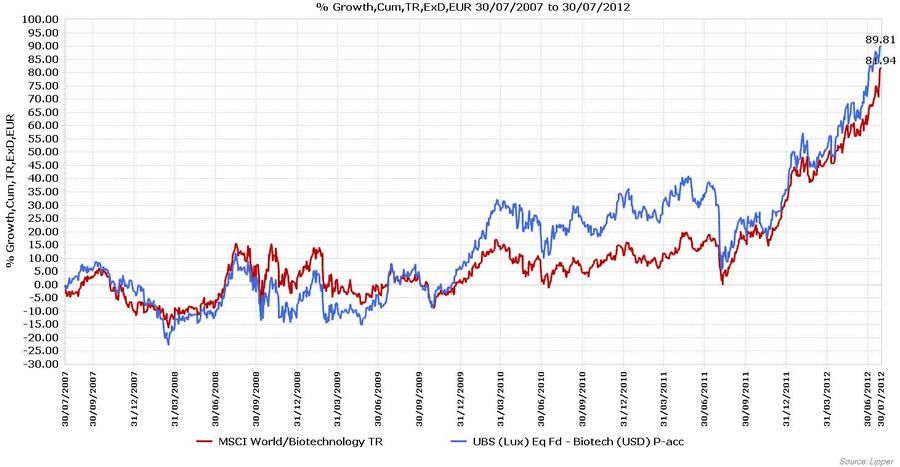

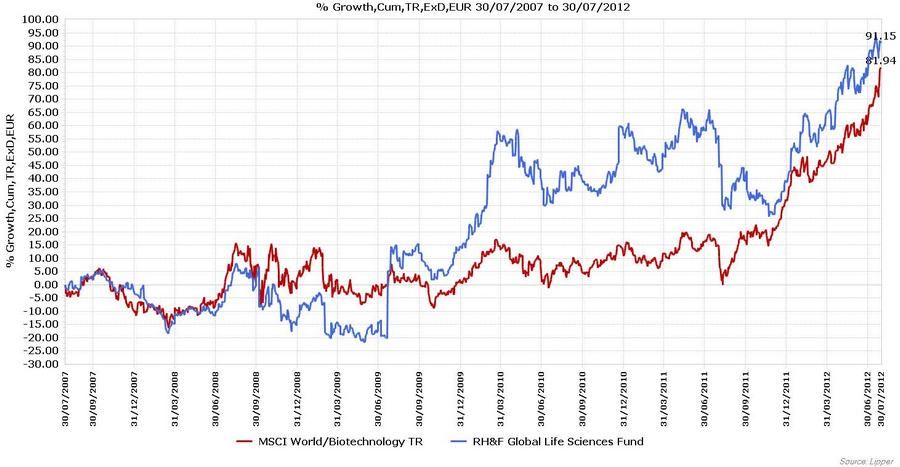

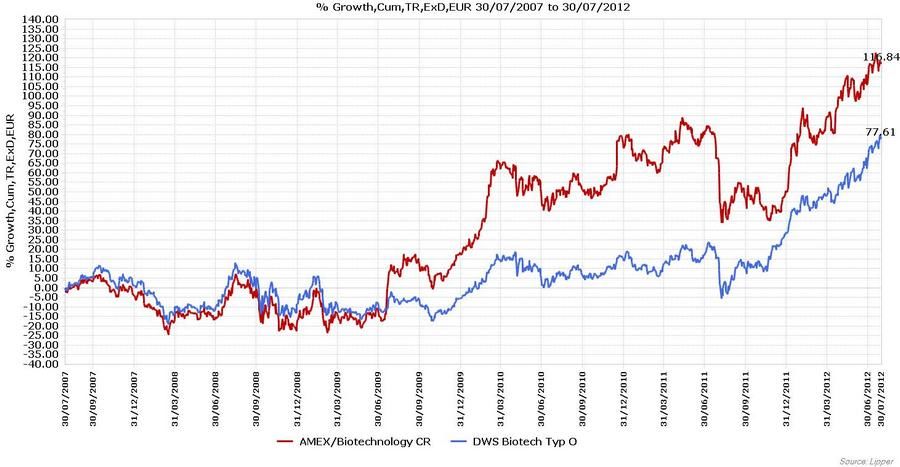

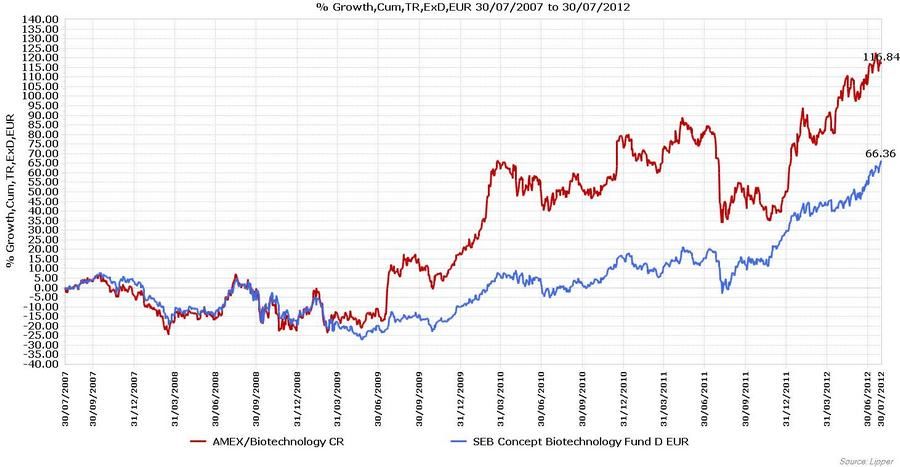

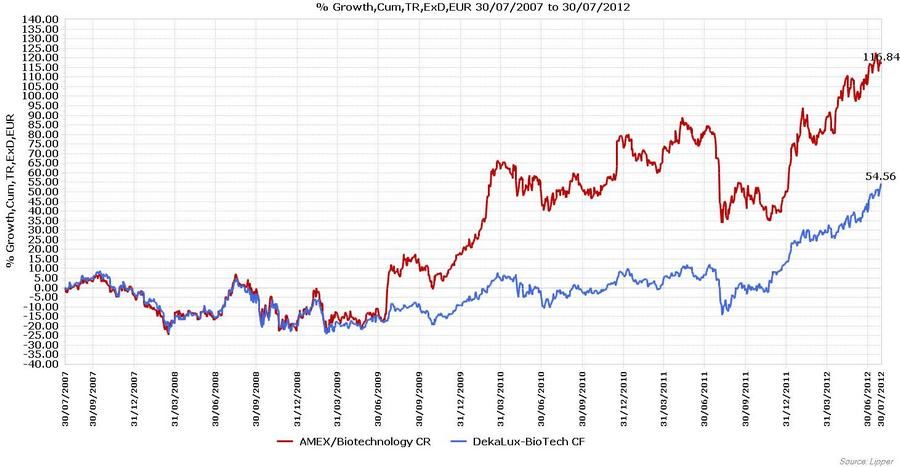

e-fundresearch: "Please comment on the performance and risk parameters of your fund in the current year as well as over the past 3 and 5 years."

We enjoy a 5 star overall Morningstar ranking for the fund and are ranked well into the 1st quartile in the Morningstar peer group on a 3, 5 and 10 year view.

We strive to keep the volatility of the fund as low as possible (YTD we are below the volatility of the NASDAQ Biotech Index) but the sector is (and always was) somewhat more volatile than the global stock market."

3 Jahre: 88,37%

5 Jahre: 80,43%

Kurse: 31.7. 2012."

profitieren. Alleine im ersten Halbjahr 2012 konnte unser Fonds um +26 Prozent zulegen. Betrachtet man in den vergangenen Jahren zudem die internationalen Aktien-märkte, zeigt sich für die Branche ein deutlich positiveres Bild. Der RH&F Global Life Sciences Fund hat in den letzten 5 Jahren um 67,8 % zugelegt, in den letzten 3 Jahren sogar um 88,2 %. Aufgrund dieser Resultate konnten wir auch den Lipper Fund Award 2011 für den besten Fonds im Sektor Biotechnologie entgegennehmen und die führende europäische Ratingagentur Feri Eurorating Services AG bewertet den Fonds seit längerer Zeit mit der Bestnote „A“. Diese Auszeichnungen zeigen auf, dass der Fonds über einen mittleren Zeithorizont eine stabile überdurchschnittliche Performance mit relativ niedrigem Risiko aufweist.*"

*) Zahlenwerte per 30.6.2012

Paul Wagner, Fund Manager, "Allianz Biotechnologie - A - EUR" (ISIN: DE0008481862) (02.08.2012): "YTD the fund is up 32% as the biotechnology sector has benefited from new developments in areas like Hepatitis C as well as from acquisitions. Over the last 3 years the fund is up 82% and over the last 5 years the fund is up 62%. Risks within the sector include: increasing regulatory scrutiny, further pricing pressure on drugs and clinical trial/launch failures leading to heightened investor risk aversion and a resulting reallocation of capital away from the biotechnology/therapeutics sector. In terms of

a potential for increasing regulatory scrutiny, if drug development companies can show reasonable efficacy in an area of unmet need the regulatory agency is still willing to consider expedited reviews and approvals, as seen by the recent FDA approval of Onyx's multiple myeloma drug based on early clinical data. Pricing is an issue within the sector, and in particular the pricing differential between the US and ex-US; however, investors have largely discounted this pricing pressure into expectations given the recent EU country budget constraints. Clinical trial risk and commercial drug launches that fail to meet expectations can pressure the sector; however, indiscriminate pullbacks can create investment opportunities for those companies with high potential drug pipelines."

e-fundresearch: "Where do you see opportunities and where do you see risks?"

Valuations are very reasonable still for most companies and for the sector as a whole.

All in all, we remain very bullish on the sector given the huge scientific progress that is still going on and the many interesting projects in the pipelines. We do not see a sector wise major risk or overhang, even if austerity will remain a light headwind.

The main risks are in individual companies as drugs, even approved drugs, cab be hit by unexpected side effects showing up or competing drugs being more successful. This risk can be dealt with by careful diversification and continuous assessment of all major pipeline projects.

Opportunities are plentiful. They are not linked to a specific area like oncology as it is often thought but are spread out over many diseases. There are many orphan diseases known to man (between 5000 and 7000) and better treatments in a rare disease like Duchenne dystrophy are as much needed as breakthroughs in the treatment of more widely known diseases like multiple sclerosis or alzheimer’s. Pricing power is the best in orphan diseases and drugs treated such disorders also seem the best shielded from potential future price pressures."

In our opinion, the greatest story in the biotech sector over the last couple of years is what has happened with hepatitis C research. Currently, our number one holding is Gilead Sciences."

Paul Wagner, Fund Manager, "Allianz Biotechnologie - A - EUR" (ISIN: DE0008481862) (02.08.2012): "New innovations in biotechnology can create significant disruptions and lead to divergences in stock performances as new technology overtakes the old. A great example of this disruptive innovation that has unfolded over the last several years is the rapidly evolving treatment paradigm in Hepatitis C. The historical treatment for HCV required long treatment cycles with toxic drug injections. The treatment paradigm has evolved over the last few years with the addition of new drugs on top of the previously used therapies resulting in higher cure rates and shortened durations of therapy. Looking forward over the next several years the treatment will begin to eliminate the need for the injection of the historical standard of care that is associated with numerous adverse events, resulting in better tolerated therapies, shorter courses of treatment and higher rates of cure. This significant shift in HCV treatments created numerous investment opportunities and identifying the winners and losers in this space helped drive the outperformance in the fund."

Alle Performance Daten der Top-10 Auswertung per 30.07.2012: