Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest? (ISIN: DE0009769729)

Britta Weidenbach: "The DWS Top Europe is a Pan-European fund with a large cap focus. The fund follows a stock-picking approach where the universe it picks from is best described by the Dow Jones STOXX 600. Top down assumptions do play into the stock picking process. As an example more then ever the global divergence in growth rates influences a companies growth profile depending on its regional sales and profit exposures. The investment process starts with a screening of the investment universe that mainly rests on two pillars. Firstly our strong European equities team of 21 investment experts for European equities with on average 12 years of investment experience. Dedicated sector and country specialists screen their respective universe and then come up with their investment recommendations. Secondly a growth and performance screening of the DJ Stoxx 600 Universe. This screening process as a result ranks the investment universe for potential investment ideas along past and future growth assumptions and historic performance assessments. The fund manager then puts four key criterias in place as a first hurdle that an investment idea has to pass: the sustainability and attractiveness of a companies business model, its market share and the barrier to enter its market, its global positioning plus asking the question if it is a profiteer of structural trends and certainly management quality. The second hurdle then examines the same investment idea for its underestimated growth or earnings potential. Therefore valuation is not seen as a driver of a stocks outperformance but rather growth and earnings surprise. If an investment idea passes those two tests it is chosen as an investment for the fund. Strategy wise the fund focuses on global players and companies that should be less dependent on the weak GDP growth environment in the Eurozone. We would expect the trend of globally positioned companies to outperform domestically oriented names to continue.

The fund has the MSCI Europe as a benchmark. Being focussed on stock-picking the DWS Top Europe is not benchmark driven but only benchmark oriented. The MSCI Europe best represents the large-cap oriented fund profile and the intention of the DWS Top Europe to invest up to 30% of its NAV in mid- and small- caps. The fund consists of a concentrated portfolio of 40-60 stocks that primarily will be choosen from a wider universe than the MSCI Europe, the DJ STOXX 600. Currency hedging is implemented where sensible."

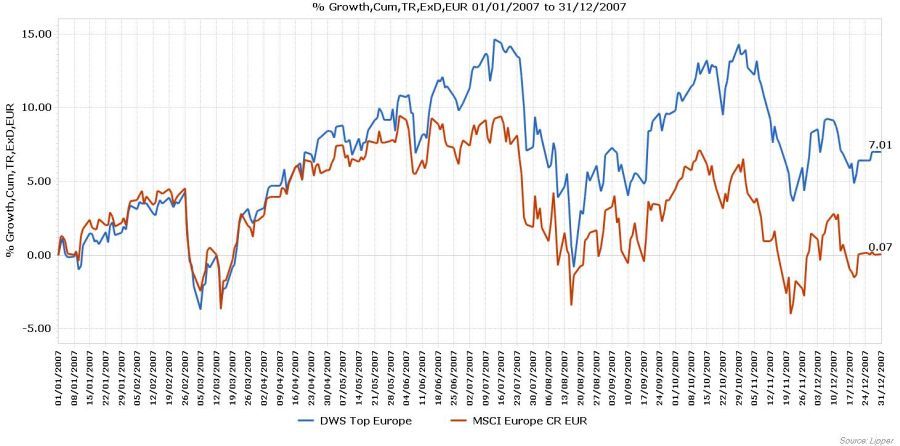

Performance Review 2007

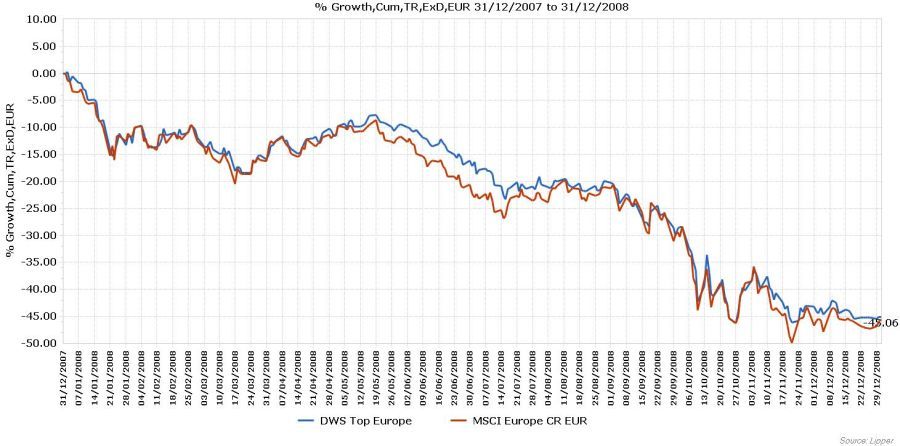

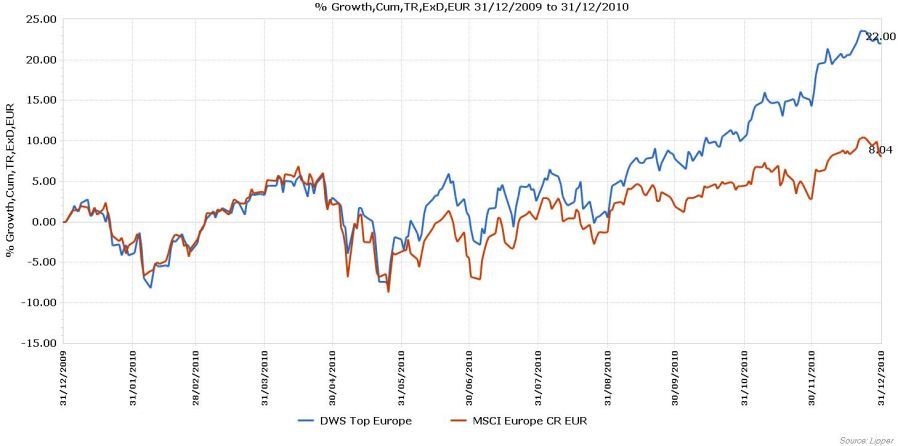

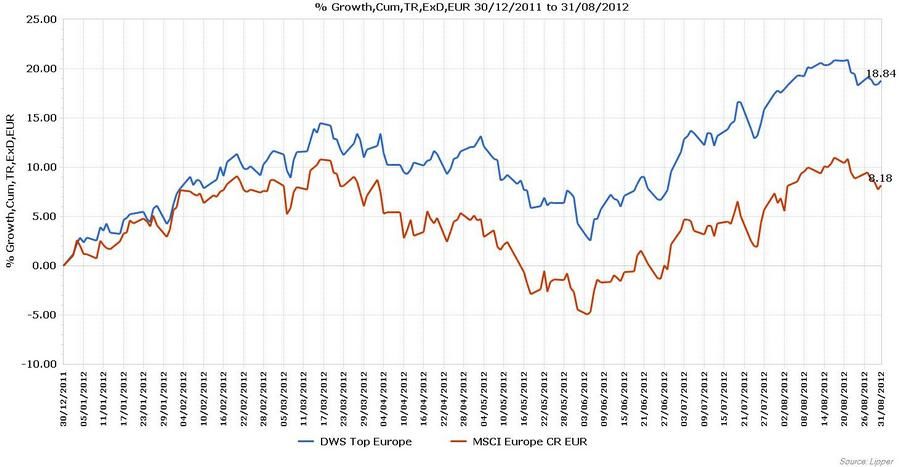

Britta Weidenbach: "In the period from beginning 2007 until August 9th 2012, the DWS Top Europe lost 9.72% and clearly outperformed the MSCI Europe index by 18.62%. Over this multi-year period, the fund consistently followed its strategy based on the successful selection of high quality single stocks. The preference of the fund for ,,global players’’ with a (potential) market leading position and therefore structurally growing stocks in sectors like e.g. Consumer Discretionary, MedTech, Technology and Industrials clearly payed off over the long run. The early anticipation and execution on macroeconomic topics like the financial crisis in 2008 and the European debt crisis since 2010 further supported the portfolios development."