Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest?

Leon Howard-Spink: "In order to achieve consistently good performance over the long term, a fund manager must be able to pick great investments year in, year out. This is a repeatable skill and comes from understanding the fundamentals of a company and owning a stock on its merit, rather than its size or position in a benchmark. That is why Schroder International Selection Fund European Special Situations (LU0246035637) looks at the facts.

And while we strive to understand how these macro issues will impact investments, performance will be generated through a solid bottom-up stock selection process which aims to produce high alpha with low volatility over the long term. Looking at the facts – company fundamentals – this fund aims to identify some of the best investment opportunities in Europe. Stocks are chosen for their potential to generate alpha, using a bottom-up approach. We look for companies with bright futures. We try to invest in those that are the best at what they do and have the potential to produce sustainable, consistent growth and a good return on capital over the long term.

Our process is based on two key skills: stock-picking and portfolio construction. Portfolio construction complements the stock picking. To lower the risk and volatility of the fund, we invest in a broad range of sectors, with varying growth drivers and levels of cyclicality. In other words, we try to diversify the risks that we are taking from a market direction or sector leadership point of view, and let the company fundamentals drive the fund’s performance. This is a disciplined approach based on in-depth research, leveraging the strengths and expertise of the broader Schroders European equities team."

Please comment on the benchmark which was selected for the fund and how it relates to the investment universe and investment strategy.

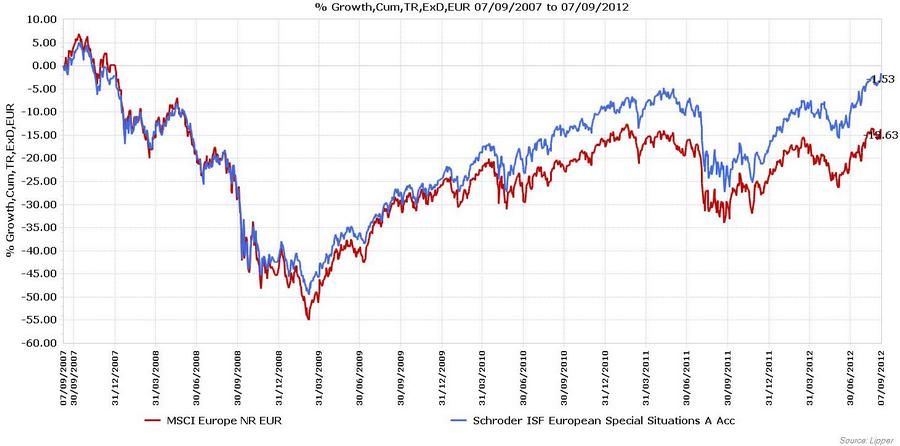

Leon Howard-Spink: "The process behind Schroder ISF European Special Situations supports the core beliefs of the manager – that a company should be chosen for its underlying merits, not because of its size or position in an index. With other words, we are not constraint by a benchmark. We use the MSCI Europe Net Return rather as a comparative index."

Performance 2012 - Year-to-Date

Leon Howard-Spink: "Despite the relief rally in July 2012, the macro landscape continues to dominate sentiment and depress share prices. As a result we are increasingly finding opportunities to pick up quality stocks at good value. This is particularly true in the healthcare sector, where we have taken advantage of the share price weakness to increase our stakes in Sanofi and Novartis. We also topped up our holding in measurement technology company Hexagon. To fund the purchases, we took partial profits in some strong performers to date including SAP, Bureau Veritas and Intertek. We are pleased we the performance of these quality holdings in the portfolio, but are also mindful of their richer valuations as a result of the share price rallies. In the volatile market conditions, we are keen to lock in a good portion of these gains while reinvesting in a diversified collection of ‘good value’ quality stocks.

Elsewhere, we continued to build on our position in Dutch cable company Ziggo. We anticipated a further offering after initiating a small position in the stock at the company’s IPO in March. This additional placing came in July and we took the opportunity to add to our existing stake. We think that cable providers have a growth advantage over traditional telecom companies given their fixed cost base (i.e. the infrastructure is already in place) and the opportunity to grow margins through the sale of ‘triple-play packages’ – where the provider offers a bundled contract for phone, television and broadband services. Both types of business offer a healthy dividend yield but the growth angle, which is tougher for traditional telecom companies to access, offers greater upside potential in our view.

Overall, we are pleased with the resilience of the portfolio, and maintain confidence in the prospects for the companies we hold – a diversified collection of quality names; market-leading franchises with good pricing power, healthy balance sheets and a range of growth drivers. As ever, we maintain a bias towards higher quality, structural growth and lower cyclicality."

Performance since 2007