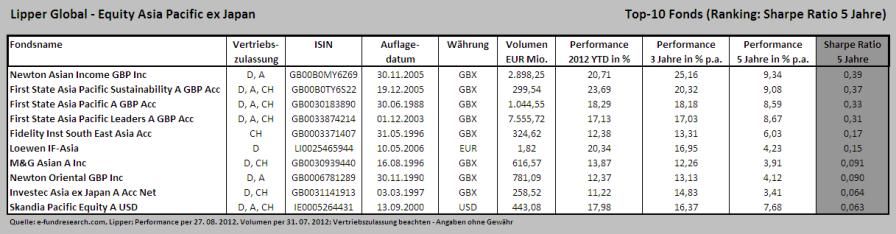

Die obige Tabelle ist eine Darstellung der besten zehn Asien Pazifik ex Japan Aktienfonds - gereiht nach Sharpe Ratio 5 Jahre (insgesamt 186 Fonds in der gesamten Assetklasse - Lipper Global Equity Asia Pacific ex Japan). Die Fondsmanager von First State und M&G haben die Fragen von e-fundresearch.com beantwortet. Keine Antworten wurden von den restlichen Top-10 Gereihten zugesandt. Die durchschnittliche Performance der Top-10 Fonds seit Beginn des Jahres liegt bei +16,8 Prozent.

e-fundresearch: "Which are the most important factors currently when you assess Asia ex Japan equities?"

Over the long term, we believe that the return on capital companies generate should be reflected in their share prices. Therefore we look closely at how companies allocate capital. We seek to invest in businesses that are using capital efficiently to create value for shareholders. This is particularly important in a region where state-owned companies and family-run firms are prevalent. Businesses with controlling shareholders are not always run for the benefit of all investors and often do not make efficient capital allocation decisions.

Notwithstanding a firm’s ability to generate high returns it is critical to pay attention to valuations. Valuations are the start and end of our process. In Asia, investors will often chase, and overpay for, growth resulting in many companies trading on valuations that imply unrealistically high growth expectations. We believe it is important not to overpay for future returns, which may fail to materialise, and therefore apply a strict valuation discipline to investments. By paying close attention to company business models and analysing the potential cashflows that their assets can generate, we seek to find companies whose ability to improve, or sustain, their level of returns is undervalued by investors."

e-fundresearch: "Which are the most important elements in your investment process?"

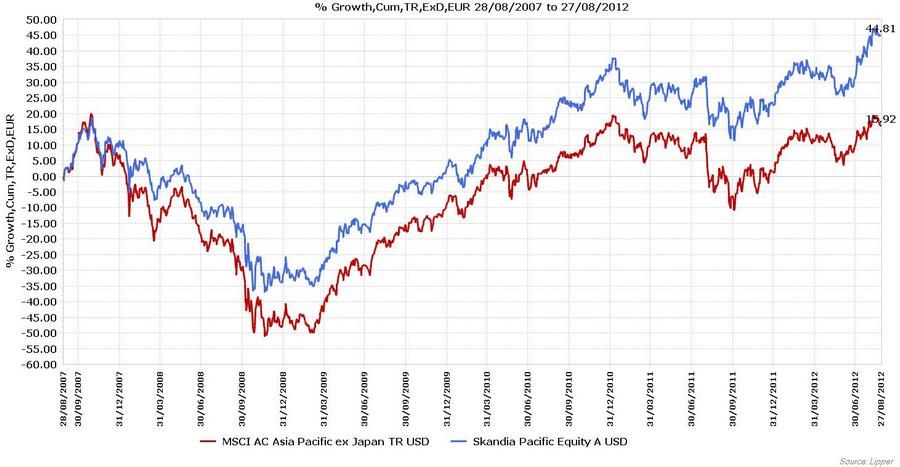

Alistair Thompson, Head of Asia Pacific Equities, "First State Asia Pacific Sustainability A GBP Acc" (ISIN: GB00B0TY6S22), "First State Asia Pacific A GBP Acc" (ISIN: GB0030183890), "First State Asia Pacific Leaders A GBP Acc" (ISIN: GB0033874214), "Skandia Pacific Equity A USD" (ISIN: IE0005264431) (04.09.2012): "In terms of investment strategy, we are cautiously positioned and believe we can mitigate the downside risk by buying good-quality companies, which is absolutely key no matter whether we are optimistic or pessimistic. If you buy good quality companies and do thorough research, you can protect yourself when risk aversion returns, and this is typically how we perform. “

Michael Godfrey and Matthew Vaight, Co-Fund Managers, "M&G Asian A Inc" (ISIN: GB0030939440) (07.09.2012): "Our long-term, bottom-up approach seeks well-managed companies that are undervalued by investors. As bottom-up stockpickers, assessing the merits of each individual company is an essential part of our investment process. We adopt a fundamental approach to identify companies with assets that can generate future cashflows.

As providers of capital, we pay close attention to corporate governance standards; we want to be able to trust the companies we invest in and know that they will use investors’ capital efficiently to achieve high returns.

We also believe a long-term approach is invaluable when investing in Asia ex Japan. This ensures that we are aligned with the strategic decisions that companies make. Our three- to five-year investment horizon is considerably longer than that of many Asian investors. This means we are able to take advantage of mispricing opportunities that arise when short-term sentiment causes share prices to deviate from company fundamentals.

As mentioned above, we also think that a keen focus on valuations is important when investing in Asia ex Japan, given the weight of expectation placed on many companies."

e-fundresearch: "Which regions and/or sectors are currently overweight or underweight in Asia ex Japan equity funds? What are the reasons for it?"

Alistair Thompson, Head of Asia Pacific Equities, "First State Asia Pacific Sustainability A GBP Acc" (ISIN: GB00B0TY6S22), "First State Asia Pacific A GBP Acc" (ISIN: GB0030183890), "First State Asia Pacific Leaders A GBP Acc" (ISIN: GB0033874214), "Skandia Pacific Equity A USD" (ISIN: IE0005264431) (04.09.2012): "We are generally light in cyclical companies, concentrating on those with resilient cash flows and sound balance sheets, as well as well-aligned and competent management teams. As a result, we have an unusually high exposure to the telecoms sector. We also have almost ten per cent of the fund in two Singaporean banks. However, with the exception of insurance we are generally wary of the financial sector.

We are a bottom-up fund manager so the geographical allocation to individual markets is the result of our stock-picking process. Relative to the MSCI AC Asia ex Japan Index, currently we are overweight in Hong Kong, Singapore, Australia, Thailand, Malaysia and Philippines, while we are underweight in Korea, Taiwan, India, China and Indonesia.”

Michael Godfrey and Matthew Vaight, Co-Fund Managers, "M&G Asian A Inc" (ISIN: GB0030939440) (07.09.2012): "The fund’s country and sector exposures are an outcome of our bottom-up approach rather than a reflection of our macroeconomic views. Our focus on corporate governance standards and our strict valuation discipline have both had a significant influence on our investment decisions.

At the end of August 2012, the most significant deviation from the benchmark was our underweight to financials. This is mainly attributable to our concerns about Chinese state-owned banks which represent a significant element of the MSCI Asia Pacific ex Japan Index. We are reluctant to commit capital to these institutions as we believe they are influenced heavily by the government and are not necessarily run in the best interests of minority shareholders.

In terms of country weighting, the fund’s exposure to Australia is the largest difference from the benchmark. We are underweight the country because we do not invest in domestic Australian businesses such as banks and retailers that constitute a large part of the index. In our view, these would not be appropriate investments for an Asian fund.

Our strict valuation approach means that we are reluctant to invest in companies that are pricing in what we believe to be unrealistic levels of future returns. For this reason we are underweight the consumer sectors which are arguably ‘crowded trades’. The emergence of the Asian consumer is well documented and the share prices of many consumer-related companies are pricing in very high growth rates.

Valuations are also the primary reason behind our underweight position in the ASEAN region. There is a strong economic growth story in the smaller ASEAN nations such as Indonesia and Malaysia where many countries have consumer-driven economies and are benefiting from attractive demographics. These markets are, however, garnering a lot of attention and investors have arguably become overly enamoured with them. From our point of view valuations are now looking expensive.

By contrast we have identified several opportunities in Singapore (the fund has an overweight position here) where valuations are attractive. Singapore is a more mature market than the rest of the region and from a corporate governance perspective the country leads the region; there have been huge advances in corporate practices in Singapore since the Asian crisis. Furthermore, Singapore is the financial hub of the region, attracting money from wealthy Indonesians, Malaysians, and Thai."

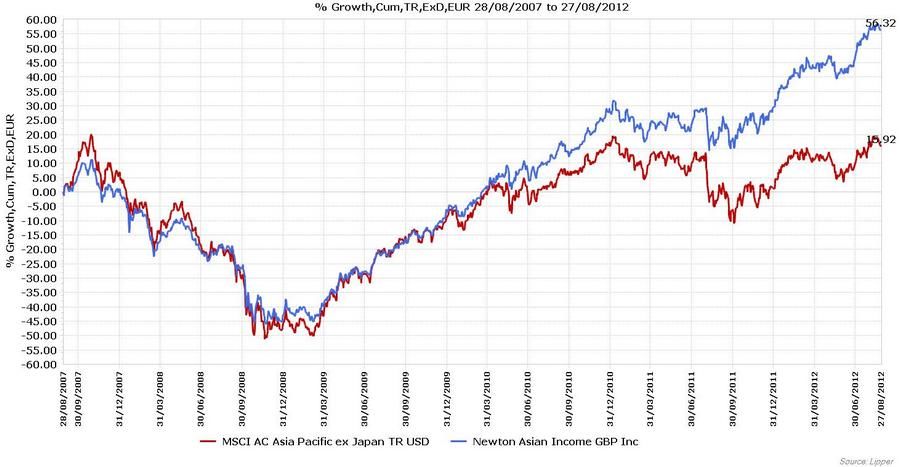

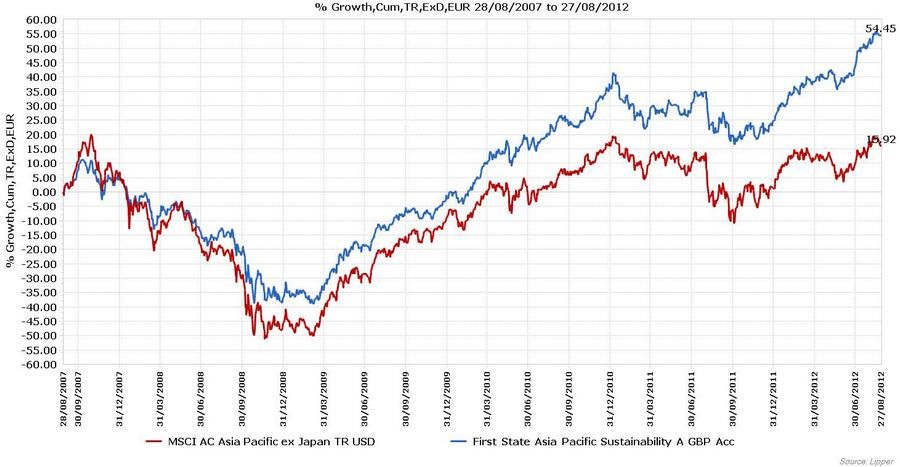

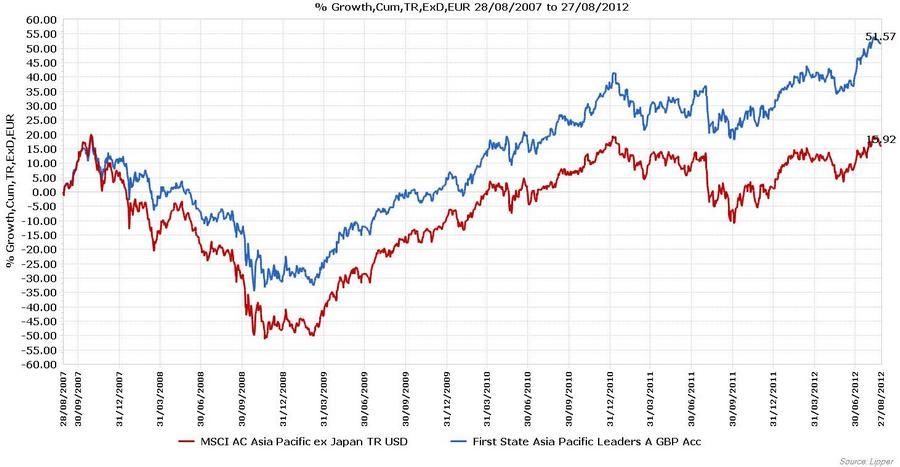

e-fundresearch: "Please comment on the performance and risk parameters of your fund in the current year as well as over the past 3 and 5 years."

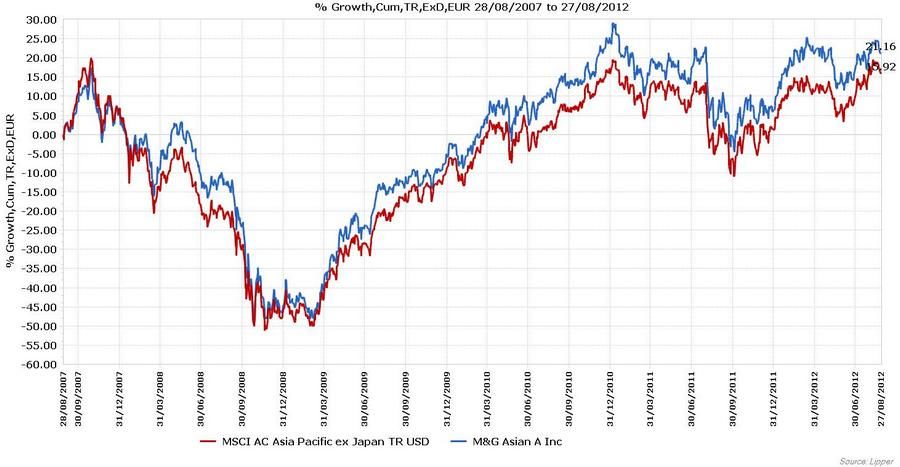

Michael Godfrey and Matthew Vaight, Co-Fund Managers, "M&G Asian A Inc" (ISIN: GB0030939440) (07.09.2012): "As bottom-up stockpickers, stock selection is intended to be the main driver of fund performance. Over the course of 2012 to the end of July, the fund has delivered a return of 14.5% (in euros), slightly behind the MSCI Asia Pacific ex Japan Index (15.5%).

One of the main influences on fund performance has been poor stock selection within the fund’s Australian holdings. As outlined earlier we do not hold firms focused on the domestic economy, which have performed strongly this year; we primarily hold Australian companies that are exposed to Asian growth such as materials firms like Panoramic Resources and Iluka Resources. These have suffered from being closely tied to economic activity, particularly in China. The slowdown in the Chinese economy also weighed heavily on a number of Chinese stocks including Yingde Gases, the manufacturer of industrial gases. Poor stock selection in India and Thailand also proved costly.

On a positive note, stock selection in South Korea and Taiwan added value. The contributors were mainly information technology firms such as Samsung Electronics, NHN, an online search company, and Delta Electronics, a manufacturer of electronics components. Good stock selection within the fund’s consumer discretionary and utilities holdings also made a positive contribution to performance.

Detailed attribution is not available for fund performance over 3 and 5 years. Over the past 3 years the fund has delivered 11.9% pa, compared with the index return of 13.6% pa. The fund has delivered 3.1% pa over the past 5 years, compared with 2.6% for the index. This period includes a time when the fund was not managed by the current managers who were appointed on 29 February 2008."

Source of performance data: Morningstar Inc, Pan-European database, as at 31 July 2012, Euro A class shares, net income reinvested, price to price.

e-fundresearch: "Where do you see opportunities and where do you see risks?"

Alistair Thompson, Head of Asia Pacific Equities, "First State Asia Pacific Sustainability A GBP Acc" (ISIN: GB00B0TY6S22), "First State Asia Pacific A GBP Acc" (ISIN: GB0030183890), "First State Asia Pacific Leaders A GBP Acc" (ISIN: GB0033874214), "Skandia Pacific Equity A USD" (ISIN: IE0005264431) (04.09.2012): "We believe the outlook for Asia-Pacific markets is looking challenging, given the problems we are facing in the developed world such as excessive leveraging. Economic growth is going to be slower than it has been in the past, and that will have ramifications in Asia, so for the companies relying on export growth might struggle, whilst companies that are dependent on domestic demand should hold up quite well.

We are optimistic on Singapore where returns should be reasonable given the combination of a strong regulator, well managed banks with strong franchises and a safe haven currency. Some of the consumer companies in Korea are attractively priced and in some cases value is beginning to emerge in China.

The key risk factors to bear in mind are if sovereign debt in the Euro Zone deteriorates, inflation surges to a very high level which forces the central banks to raise interest rates aggressively, and the political tensions escalate. Social unrest is becoming increasingly common.”

Michael Godfrey and Matthew Vaight, Co-Fund Managers, "M&G Asian A Inc" (ISIN: GB0030939440) (07.09.2012): "We see the greatest opportunity in Asia ex Japan today as the transformation in the way that companies are being managed. Many Asian businesses are taking great strides in terms of their operational and management abilities and improving their use of capital. Importantly, they are becoming increasingly aware of the need to create value for shareholders rather than focusing solely on growth. In addition, there are more and more innovative Asian firms that are starting to compete on a global basis and take market share from those based in the ‘West’. In our view, the opportunity to invest in exciting, well managed companies that are increasingly shareholder oriented is the long-term attraction of Asian markets.

In terms of risks, the slowdown in China and the weakness of global economy are concerns. However, this will likely have ramifications worldwide, rather than just in Asia ex Japan. On balance, we believe that many Asian economies, particularly in the ASEAN region, are fairly resilient to the deteriorating economic situation in China. It should be remembered that economic growth and stockmarket performance are uncorrelated; companies ultimately dictate market performance in the long term. However, economics does influence short-term investor sentiment which can increase volatility in the region. We believe the long-term prospects for the region are extremely attractive and a disciplined approach focused on returns on capital and valuations can deliver returns for the long-term investor."

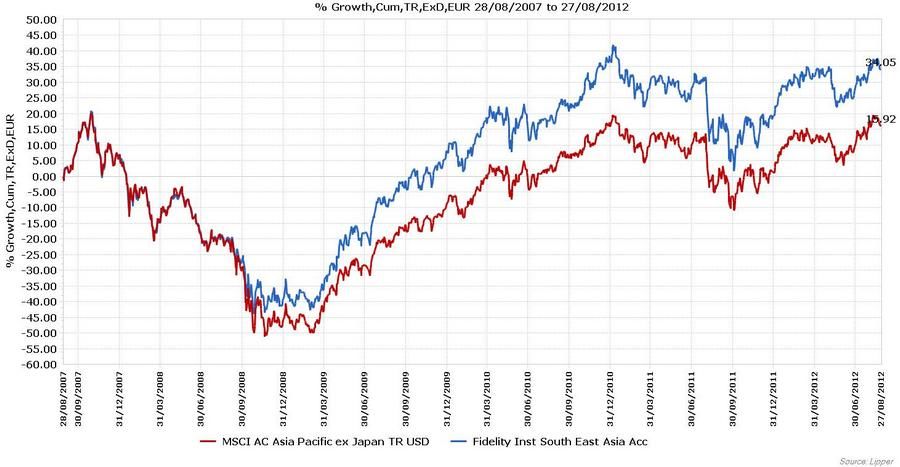

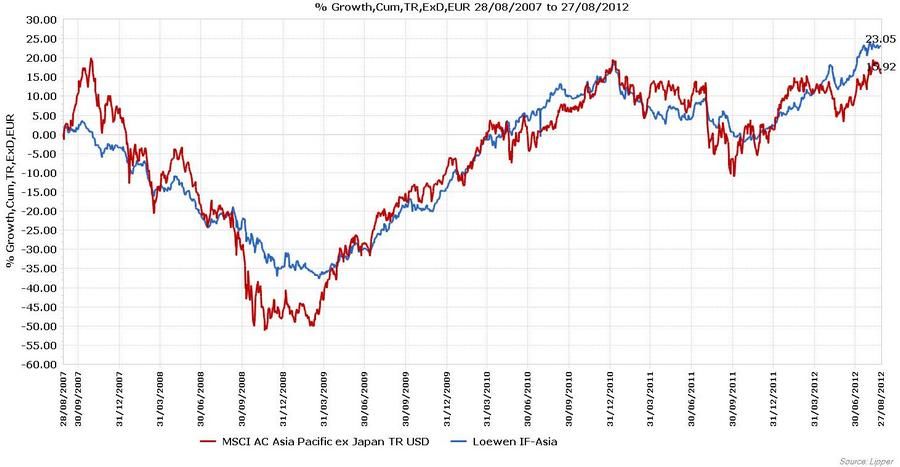

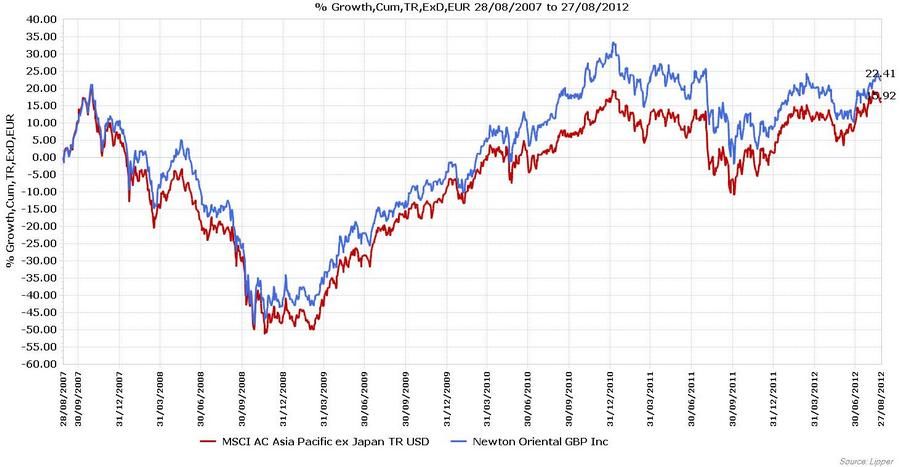

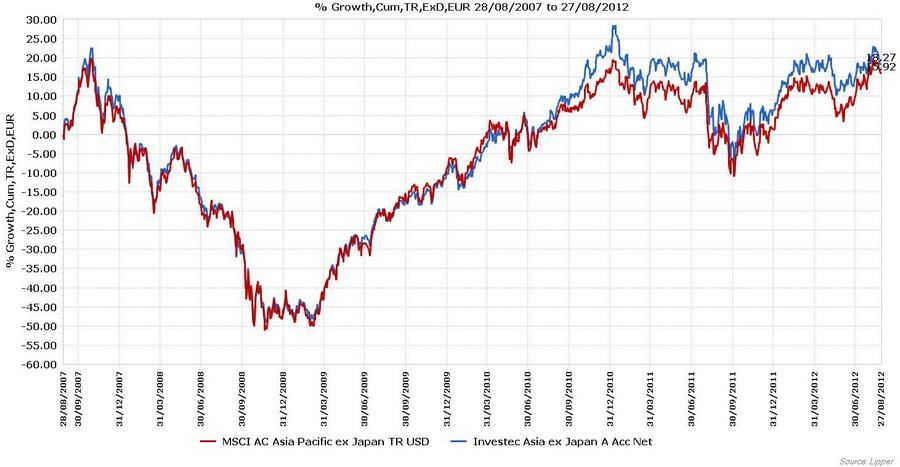

Alle Performance Daten der Top-10 Auswertung per 27.08.2012:

Fortsetzung der Artikelserie am 17. 09. 2012:

Lipper Global - Equity Emerging Mkts Global