Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest?

Threadneedle (Lux) Global Asset Allocation Fund (ISIN: LU0061474705) is a mixed asset fund offering global exposure across a range of asset classes with the aim of generating equity-like returns with up to two-thirds equity volatility.

The portfolio’s actively managed asset mix can be used as a core portfolio holding for investors seeking to generate capital growth and investment income over the long term.

The fund follows Threadneedle’s highly successful multi-asset fund investment process and is managed by the same team that has delivered strong, award-winning performance across the range of Threadneedle’s multi-asset funds. It draws on the resources of the entire Threadneedle investment team, ensuring the portfolio benefits from our best ideas.

Threadneedle is a substantial player in multi-asset investment with $47bn assets under management in asset allocation funds and mandates (representing nearly 40% of Threadneedle’s total assets under management).

Fundamental research and bottom-up stock selection drive the sub-portfolio’s construction. The fund is unconstrained by any index and has the ability to take high conviction positions across a wide range of assets reflecting Threadneedle’s asset allocation view.The fund has considerable flexibility to dynamically allocate across equities, fixed income, commodities and cash.

The target is to generate equity-like returns with up to two-thirds equity volatility.

Capital preservation (downside protection) is key to the fund and this is managed through active asset allocation using our research, strategy and portfolio management processes.

Managed by Alex Lyle and Toby Nangle who each have extensive experience and a proven track record in multi-asset fund management.

Alex Lyle is Head of Managed Funds and has 31 years’ experience. He is co-manager of the fund responsible for asset allocation. Toby Nangle is Head of Multi-Asset allocation and has over 15 years’ experience. He is co-manager responsible for the fund’s asset allocation and management of non-equity portion.

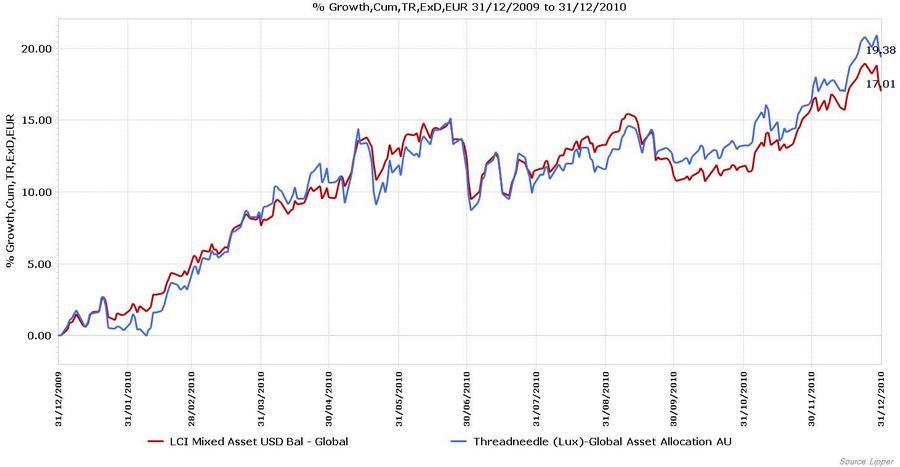

Performance Review 2009

Täglich die aktuellsten News im newsletter: hier anmelden