Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest?

Investment universe

The investment universe for the LO Funds – Europe High Conviction I A (hereafter “LOF Europe High Conviction” or the “Fund”) comprises Western European equities excluding financials, oils, metal & mining (theoretical: approx. 1,200 stocks, practical, with the abovementioned exclusions: approximately 250-300 stocks).

Investment strategy

The fund implements a bottom-up, high conviction investment strategy, with the aim to generate capital growth over the long term. Our portfolio is managed to beat the MSCI Europe index over the long term rather than to track the index over the short term. We follow a strict research-intensive, fundamental, bottom-up approach, targeting mispricings coupled with catalysts.

In selecting the individual stocks, the fund manager is guided by his own financial analysis of companies. At times, sectors considered unattractive or difficult to analyze thoroughly – as listed below – will be excluded. The result is a concentrated portfolio of 30-50 different companies.

- Businesses whose future developments are unpredictable (e.g. banks) and/or balance sheet and accounting rules are difficult to penetrate (e.g. Insurance)

- Businesses whose investment case revolves around the price of an underlying commodity (e.g. Oil, Oil& Oil services, Metals& Mining)

- Businesses with significant/prevailing government intervention in corporate governance, units sold or pricing

The key strength of the Fund is its structured investment strategy that uses tiered portfolio construction to focus on performance throughout the business cycle. A constant eye on investment discipline mitigates the risk of style drift, ensuring the highly experienced management team follows its valued and distinctive approach.

Our portfolio is built in 3 distinct tiers, so as to enable the fund to navigate through any economic or market cycles:

(i) High-quality companies: mostly acyclical businesses which should outperform significantly in down markets

(ii) (Corporate event candidates: these businesses may also be fund in a more cyclical spectrum and should profit from benign, M&A-fuelled macro environments

(iii) High growth companies: these companies should benefit from innovative products, market share gains, emerging market exposure.

This tiered portfolio construction creates a strong discipline: investments not fitting in one of three buckets are discarded. Thus, the team focuses on a subset of opportunities, building depth of knowledge rather than stretching itself too thin over a broad universe of stocks.

Investment process

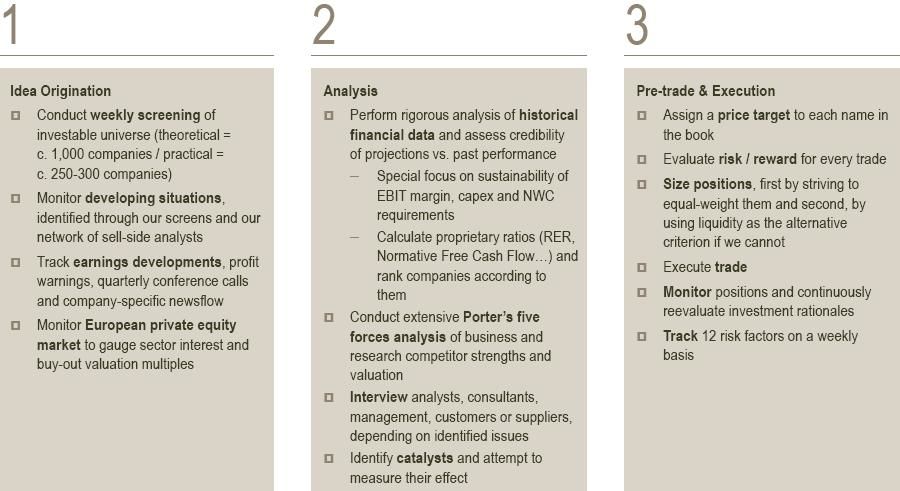

The fund’s portfolio is the result of fundamental analysis performed by the team, following a three-step qualitative process:

LOF – Europe High Conviction uses MSCI Europe Net Dividends as its benchmark. MSCI indices are the most commonly used ones when it comes to Equities funds, so we have chosen this benchmark for consistency. Our portfolio is managed to beat the MSCI Europe index over the long term and not to track the index over the short term. In theory, we could allocate 100% of the portfolio to non-benchmark stocks, however, in practice the maximum limit would be 50%.

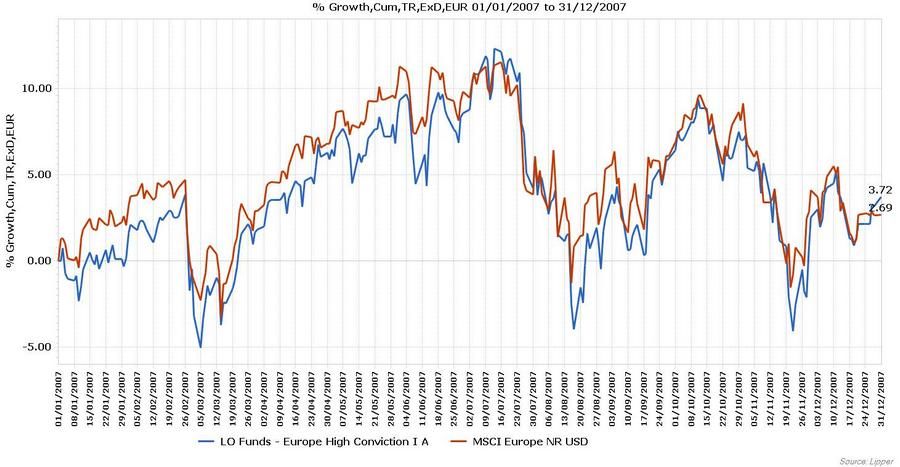

Performance Review 2007

Arpad Pongracz: "European stocks declined following concerns that the losses related to the collapse of subprime mortgages would sap economic growth, inflation would accelerate, and measures by central banks to tackle the credit crunch would be insufficient to defuse the crisis. Sectors most sensitive to interest rates and the economy like financials, IT, and consumer discretionary were the main losers. On the other hand, "defensive" sectors like utilities and telecoms were able to show positive performance. During the 4th quarter, we reduced our overweight in materials and IT. The proceeds were invested in staples and healthcare as well as in financials where we took advantage of the group correction to neutralize our exposure, having been significantly underweight. In terms of performance, the relative outperformance to the benchmark was mainly due to stock picking while sector allocation was negative. We gained most in Capital Goods and Healthcare while Autos and Utilities (underweight) contributed negatively."

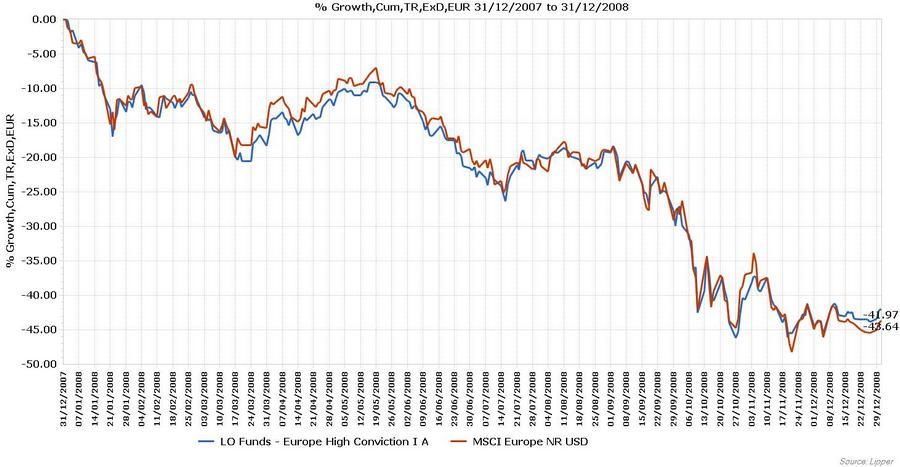

Performance Review 2008

Marc Bollet: "2008 was a tough year for investors all around the world, with the final quarter of the year being particularly challenging. Between the beginning of October and the end of December European markets fell by 23%, taking yearly performance to -42%. The negative impact of the credit crunch, strongly deteriorating macro-economic data, and continued financial deleveraging resulted in an accelerating downward spiral in financial markets during the final months of the year. During the second half of the quarter, we reduced our defensive stance in the portfolio somewhat (reducing our exposure levels in healthcare and utilities and adding to our consumer discretionary holdings). Nevertheless, the overall performance of the Fund during the last quarter of the year was satisfying on a relative basis as we outperformed our benchmark by 167 bps."

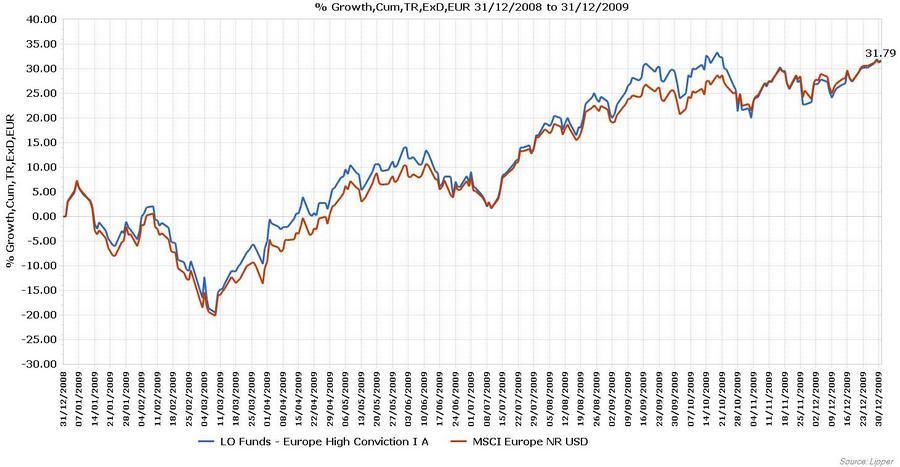

Performance Review 2009

Clemens Aichholzer: "The global risk rally lost steam during the last quarter of the year after six very strong months for the markets. Investors grew increasingly concerned that cyclical sectors in particular had risen too fast compared to the still relatively tenuous economic recovery; besides, the market had started to look technically overbought toward the end of the 3rd quarter. The financial crisis in Dubai (Abu Dhabi eventually came to the rescue) and over-stretched Greek finances also served as a reminder of the fragility of the global economy. During the last quarter, we reduced our exposure to industrials and energy somewhat, taking profits in names that had performed strongly and were approaching our price target."

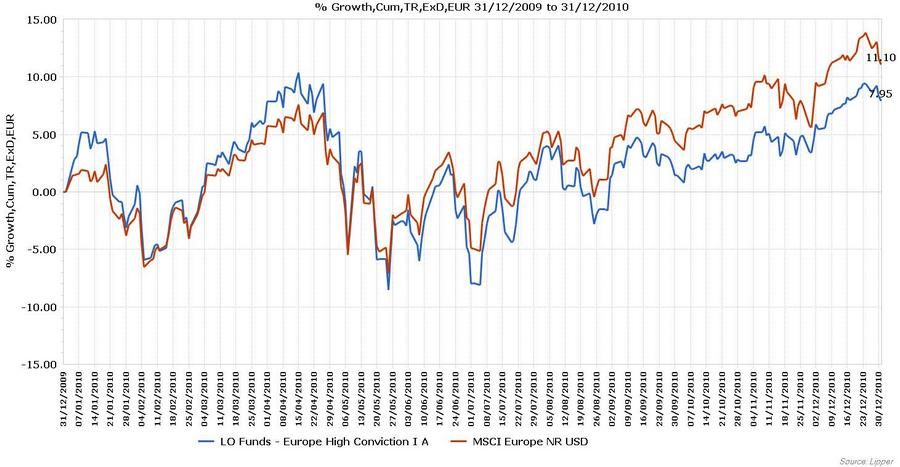

Performance Review 2010

Clemens Aichholzer (Marc Bataillon from 15 November 2010): "A change in brief and management took place on 15 November 2010; the investment strategy was based on: (1) High-quality companies (2) High-growth companies and (3) M&A targets. Sectors difficult to understand from a business perspective (banks, insurers with opaque balance sheets) or in sectors where it is nearly impossible to have an opinion on future prices (oil, basic resources) would be excluded. The fund will invest exclusively in western European-listed companies (even though they can have major exposure to emerging countries). With markets in turmoil, the change in strategy helped the fund achieve significant outperformance in the last fifteen days of the month thanks to the underexposure to the financial sector. December was an extremely positive month for European equities, however our stance led us to underperform the market in December, as a consequence of our significant underexposure to raw materials and financials. However, we strongly mitigated this effect through decent stock picking."

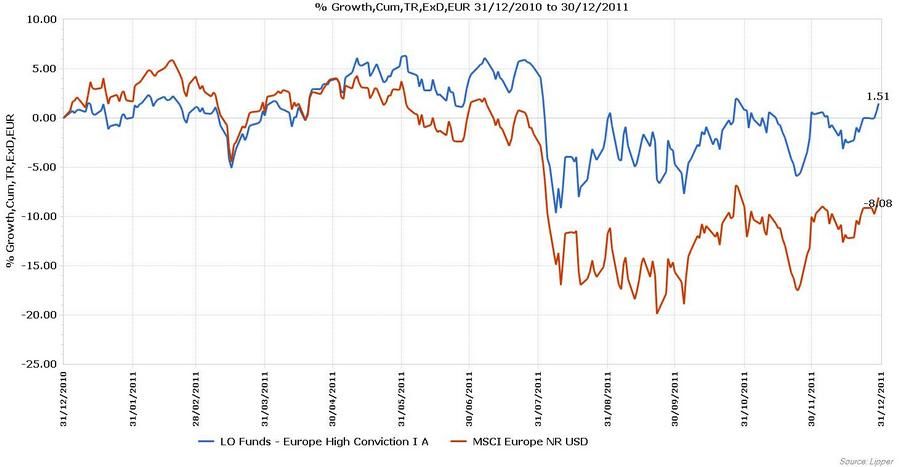

Performance Review 2011

Marc Bataillon: "In 2011, the fund outperformed its benchmark by almost 10%, and finished the year top of its Morningstar category.

In a difficult and volatile year, the European market declined around 8% in 2011 after initially gaining during the first half. The market was in negative territory for most of the second half and was down 20% year-to-date at one point in the third quarter before recouping some losses in the last quarter. Two third of the fund’s outperformance is explained by our stock-picking exclusion and the rest is due to sector exclusions. All our categories contributed to this outperformance, as each of them is represented in our Top 10 contributors – the best ones came from the Corporate Event Opportunities bucket."

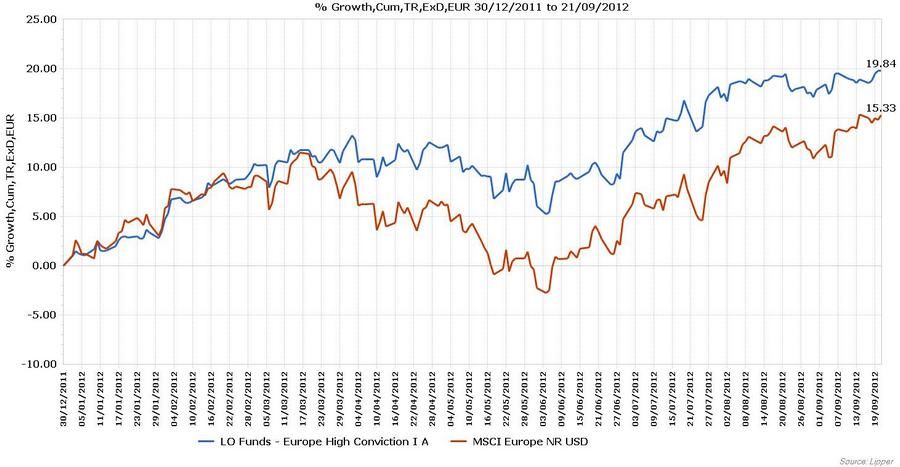

Performance Review 2012

Marc Bataillon: "In the first quarter of 2012, the fund outperformed its benchmark again, thanks to very good stock picking, especially in the unfavored sectors of the quarter, like healthcare, telecom and consumer staples and no exposure to the energy sector which underperformed the overall market. The fund’s outperformance is notable as the fund was negatively impacted this quarter by sector rotations which favored sectors in which the fund has no exposure (autos and financials).

Always pursuing an excellent relative performance, the fund was -0.14% vs.-2.90% for the benchmark in the second quarter of 2012. This is mainly due to a very good stock-picking, especially in Industrials, Materials and IT and no exposure to financials and energy sectors which again underperformed significantly in the market (sovereign debt issues and decline in the oil price).

Performance 2007 - Year-to-Date

Marc Bataillon, lead portfolio manager of LOF – Europe High Conviction (as well as of a European equity long/short fund), and his team implement a fundamental approach to investing in this market. As mentioned before, the team does not invest in sectors with business models that they view as unpredictable, overly complex or which are subject to fluctuations driven by the price of underlying commodities. As a result, they do not invest in financials and energy/commodity stocks. They favor high quality companies with demonstrated pricing power, companies with above average growth, and companies that are attractive acquisition candidates. In addition, the highly experienced team keeps a constant eye on investment discipline to mitigate the risk of style drift.

Since November 2010, the fund has outperformed the benchmark by more than 18% in a very difficult and volatile market environment. The outstanding Lipper rankings achieved over the short and long terms further exemplifies the fund’s strong performance across market cycles.