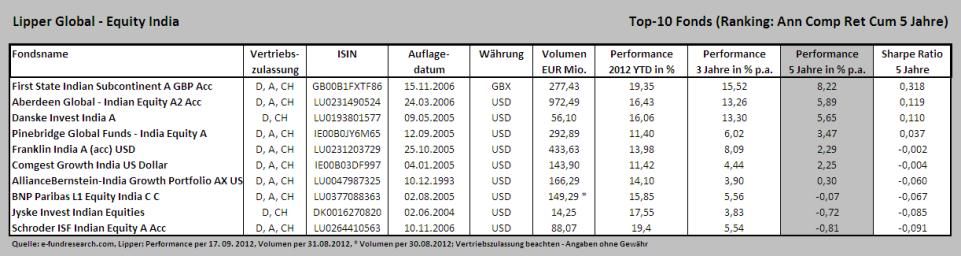

Die obige Tabelle ist eine Darstellung der besten zehn Indien Aktienfonds - gereiht nach Performance 5 Jahre in % p.a. (insgesamt 43 Fonds in der gesamten Assetklasse - Lipper Global Equity India). Die Fondsmanager von BNP Paribas, Comgest, AllianceBernstein und Schroders haben die Fragen von e-fundresearch.com beantwortet. Keine Antworten wurden von den restlichen Top-10 Gereihten zugesandt. Die durchschnittliche Performance der Top-10 Fonds seit Beginn des Jahres liegt bei +15,55 Prozent.

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...e-fundresearch: "Which macroeconomic factors are currently most important for Indian equities?"

Manish Shah, Fund Manager, "Comgest Growth India US Dollar" (ISIN: IE00B03DF997) (26.09.2012): "India’s persistently high inflation coupled with a fiscal deficit have been strong headwinds for investors in Indian equities. As the growth rate has slowed, investors have become increasingly concerned by the lack of government action. Fortunately, the government has finally come to realise that 7% growth rates are not pre-ordained and have proposed measures to invigorate business investment. These measures include, the opening up of modern retail and airlines to foreign ownership; an increase in fuel prices and the restructuring of the State Electricity Boards loans. If these measures are implemented either in full or partially, investment should accelerate and this would be a positive for Indian equities."

- A pickup in the GDP growth estimates from FY’14, after a dip in the growth in FY’13 is going to be a key driver for Indian equities.

- A major challenge India has, different to other economies witnessing slowing growth, is high Inflation. With Inflation around ~ 7.5 % the Indian central bank RBI (Reserve Bank of India) has limited room for interest-rate cuts in an economy growing at near to its slowest pace in three years. The latest government actions will go a long way in assuring the central bank that it too is keen on improving the fiscal scenario. The market is expecting a 50 basis points rate cut by RBI sooner rather than later.

- India’s budget estimate for fiscal deficit for FY’13 is 5.1% of GDP, which is expected to worsen further unless the government takes measures to cut down on the subsidies. This coupled with pace of reforms is crucial for retaining external interest in Indian equities and to avoid a possible threat of a downgrade by the rating agencies. This is largely avoided for the time being given the positive steps taken by the government both on the fiscal deficit side and reform side related to opening up sectors further to FDI investments."

This has also led to inflationary pressures in the economy sustaining for the last couple of years. The strong consumption trend in the country (partly attributable to government policies) is also reflecting in high trade and current account deficit which is a concern for the Rupee. Second factor that we are closely monitoring is the capex and investment cycle in the country which has ground to a complete halt due to policy inaction after a series of corruption scandals. Any steps that government takes to revive investment sentiment will be a positive for the structural outlook of the economy."

e-fundresearch: "Which are the most important elements in your investment process?"

Manish Shah, Fund Manager, "Comgest Growth India US Dollar" (ISIN: IE00B03DF997) (26.09.2012): "Comgest has a quality growth strategy. Firstly we ask, do we like this industry, secondly, do we like the management and finally, should we invest at this price. Companies that have a strong franchise are able to generate superior returns over the long run and this should translate into superior equity returns. The strict criterion imposed by Comgest only allows the fund to invest in a limited number of companies."

Rajeev Eyunni, Senior Research Analyst, "AllianceBernstein-India Growth Portfolio AX USD" (ISIN: LU0047987325) (26.09.2012): “We continue to focus on what we believe are well-managed companies with a strong growth potential. We believe that stocks with a combination of growth and value should perform best in this environment."

Simon Godfrey, Investment Specialist Emerging Markets, "BNP Paribas L1 Equity India C C" (ISIN: LU0377088363) (25.09.2012): "Our investment philosophy is that, “Companies create wealth, not markets”, we implement this philosophy in our investment process and stock selection by giving utmost importance to ensure that we invest in companies that have: Strong Businesses, Capable Management and are available at reasonable Valuation using a robust “BMV” framework.

- The portfolio selection is structured with 2 layers of alpha generation objective, one at the model portfolio level (provided by research team) and the other at the portfolio level by the fund manager in the stock selection from the model portfolio.

- Every investment team member is an analyst covering their respective core sectors and the coverage is structured to have peer review to spread the risk."

Manish Bhatia, Fund Manager, "Schroder ISF Indian Equity A Acc" (ISIN: LU0264410563) (19.09.2012): "Our investment process is essentially bottom-up and a distinctive feature of our process is that our equity research is undertaken by a team of in-house analysts. The entire team ( Fund manager + analysts) then drive the stock selection for the Fund."

e-fundresearch: "Which over- and underweight positions are currently implemented in your Indian equity positions?"

Manish Shah, Fund Manager, "Comgest Growth India US Dollar" (ISIN: IE00B03DF997) (26.09.2012): "The India fund is heavily underweight the financial, materials, IT and energy sector and overweight consumer staples, healthcare, utilities and industrials."

Rajeev Eyunni, Senior Research Analyst, "AllianceBernstein-India Growth Portfolio AX USD" (ISIN: LU0047987325) (26.09.2012): “The portfolio is currently overweight industrials and financial while underweight consumer staples, telecom and energy. This includes companies that can benefit from India’s ongoing deregulation and strong economic growth, and also companies that we believe have attractive long-term prospects but are undervalued for a range of reasons in the short term.”

Simon Godfrey, Investment Specialist Emerging Markets, "BNP Paribas L1 Equity India C C" (ISIN: LU0377088363) (25.09.2012): "Our portfolio positioning is currently overweight in telecommunication services, consumer staples, healthcare and consumer discretionary sectors and underweight in financials, information technology, materials and industrials."

Manish Bhatia, Fund Manager, "Schroder ISF Indian Equity A Acc" (ISIN: LU0264410563) (19.09.2012): "We are currently overweight consumer related sectors of the economy which continue to benefit from attractive demographics and ongoing wage growth. We also like IT and pharma sector which are reporting steady top line growth and get additional tail wind support from weak currency. We are underweight deep cyclical sectors such as commodities as we think global economy will continue to witness sluggish growth. We are also underweight Telecom and Utility sectors where regulatory issues are an overhang."

e-fundresearch: "Where do you see risks for investments in Indian equities?"

Manish Shah, Fund Manager, "Comgest Growth India US Dollar" (ISIN: IE00B03DF997) (26.09.2012): "The major risks for Indian equity investors barring an exogenous shock are policy gridlock and an uncertain regulatory framework, which is discouraging investment in the telecom sector. The other major concerns are inflation and persistent fiscal and current account deficits."

Rajeev Eyunni, Senior Research Analyst, "AllianceBernstein-India Growth Portfolio AX USD" (ISIN: LU0047987325) (26.09.2012): “India’s currently undergoing a cyclical slowdown exacerbated by political maneuvering ahead of the 2014 general election. Continued policy paralysis could stunt economic growth, aggravate the fiscal deficit, and bring about a period of protracted high inflation and high interest rates. This scenario would also cause the Rupee to further weaken against the US Dollar.”

Simon Godfrey, Investment Specialist Emerging Markets, "BNP Paribas L1 Equity India C C" (ISIN: LU0377088363) (25.09.2012): "Risk of a weaker currency due to the threat of a downgrade by rating agencies on account of India’s expansionary fiscal policy leading to a fiscal deficit of 5.1% of GDP (BE 2013), however, the government has taken some quick steps to address this issue providing some assurance that it can keep the fiscal scenario under check.

Indian equities have seen close to $13 billion of net FII inflows YTD on the backdrop of a net YTD negative flows by the domestic institutions. There is a risk of a correction on the backdrop of a global economic slowdown, to which India will not be immune to. However, as India is a net importer of commodities (largely crude oil) it stands to benefit once these commodities come off their highs."

Manish Bhatia, Fund Manager, "Schroder ISF Indian Equity A Acc" (ISIN: LU0264410563) (19.09.2012): "Currency weakness is a major risk factor for Indian markets as it can exacerbate the fiscal and trade deficits and also lead to inflationary pressures sustaining for longer. Rating agencies are closely monitoring the pace of structural reforms being undertaken by the government and any disappointment could be negative for capital inflows into the country."

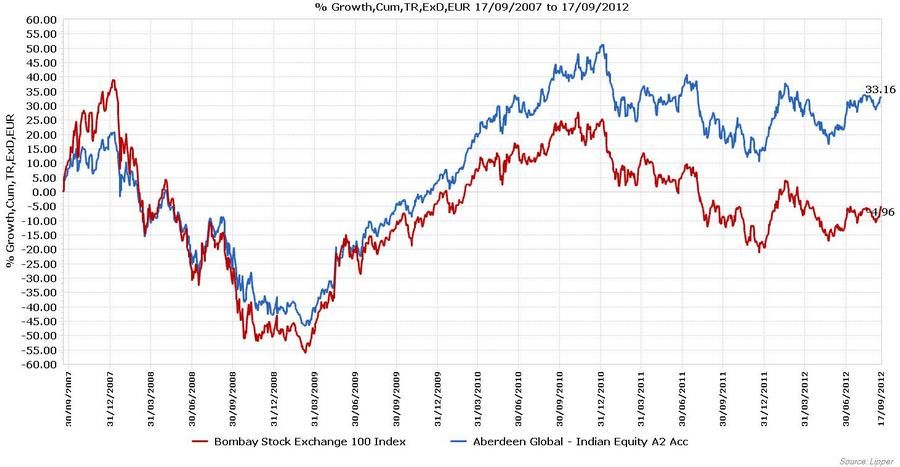

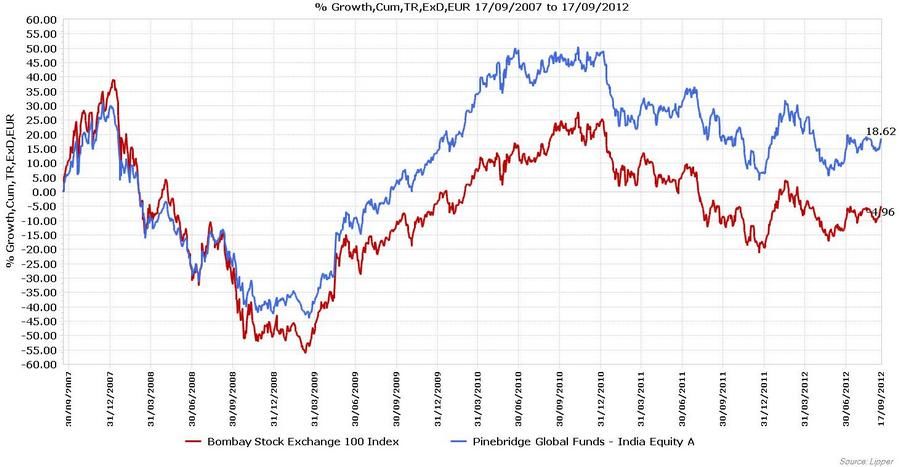

e-fundresearch: "Did your fund outperform or underperform vs. benchmark over the past 5 years and which part could be linked to stock selection (Performance Attribution)?"

Manish Shah, Fund Manager, "Comgest Growth India US Dollar" (ISIN: IE00B03DF997) (26.09.2012): "The fund outperformed the index by 3.8% per annum over the last five years. While cognisant of the macro economic conditions that can impact the market in the short to medium term, we remain stock pickers at heart and remain wedded to investing in strong companies, which are able to consistently add value to shareholders."

Rajeev Eyunni, Senior Research Analyst, "AllianceBernstein-India Growth Portfolio AX USD" (ISIN: LU0047987325) (26.09.2012): “While the portfolio (Class AX USD) is down in a 5 year period it has outperformed its benchmark the Bombay Stock Exchange 200 Index by around 5 per cent, the majority of which is attributable to stock selection.”

Simon Godfrey, Investment Specialist Emerging Markets, "BNP Paribas L1 Equity India C C" (ISIN: LU0377088363) (25.09.2012): "The fund has outperformed the benchmark S&P CNX Nifty over the past 5 years and it can largely be attributed to stock selection."

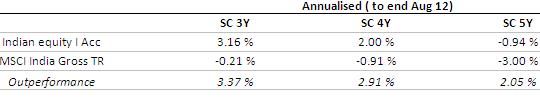

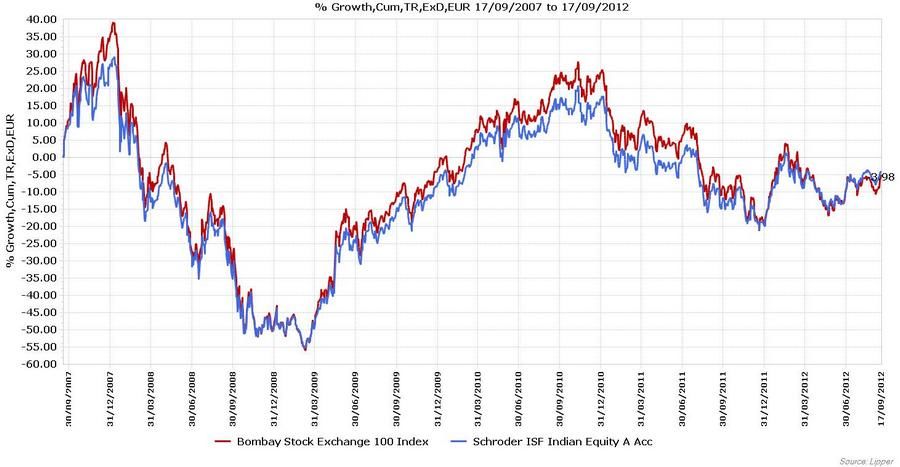

Manish Bhatia, Fund Manager, "Schroder ISF Indian Equity A Acc" (ISIN: LU0264410563) (19.09.2012): "The fund outperformed its benchmark over last 3/4/5 year time horizon and this outperformance is primarily driven by stock selection."

All performance data in Top-10 list per 17th of September 2012: