Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest? (ISIN: LU0219444758)

The fund’s objective is capital appreciation, measured in US dollars. The fund invests primarily (at least 70%) in Japanese equity securities. It may invest in companies it believes to have above-average earnings growth potential compared with other companies (growth companies), companies it believes are undervalued compared with their perceived worth (value companies) or in a combination of growth and value companies. We consider the fund’s primary universe to be any stock that is a member of the MSCI Japan Index (the fund’s benchmark) or the TOPIX Index. The investable universe consists of approximately 400 companies representing approximately ¥250 trillion of market cap. While the majority of stocks in the portfolio are in the benchmark, we will invest in stocks outside of the benchmark that meet our buy criteria. Generally, the goal of MFS® MeridianSM Funds – Japan Equity Fund is to outperform its benchmark, the MSCI Japan Index over full market cycles, typically three to five years, while maintaining a reasonable level of risk.

The fund is managed by a team of MFS® research analysts who employ bottom-up, fundamental research and a peer review process to build a portfolio representing their best ideas for capital appreciation across Japanese industries. We believe that equity prices of individual companies are driven by perceived future earnings and cash flow and that stock selection based on bottom-up, fundamental research is the most consistent method for generating alpha over the long term.

The analyst team researches companies and industries in order to generate their best ideas. Analysts communicate with several sources in the idea generation process. The research analysts develop investment ideas by obtaining and analysing company and industry information from contacts with company managements, suppliers, consumers and competitors, industry consultants and the research community. Analysts are responsible for developing and maintaining their own models on each of the companies that they follow. The analyst team meets weekly to discuss investment ideas. Each analyst is responsible for two or three industries at a time and for recommending allocation levels in his or her respective industries. Portfolio construction is bottom up and stock specific. Each analyst identifies his or her best ideas, which typically have a market capitalisation in excess of ¥200 billion within his or her covered industries. The portfolio is managed in a sector-neutral style, and sector teams work together to reallocate money within the same sector from existing holdings to new, more attractive ideas. All new ideas are presented to the analyst team along with an earnings model, target price and investment thesis, and the sector team makes the final decision on which ideas to hold. The selection process is unique for each sector and incorporates the sector’s distinguishing characteristics. Analysts seek to pick the best stocks in their coverage based on sector-specific factors and valuation metrics. For example, the financial sector team generally compares stocks using different valuation criteria (such as price to book and tier-1 capital ratios) than those that are employed by the technology team in evaluating stocks in its sector (such as price to earnings and enterprise value/earnings before interest, taxes, depreciation and amortisation (EV/EBITDA)).

Earnings forecasts for retail (consumer cyclical) stocks rely on different critical metrics (such as same-store sales) than capital goods stocks (such as monthly orders). Our analysts develop a deep understanding of the sectors they cover and take each of the sector’s unique attributes into consideration when we invest and develop specific methodologies for each sector.

The portfolio will typically hold 30 to 60 securities of companies that we believe have sustainable business models, are trading at a greater valuation discount than peers of similar quality and returns and are the most likely to outperform their respective sectors. The decision to invest in new ideas can be done after informal, ad hoc discussions or during the more formal weekly research and monthly rebalance meetings.

The team is overseen by Simon Gresham, Director of Equity – Asia, and Kevin Dwan, Director of Research – Asia. Institutional Equity Portfolio Manager Sanjay Natarajan and Equity Research Analyst Joseph Skorski, the portfolio coordinators, chair the weekly meetings.

Performance Review 2007

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...

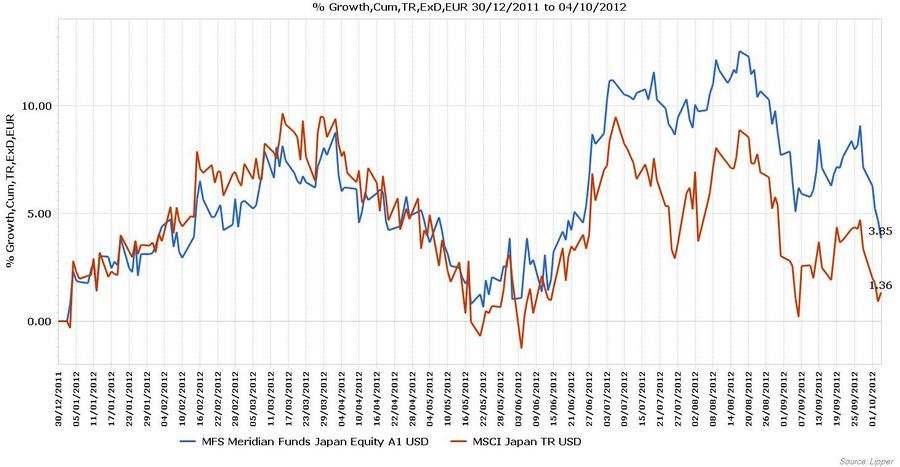

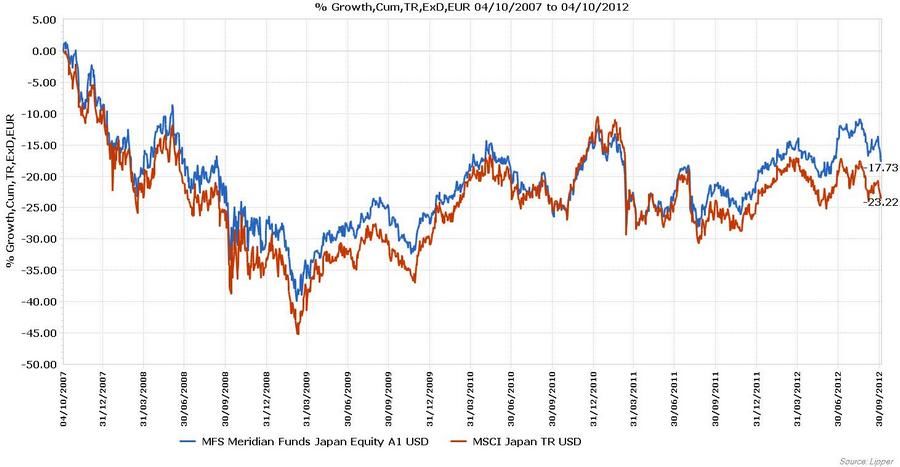

Simon Gresham, Kevin Dwan, Sanjay Natarajan: "In the 5 year period ended 31 August 2012, the MFS Meridian Funds- Japan Equity Fund A1USD shares have outperformed its benchmark, the MSCI Japan Index (Net Div). During the period, the fund's stock selection within Technology, Energy, Capital Goods, Health Care, Consumer Cyclicals, Consumer Staples and Financial Services benefited returns. Conversely, the fund's underweight allocation and stock selection within Telecom/CATV negatively impacted returns."