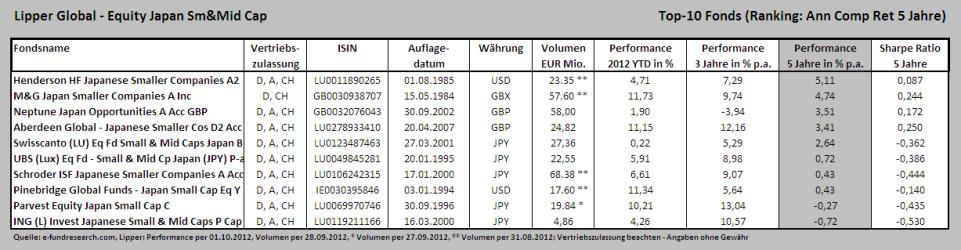

Die obige Tabelle ist eine Darstellung der besten zehn japanischen Small & Mid Cap Aktienfonds - gereiht nach Performance 5 Jahre in % p.a. (insgesamt 21 Fonds in der gesamten Assetklasse - Lipper Global Equity Japan Sm&Mid Cap). Die Fondsmanager von Aberdeen Asset Management und Swisscanto haben die Fragen von e-fundresearch.com beantwortet. Keine Antworten wurden von den restlichen Top-10 Gereihten zugesandt. Die durchschnittliche Performance der Top-10 Fonds seit Beginn des Jahres liegt bei +6,80 Prozent.

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...e-fundresearch: "Which facts are relevant in the current market environment to value Japan Small/MidCap stocks?"

e-fundresearch: "What is your expectation concerning the relative performance of Japan Small/MidCaps over the coming 6-12 months?"

Chern-Yeh Kwok, Fund Manager, "Aberdeen Global - Japanese Smaller Cos D2 Acc" (LU0278933410) (09.10.2012): "Given the uncertain global macroeconomic outlook, Japan's equity markets are likely to stay volatile in the near term. While small caps are often less exposed to external demand, they face a number of headwinds at home too. The domestic economy is slowing, and political instability could resurface with an election expected in coming months. The yen, meanwhile, has remained strong despite government and central bank interventions. Against such a backdrop, picking the right stocks (ie well-run companies with solid balance sheets and robust business models) will prove vital."

Tadahiro Fujimura, Fund Manager, "Swisscanto (LU) Eq Fd Small & Mid Caps Japan B" (ISIN: LU0123487463) (05.10.2012): “Japanese markets, both large and mid/small caps, lagged against other developed countries' markets. Due to the concerns of downward earnings revisions associated with a slowdown in China, Japanese markets dropped more than 10% over the last 6 month. Meanwhile, the Dow, S&P 500 and DAX rose by 1-5% over the same period. We believe the Japanese markets will recover and catch up with the western markets after the release of semi-annual earning results which will start in mid-October. Therefore, we believe large cap markets will recover by 10% next 6-12 months and mid/small caps may recover as much as large caps but the upturn will last longer due to inexpensive valuations.”

Ayumi Kobayashi, Fund Manager, "Schroder ISF Japanese Smaller Companies A Acc" (ISIN: LU0106242315) (12.10.2012): "We do not have specific forecast of market performance, however, given its lower valuation of small cap market compared with large cap stocks, we have rather positive view on small cap over large cap. In addition, small-cap companies generally have a single business focus and often tend to be in growing industries with new and promising products or services. Investors can access these growth opportunities more efficiently in small caps than large caps. Furthermore, in contrast to the general perception about the Japanese economy, domestic consumption in Japan has been growing. This is beneficial for smaller companies who can gain direct exposure to rising consumption levels."

e-fundresearch: "Which are the most important elements in your investment process?"

Chern-Yeh Kwok, Fund Manager, "Aberdeen Global - Japanese Smaller Cos D2 Acc" (LU0278933410) (09.10.2012): "We never invest in stocks we have not visited, and we are not driven by benchmarks. Rather, we evaluate companies based on their quality, in terms of business prospects, transparency, balance sheet strength, management openness and fair treatment of shareholders. We shun businesses we do not understand or those with discriminatory shareholder structures. Companies that pass our quality filter are then assessed for value. Equally central to our process is our team approach, where investment managers share company research duties and cross-cover visits; our emphasis is on collective wisdom, not star managers."

Tadahiro Fujimura, Fund Manager, "Swisscanto (LU) Eq Fd Small & Mid Caps Japan B" (ISIN: LU0123487463) (05.10.2012): “We believe our direct-research approach is extremely effective and is the most important element in finding attractive value gap situations in the mid and small cap arena. Meeting with top management is one of the most effective approaches to understanding a company´s business model in an effort to determine intrinsic value. The influence of top management on a small company´s business and future direction is much more important than that of large cap companies. The information gap between publicly available information and information obtained from direct research is huge. Our 23 years of direct research experience enables us to identify not only new growth opportunities, which most small cap managers tend to identify, but also re-growth opportunities which are companies that suffer a temporary slump in earnings and trade at cheap valuations. With this approach, the portfolio has a blended style of growth and value which we expect will provide consistent outperformance during phases of a market cycle.”

Ayumi Kobayashi, Fund Manager, "Schroder ISF Japanese Smaller Companies A Acc" (ISIN: LU0106242315) (12.10.2012): "Our most important elements in the investment process of this fund is our in-house fundamental research.

Schroder ISF Japanese Smaller Companies seeks to make the most of opportunities in small-cap stocks by our research.

The fund typically invests in stocks with a market cap of less than yen ¥80 billion – about US $1billion. Only 50% of companies around the 500th size rank (less than US $1billion) are researched by at least 5 sell-side analysts. This gets less and less as we go down the size spectrum, where we try to exploit opportunities.

As a result, research by our small-cap team (with three experienced members) gives us a competitive advantage. We focus on finding gaps between market prices and the fair value of companies, using information from company visits and by applying our valuation discipline. This provides alpha-generating opportunities to enhance returns.

The first step in our investment process is to screen the small cap universe of 3,200 stocks for liquidity. This gives us a research universe of about 1,200 stocks which we screen for company prospects and fundamentals. Part of our investment process are also company visits. In 2011, for example, 910 visits were carried out by the three members of the team. The next step in the investment process is to narrow down the 1,200 stocks into a research focus group of approximately 500 companies. Here we assess and identify investment opportunities through a valuation analysis which will lead to about 150 candidates on our buy list. I then select 60-80 stocks to go into the portfolio, where I have absolute discretion.

We use a multiple valuation method, including price to earnings (PER), price to book and other traditional methods. We also have our own proprietary valuation model. This is a PER model, developed by our analysts, using three year earnings forecasts. The fair value model is not the only determinant, however, it’s important as a basis and ensures we maintain a consistent investment style.

When considering making investment decisions, the company’s long-term earnings power needs to be assessed. These are based on fundamentals such as strength of management, financial standing and resources, its position in its industry and the prospects of the industry itself. An important determinant is the amount of potential share price upside relative to our assessment of the stock’s fair value. And finally, we ask if there are any catalysts in place which could lead to an improvement in share price performance. Improving corporate governance could be one such catalyst."

e-fundresearch: "Which over- and underweight positions in stocks do you have currently implemented in your fund?"

Chern-Yeh Kwok, Fund Manager, "Aberdeen Global - Japanese Smaller Cos D2 Acc" (LU0278933410) (09.10.2012): "The fund's largest overweight position is in Pigeon, a market leader in baby care products which is underpinned by a strong brand and has substantial growth prospects in Asia. The fund also has considerable exposure to Nabtesco, the world's largest precision gear maker with about 60% global market share, as well as Asics, a conservatively managed athletic footwear company which has successfully grown its overseas business. On the other hand, the biggest underweight positions are in ATM operator Seven Bank, telecommunications construction company Comsys Holdings and parking lot operator Park 24. These are non-holdings in view of quality concerns."

Tadahiro Fujimura, Fund Manager, "Swisscanto (LU) Eq Fd Small & Mid Caps Japan B" (ISIN: LU0123487463) (05.10.2012): “We are overweight in the cyclical names and electronic names. As the Japanese markets are too pessimistic about the Chinese economy, cyclical stocks including steels and papers dropped sharply on fears of further sales price declines. We believe that sales prices may bottom out as current prices are below production cost and we expect the Chinese market will start recovering within 6 months. Also, we are positive on the electronic names. Smaller electric parts companies declined as major Japanese electronic appliance companies such as Sony and Sharp have been suffering. Based on our bottom up research, we believe that the Japanese parts companies have maintained their strong competitive edge.”

Ayumi Kobayashi, Fund Manager, "Schroder ISF Japanese Smaller Companies A Acc" (ISIN: LU0106242315) (12.10.2012): "We currently focus on four areas which we believe offer good investment opportunities:

1) Healthcare – growing market in an aging society

2) Leading companies in a mature domestic market – growth potential in industry consolidation

3) Innovative companies – offer brand new services and products

4) Exporters benefitting from growth of Asian countries – auto parts, healthcare equipment, toiletry makers, etc."

e-fundresearch: "Please comment on the performance and risk parameters of your fund in the current year as well as over the past 3 and 5 years."

Chern-Yeh Kwok, Fund Manager, "Aberdeen Global - Japanese Smaller Cos D2 Acc" (LU0278933410) (09.10.2012): "We do not manage the fund to specific ex-ante tracking error or volatility targets, though we monitor these regularly. With regards to performance, the fund has not only outperformed the benchmark Russell Nomura Small Cap Index for the past several years but it is also consistently ranked in the top quartile of its peer group. Looking at the year to end-August, it gained 13.0% in yen terms, significantly better than the index, which rose 2.2%. Likewise, it outperformed by 6.7% and 3.4%, relative to the benchmark, over three and five years respectively. On the whole, the outperformance over the years has been driven by good stock selection, a reflection of our holdings’ resilience over an extraordinary period which encompassed the 2008 global financial crisis as well as the earthquake, tsunami and nuclear meltdown in Japan last year."

Tadahiro Fujimura, Fund Manager, "Swisscanto (LU) Eq Fd Small & Mid Caps Japan B" (ISIN: LU0123487463) (05.10.2012): “Stock selection based on our 23 years of experience researching small caps is the major factor for the outperformance for YTD, the past 3 and 5 years. YTD outperformance is attributed to the real estate stocks which were undervalued among the domestic sector. Meanwhile, undervalued Manufacturers, which we have been overweighting, performed negatively this year. In terms of risk parameters, our portfolio took consistent risk since the inception of the fund, in 2001, with a tracking error of around 4-5%. Our consistent portfolio construction process, to keep same level of number of names for diversification, makes the same risk level.”

Ayumi Kobayashi, Fund Manager, "Schroder ISF Japanese Smaller Companies A Acc" (ISIN: LU0106242315) (12.10.2012): "We have been successfully capturing attractive investment opportunities in Japanese small cap market over the years.

YTD 2012, the fund achieved a positive performance of 8.9 per cent (based on C share class, NAV price based), where the benchmark only gained 4.2 per cent (per 28.09.2012).

On the same basis above, the fund performed 1.3% over 3 years and -35.3% over 5 years -39.4%, where the benchmark was -4.1% and -33.4% respectively. We slightly underperformed over 5 years, but this is mainly due to the period of global financial crisis in 2007 and 2008 when the market moved very abnormally."

All Performance Data in Top-10 list per 1st of October 2012: