Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest? (ISIN: LU0568606817)

I- Investment universe

Amundi Funds Equity Euroland Small Cap‘s investment universe comprises all listed stocks in the euro zone with a market cap from EUR 400 million up to 5 billion. The investment team implements a liquidity filter based on the daily transaction volume on 3 months average (which must be above EUR 600 000). After this filter, the universe reduced to stocks offering sufficient liquidity comprises around 500 stocks.

II- Investment process

Stock-picking is at the heart of the strategy.

We have a medium term investment horizon as we accompany the companies’ business development over the medium term. We are opportunistic and have no style constraint which introduces flexibility and capability to outperform in any market periods. We may introduce tactical investment when market volatility offers good “value” opportunities while keeping our quality investment approach.

We have a flexible approach and we are active managers

The investment approach looks for selecting companies without any style constraints nor restrictions on sector and country allocations. The conviction-based strategy relies on a fundamental approach run by the 5 portfolio managers (and analysts) specialised by sector. All of them have the responsibility to detect the best opportunities. In order to detect, among the investable universe, the best opportunities the investment team relies on idea generation.

Idea generation relies on 4 pillars :

- Investment themes

- Search for catalysts

- Company meetings.

- Screening

After a first step of identifying potential investment cases, the next step consists in a thorough fundamental analysis of these investment cases through :

- Direct contacts with companies

- Analysis of the sector and competitive environment,

- Analysis of the company financials

- Valuation.

Portfolio construction is based on the conviction list (team’s strongest convictions) and each portfolio’s constraints (universe, benchmark, risk constraints).

The final portfolio holds 50 to 70 stocks. Although the team’s conviction-based management unfolds on a medium-term horizon (12-18 months), certain positions are more tactical.

III- Benchmark

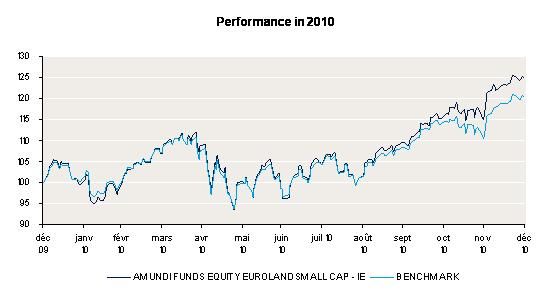

The fund changed reference index in October 2010, from FTSE EUROBLOC to MSCI EMU SMALL CAP. Previously, from 2004 to 30/04/2009, the index was HSBC SMALLER EURO BLOCK.

The current benchmark is the MSCI EMU small cap.

Once again, Index is just a reference, not the reference. It is used a posteriori to monitor the deviation of the portfolio vs benchmark.

IV- Managers

This fund is run by Beryl Bouvier di Nota (Lead portfolio manager) and Caroline Gauthier.

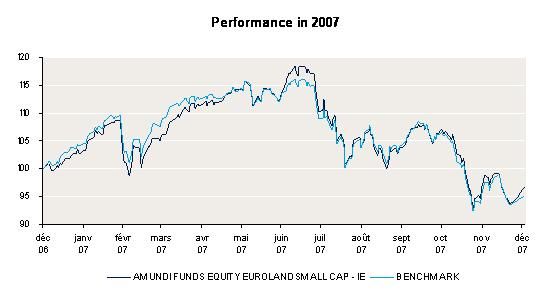

Performance Review 2007

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...

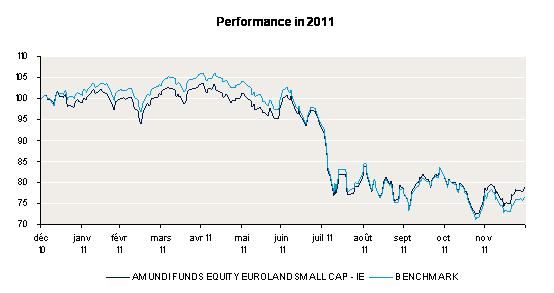

Béryl Bouvier Di Nota: "2011: Fund net performance: -21.0%, Benchmark performance: -23.26%, Relative performance: +226bp

2011 will be remembered for the difficult summer that the euro zone experienced. Strong opposition to austerity measures in Greece (which resulted in a « voluntary » swapping of debt with haircut) caused equity markets to tumble and bond yields to soar. Following the downgrade of the US credit rating by S&P on 6 August, the threat of a general downgrade hangs over the countries of Europe. On 5 December, S&P put France and Germany’s AAA rating on negative watch, along with those of 13 other euro zone countries. Moreover, Europe remained paralysed by the crisis of governance.

The MSCI EMU SMALL CAP index went down 23.3% whereas the DJ euro Stoxx 50 lost 14%.

Amundi Funds equity euroland small cap outperformed its benchmark by 226bp.

At the beginning of the year we experienced a sudden and sharp sector and style rotation towards banks and peripheral countries as the market wanted to believe in improvement in the European sovereign crisis. Stocks that outperformed on the second half of 2010 (emerging markets exposure and cyclical names) were sold by investors which preferred value stocks. We moved from an aggressive stance to a more defensive stance and ended the year with a clear advance on the benchmark. The best performers were Rémy Cointreau, Grifols and Elan."

Performance 2012 - Year-to Date

Béryl Bouvier Di Nota: "2012 YTD: Fund net performance: +20.02%, Benchmark performance: +14.05%, Relative performance : +597bp

Since the beginning of the year, the Amundi funds equity euroland small caps rose +20% and outperformed the MSCI EMU Small cap by 597 bp. Most of the contributions to this performance come from our stock selection within capital goods and business services (Gemalto and Prysmian), financials despite the sector underperformed, with GSW Immobilien (a German Real estate company and Pohjola bank a Finnish diversified bank) and oil services with the strong performance of Schoeller–Bleckman and Tecnicas Reunidas in Spain. Since end of Q1 we reduced our exposure to capital goods taking into account strong macro deterioration and reinforced our positions on some basic resources company which underperformed YTD like Aurubis."

Performance since 2007

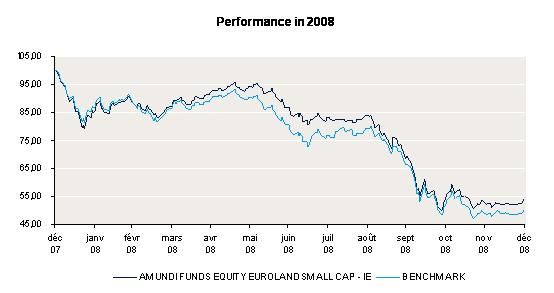

Béryl Bouvier Di Nota: "2007-2012: Fund net performance: -13.3%, Benchmark performance: -26.92%, Relative performance: +1 362bp

Over the last five years, in a very volatile equity markets AMUNDI FUNDS EUROLAND SMALL CAP outperformed its benchmark by 1 362 bp (performance net of fees). This performance highlights the capability of the portfolio manager to outperform in bear markets as well as in bull markets thanks to the flexible investment approach with no style constraints.

The alpha generation over the period comes from stock-picking. The Portfolio Managers were successful to select the highest risk-adjusted opportunities in the investment universe."

Outlook

Béryl Bouvier Di Nota: "The current equity rally is fuelled by liquidity resulting from massive and synchronised policy action. We are cautiously optimistic. Thanks to the central banks’ intervention, extreme downside risks have faded. Admittedly, markets continue to face headwinds, with ongoing growth and earnings downgrades. In the euro zone, leading indicators are still pointing to weakness, even though the potential for further negative surprises is diminishing. Short term, the current volatility offers interesting entry point for medium term investment. On the positive side, leading indicators for China and US are stabilizing and even show signs of improvement in the US. Until the global economy is above 3% there is still room for Eps growth within our investment universe. In addition to that, as dispersion is increasing again, we believe we can find “value” through stock selection and may reinforce our positions on value stocks for which valuation is attractive and earnings forecasts already discounting downgrades for 2013."