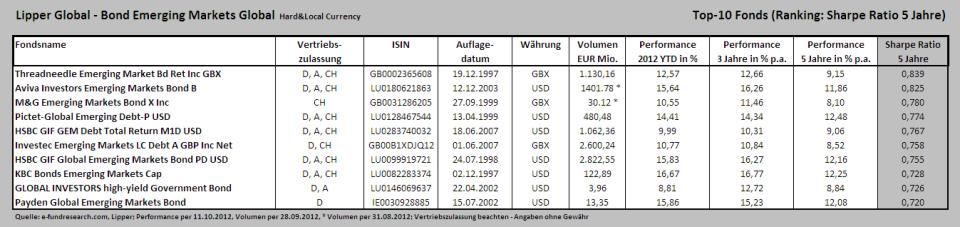

Die obige Tabelle ist eine Darstellung der besten zehn Schwellenländer Anleihenfonds - gereiht nach Sharpe Ratio 5 Jahre (insgesamt 211 Fonds in der gesamten Assetklasse - Lipper Global Bond Emerging Markets Global). Die Fondsmanager von KBC, HSBC, Threadneedle und Pictet haben die Fragen von e-fundresearch.com beantwortet. Keine Antworten wurden von den restlichen Top-10 Gereihten zugesandt. Die durchschnittliche Performance der Top-10 Fonds seit Beginn des Jahres liegt bei +13,11 Prozent.

e-fundresearch: "Which fundamental factors are currently the most important ones when you assess global emerging markets bonds?"

Emerging market policymakers appear to have learned the lessons of the past. In general, there is a theme of sensible fiscal policy with deficits firmly under control – less than 2% of GDP in 2012 across the emerging markets universe, compared to nearly 6% among advanced economies (July 2012 IMF Fiscal Monitor update). This gives central banks the scope to use monetary policy as it was intended – to tame inflation when required, and boost growth when necessary. This is evident from Mexico to Korea and from Brazil to India. Central banks are running countercyclical interest rate policies and they are generally working, as growth remains sensitive to monetary policy."

Once a country is selected, the medium-term fundamental drivers are examined. There are general fundamental factors and then specific factors which can be different for hard currency sovereign bonds and local currency bonds where local interest rates and currency are separate components of risk. It should also be stressed that the fundamental factors in assessing a country should be both quantitative as well as subjective – both ‘an art and a science’. Once we have established a country bias for hard currency debt or currency and rates for local bonds, the probability of success is greatly improved by timing. Thus we examine short-term drivers such as volatility, positioning and flows to determine the timing of implementing the investsment idea.

There are several key criteria for assessing country fundamentals and these include; external financing (i.e. external debt/GDP), public finances, the economic environment (i.e. specific sources of inflation), the political environment, structural strength and the financial system. We also use proprietary models which each can include approximately 40 subfactors which are additional tools that act as a check and balance on our views, but they are not a trading tool. In furtherance, we undertake country due diligence trips where we meet with government officials, local investors and traders in order to obtain on the ground intelligence as part of our country fundamental analysis."

Henry Stipp, Fund Manager, "Threadneedle Emerging Market Bd Ret Inc GBX" (ISIN: GB0002365608) (24.10.2012): "Both the Federal Reserve’s decision to embark on a third round of Quantitative Easing (QE) in September and the launch of the European Central Bank’s plan to buy bonds of troubled peripheral sovereigns were designed to boost the US and Eurozone economies. However, the emerging economies have proved to be among the main beneficiaries of these measures. With yields on core government bonds falling to paltry levels, increasing numbers of investors are willing to explore the potential offered by emerging market debt. A huge amount of cash is searching for income and demand is growing thanks to QE (in Japan and the UK as well as the US and Europe). Moreover, the fundamentals of the emerging world are very appealing, particularly in relation to developed economies."

Andrew Grijns, Senior Product Specialist, "Pictet-Global Emerging Debt-P USD" (ISIN: LU0128467544) (24.10.2012): "In terms of current spread levels on hard currency debt, they currently stand at around 285bps using the JP Morgan EMBI GD benchmark (hard currency debt). The historical lows were seen in Q2 2007 when they reached around 165bps. In an environment of lower growth and ‘low rates for longer’, we see investors continuing to push demand for quality yielding assets such as emerging debt. It is now recognised that emerging market sovereigns have good fundamentals versus developed markets, such as low debt to GDP levels of around 33% versus over 100% for developed markets, better growth even if it has slowed and strong reserve levels and an upward trajectory for credit ratings with a few exceptions. In addition, long-term institutional investors have approximately 0 to 2.5% allocated to the asset class, but many are working towards an allocation of around 5%. Central banks and sovereign wealth funds have also been allocating. It should also be noted that it is not a static opportunity set as some countries have ‘graduated’ from the benchmark such as Czech Republic and new countries have been entering such as Zambia in September and Bolivia will be entering soon. However, the asset class can be sensitive to US treasuries, particularly tighter spread, lower beta countries, which means that rising rates in the future may lead to some spread widening."

Markus Ackermann, Direktor und Produktspezialist für Emerging Markets, "HSBC GIF GEM Debt Total Return M1D USD" (ISIN: LU0283740032) & "HSBC GIF Global Emerging Markets Bond PD USD" (ISIN: LU0099919721) (24.10.2012): "Im Jahre 2012 haben die Spreads eine deutliche Einengung gesehen. Auch wenn sie auf einem aktuellen Niveau von unter 300 Basispunkten gegenüber US-Staatsanleihen dem ein oder anderen auf den ersten Blick nicht mehr attraktiv erscheinen, lohnt sich sicher ein zweiter Blick und eine Analyse der Historie. Zum Einen ist das aktuelle Niveau immer noch doppelt so hoch, wie im Jahr 2007, als der Spread auf seinen historisch tiefsten Stand fiel. Gleichzeitig hat sich in den vergangenen Jahren das durchschnittliche Rating von BB auf BBB verbessert. Ebenso lohnt sich die Betrachtung der einzelnen Länder. Während wir die Spreads der Anleihen südamerikanischer Emittenten, allen voran Brasilien, Kolumbien und Chile für wenig attraktiv halten, sehen wir in Osteuropa deutlich höhere Renditeabstände, die uns attraktiv erscheinen. Ebenso sehen wir Value im nicht Investment Grade gerateten Segment des Marktes. Ebenfalls interessant sind die Anleihen vieler Unternehmen in den Emerging Markets, die wir unseren Portfolios regelmäßig beimischen, nachdem wir sie einem umfangreichen Credit Research Prozesses unterzogen haben."

Bob Maes, Fund Manager, "KBC Bonds Emerging Markets Cap" (ISIN: LU0082283374) (23.10.2012): "Credit spreads have been narrowing this year, despite the temporary uptick between March and June related to the euro zone crisis. Currently, the average spread is around 250 bps above US Treasuries, which is similar to the levels seen at the end of 2010, beginning 2011. This is still much higher than just before the credit crisis, when spreads were less than 200 bps above US Treasuries. Overall, we don't expect spreads to narrow much further, but judge current yield levels still interesting given the outlook for sustained low yields in the developed world."

Henry Stipp, Fund Manager, "Threadneedle Emerging Market Bd Ret Inc GBX" (ISIN: GB0002365608) (24.10.2012): "Public debt in advanced markets has been rising for five years and continues to do so as austerity measures are being overshadowed by weak GDP growth. Conversely, in emerging markets, public debt is low and falling. The IMF estimates that advanced markets’ public debt stands at around 110% of GDP in 2012 and rising; the equivalent figure for emerging markets is around 34% and falling (July 2012 IMF Fiscal Monitor update). In addition, the risk of emerging market default has been lessened because an increasing proportion of debt is being issued in local currencies. Investors continue to allocate assets to local currency emerging market bonds, but these assets constitute just 10% of the global bond market. External debt is an even lower proportion at just 2%.

Overall, emerging market fundamentals remain generally stronger than those of the developed world. Balance sheets are more robust, fiscal and monetary policies are mostly appropriate, management of foreign exchange reserves is sensible and growth is strong. Over the past 12 months, there have been 11 downgrades in developed markets and no upgrades. In Latin America, the ratio is eight upgrades to four downgrades. In Asia, the ratio is four upgrades to one downgrade. Even in Eastern Europe, there have been more upgrades (four) than downgrades (three). The rating agencies clearly see lower risks in emerging markets – and the evidence backs this up in several ways.

Unsurprisingly, given these attractive fundamentals, we are seeing very strong investor inflows into Asia and other areas of the developing world, which are supporting both local and hard currency bonds."

Andrew Grijns, Senior Product Specialist, "Pictet-Global Emerging Debt-P USD" (ISIN: LU0128467544) (24.10.2012): "It is attractive to invest in emerging market local currency bonds given some of the same push factors mentioned in question 1 in terms of investor demand and market fundamentals, however there are risks. Investors are exposed to emerging market currencies which adds an additional element of volatility over hard currency debt, but this also provides an additional alpha generating opportunity and a diversification away from developed market currencies. There are 2 main risk components which have different drivers and can react differently depending on market conditions. Generally speaking, the currency component can do particularly well in an environment of good global growth while the bond or local rates component does well when interest rates are being cut and investors can benefit from spread compression. As of October 2012, we have moved from an overweight rates position in Brazil where interest rates were aggressively cut, to an overweight currency position as there are some signs that growth is starting to return. We also like the Mexican peso which we believe will benefit from some of the first signs of positive US growth. We are underweight the Indonesian rupiah as we believe there is an element of overvaluation, the current account deficit is widening, the central bank does not want to use reserves to support the currency and its higher beta nature means it is more susceptible to market dislocations."

Markus Ackermann, Direktor und Produktspezialist für Emerging Markets, "HSBC GIF GEM Debt Total Return M1D USD" (ISIN: LU0283740032) & "HSBC GIF Global Emerging Markets Bond PD USD" (ISIN: LU0099919721) (24.10.2012): "Aus Sicht von Euroanlegern ist eine Diversifizierung ihres Portfolio in puncto Währungen sicher grundsätzlich interessant. Die immer noch ausgeprägte Unterbewertung vieler Emerging Market Währungen liefert ein gutes fundamentales Argument dafür. Allerdings sind auch hier die Renditen der betreffenden Anleihen zurückgekommen, was wir mit Blick auf die relativ hohe Volatilität der Anlageklasse Emerging Markets Local Debt als kritisch sehen. Auf der Währungsseite sehen wir zur Zeit den Renminbi Markt als attraktiv an. Die gegenüber der Anfangszeit dieses Marktes gestiegenen Renditen und die gemanagte Aufwertung der Währung machen den Einstieg dort lohnend. In Brasilien sind die nach wie vor hohen realen Renditen der Staatsanleihen verlockend, allerdings sehen wir hier nur wenig Potenzial für zusätzliche Währungsgewinne. Ebenfalls kritisch sehen wir die Währungen Osteuropas."

Bob Maes, Fund Manager, "KBC Bonds Emerging Markets Cap" (ISIN: LU0082283374) (23.10.2012): "We do think that emerging market currencies will continue their long-term appreciation trend compared to the currencies of developed markets. This is reflected in the current account surpluses of many EM countries, mainly in Asia. Investing in local currency EM bonds is however more volatile than in hard currency bonds, but we do think this will be rewarded with higher returns. Given the recent tightening in credit spreads, we do favour local currency EM bonds over hard currency EM bonds, which can be done via KBC Bonds High Interest."

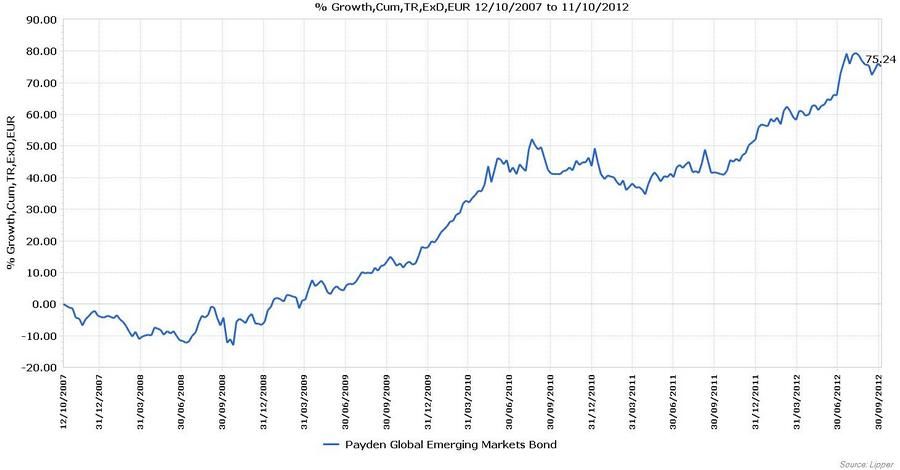

Henry Stipp, Fund Manager, "Threadneedle Emerging Market Bd Ret Inc GBX" (ISIN: GB0002365608) (24.10.2012): "The fund has a record of very strong performance. It has returned close to 16% year- to-date. Over the last three years it has returned 34% and over the last 5 years it went up in value by 55.6%. Risk management is a key component of our investment process. The main idea guiding everything that we do is that we should be actively taking risk, but the reward for taking risk should more than compensate for any potential downside that we may incur. This ensures that our investment strategy continues to be an active source of alpha for our investors."

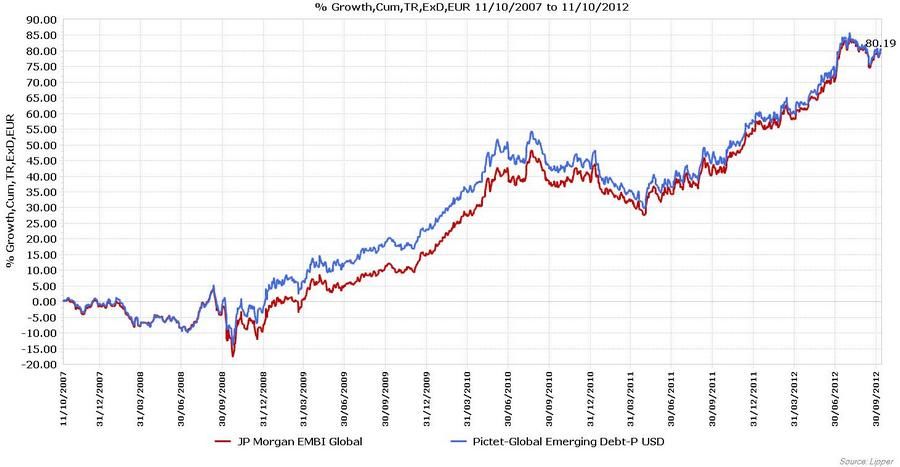

Andrew Grijns, Senior Product Specialist, "Pictet-Global Emerging Debt-P USD" (ISIN: LU0128467544) (24.10.2012): "We are an ‘all-weather’ manager and aim to provide a risk/return profile that has an element of predictability with no surprises. The risk approach is driven by three principles: 1) risk target and limit; 2) diversification; and 3) stop-loss discipline. The fund is managed to a maximum tracking error of 6% with the aim of outperforming the benchmark by 1 to 3% per annum and to provide protection on the downside. Risk is controlled in a number of ways including the separate management of the interest rate and currency components of local currency bonds as well as the use of specific stop and profit price targets for each active trade."

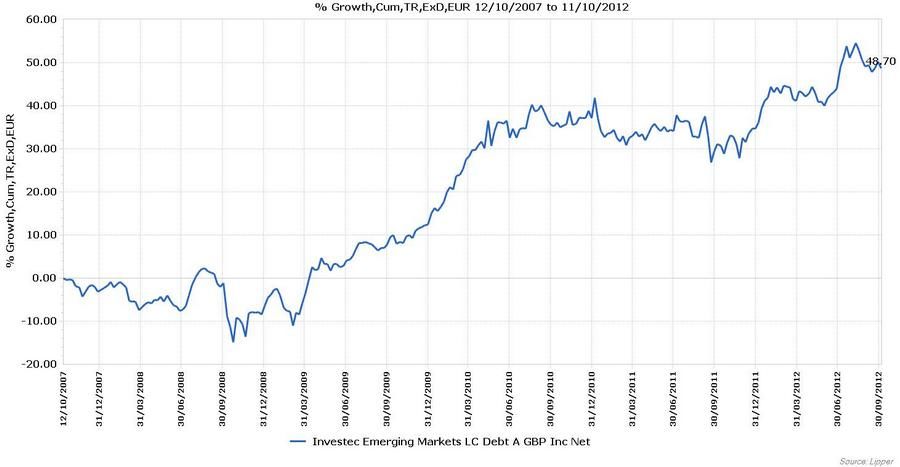

Markus Ackermann, Direktor und Produktspezialist für Emerging Markets, "HSBC GIF GEM Debt Total Return M1D USD" (ISIN: LU0283740032) & "HSBC GIF Global Emerging Markets Bond PD USD" (ISIN: LU0099919721) (24.10.2012): "Der HSBC GIF GEM Debt Total Return ist ein benchmarkfreies Konzept, in dem wir versuchen, die positive Performance des Marktes zu realisieren und gleichzeitig durch eine aktive Allokation Phasen negativer Entwicklung zu vermeiden. Insgesamt erreichen wir somit eine attraktive Rendite bei geglätteter Volatilität. In 2008 konnte der Fonds mit dieser Strategie die Verwerfungen in Folge der Lehman Pleite abmildern und schloss das Jahr mit einer negativen Wertentwicklung von -5,40% ab. An der Rally des Jahres 2009 konnte der Fonds aufgrund der deutlich erhöhten Investitionsquote vollumfänglich teilnehmen (+26,39%) und auch in 2010 legte er stark zu (+8,52%). Mit der Verschärfung der europäischen Schuldenkrise in 2011 rutschten auch die Emerging Market Anleihemärkte zeitweise in den Keller. In diesem Jahr wies der Fonds eine "rote Null" aus (-1,29%). Im Jahr 2012 konnte der Fonds bisher eine Performance von +9,80% erzielen. Dabei gelang es, die schwachen Marktphasen im Frühjahr 2012 durch eine geringe Investitionsquote des Fonds zu vermeiden. In den vergangenen 5 Jahren wies der Fonds eine annualisierte Volatilität von 7,6% auf. Der maximale Drawdown lag in diesem Zeitraum bei 7,9%. (Quelle: Mercer)

Der HSBC GIF GEM Bond Fonds investiert ausschließlich in USD-denominierte Staats-, Quasi-Staats- und Unternehmensanleihen. Er nutzt den JPMorgan EMBI Global als Benchmark. Durch eine aktive Allokation der vorgenannten Instrumente, eine Steuerung der Ländergewichte, die Beimischung von Off-Benchmark-Positionen (Unternehmensanleihen) und in geringem Umfang die Steuerung der Duration versucht der Fonds, seine Benchmark zu schlagen. In den Verwerfungen des Jahres 2008 sorgten nicht nur Kursabschläge sondern auch die Ausweitung der Geld/Brief-Spannen für einen rückläufigen NAV. Insbesondere der negative Effekt auf Anleihen mit niedrigeren Ratings resultierte in einer Underperformance des Fonds gegenüber der Benchmark (-12,14% vs. -10,89%). Durch eben diese Übergewichtung von Instrumenten mit höheren Betas konnte er allerdings in 2009 eine Outperformance erzielen, mit der das vglw. schwache Vorjahresergebnis wieder aufgeholt wurde (+32,08% vs. +28,17%). Auch im Jahr 2010 konnte der Fonds durch ein im Vergleich zur Benchmark höheres Risiko überproportional zulegen. (+12,20% vs. +11,99%) Erneute Marktverwerfungen im Herbst des Jahres 2011 belasteten dann die Performance und verursachten vor allem durch die Positionierung in EM- Unternehmensanleihen und eine etwas verkürzte Duration eine Underperformance (+6,97% vs. +8,59%). Im Jahr 2012 liegt der Fonds bisher knapp hinter der Benchmark (+15,94% vs. +16,04%) Die annualisierte Standardabweichung des Fonds lag in etwa auf Indexniveau, d.h bei ca. 9%. Der annualisierte Tracking Error lag bei rund 2%."

(Alle Performanceangaben beziehen sich auf die genannten ISINs und verstehen sich in USD nach Kosten. Bloomberg. Stand: 12.10.12.)

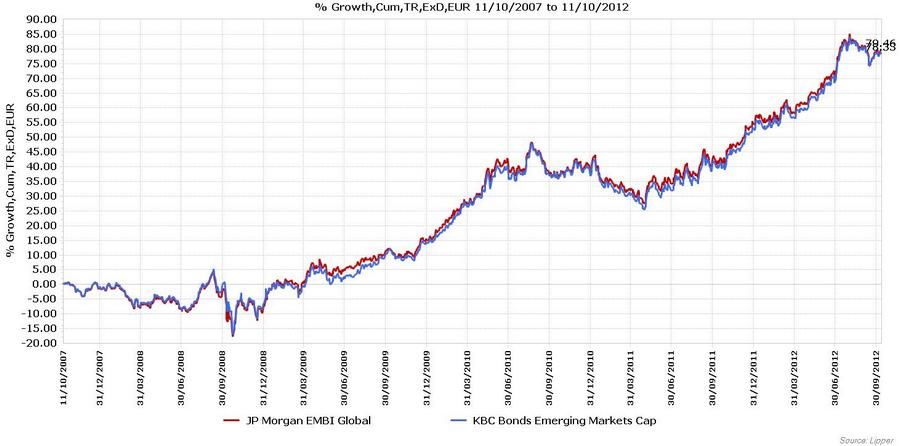

Bob Maes, Fund Manager, "KBC Bonds Emerging Markets Cap" (ISIN: LU0082283374) (23.10.2012): "The performance of KBC Bonds Emerging Markets has been very strong this year. Both in absolute terms as compared to the benchmark (JPM EMBI+ Index). In absolute terms, the Fund has gained more than 17% YTD. As such, the Fund has outperformed the benchmark by more than 250 bps gross of fees and around 150 bps net of fees this year. Overall, the fund has been outperforming the benchmark for the past seven years. On a 3- and 5-year horizon, the Fund has gained respectively more than 40% and 60%. At the same time, the volatility of the Fund has remained in line with the benchmark, except during the Lehman crisis in 2008, when there was almost no liquidity in the market. Overall, we do have a maximum tracking error of 2.5% in the Fund. The strong performance of the Fund within a strict risk framework has been awarded by winning the Morningstar Awards in Germany, Switzerland and Austria in 2011."

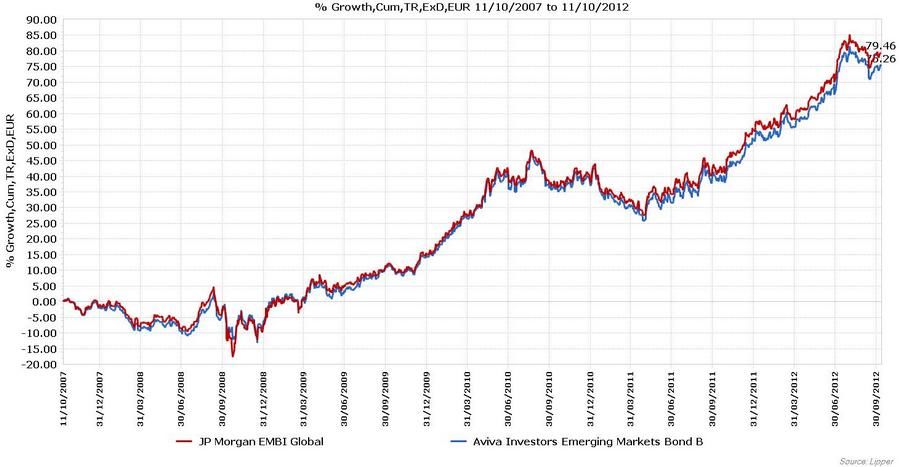

Henry Stipp, Fund Manager, "Threadneedle Emerging Market Bd Ret Inc GBX" (ISIN: GB0002365608) (24.10.2012): "The fund has performed very well over the last 5 years. Indeed it has outperformed its benchmark every year since 2007 except for 2010. Security selection and asset allocation both have been sources of alpha."

Andrew Grijns, Senior Product Specialist, "Pictet-Global Emerging Debt-P USD" (ISIN: LU0128467544) (24.10.2012): "Both the Pictet Emerging Local Currency Debt Fund and the Pictet Global Emerging Debt Fund (hard currency debt) outperformed the benchmark over the past 5 years (gross). For the local currency bond strategy, 2008 and 2011 were negative years for the asset class and our skills in protecting the portfolio on the downside was a contributing factor to outperformance during those years. The strongest contributors to performance was our skill in the timing and selection of currencies and more recently in local rates where we benefitted from taking advantage of markets where interest rates were on a downward trajectory."

Bob Maes, Fund Manager, "KBC Bonds Emerging Markets Cap" (ISIN: LU0082283374) (23.10.2012): "The outperformance of the Fund has been a combination of both top-down as well as bottom-up approach. The process has been awarded by a Gold rating by S&P. In fact, we first judge the overall investment climate based on quantitative and qualitative filters. Depending on the outcome, we will decide on the risk budget and the overall duration of the Fund. In a second stadium, we will take a decision on the issuer and the specific bond to buy. Overall, the top down approach has been the main driver of the performance."

All performance data in top-10 list per 11.10.2012: