e-fundresearch.com: Mr. Eric BOUTHILLIER , you are the fund manager of the Parvest Convertible Bond Europe Small Cap fund (ISIN: LU0265319003). When did you take over the responsibility of managing this fund?

e-fundresearch.com: What is the current size of the fund?

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...Eric Bouthillier: The current size of the fund is EUR 212.97 million at 23 January 2014.

e-fundresearch.com: Do you also manage other funds or mandates?

Eric Bouthillier: Indeed, I currently manage another European fund: Parvest Convertible Bond Europe and its French-domiciled equivalent: BNP Paribas Convertibles Europe. These funds have each EUR 589 million and EUR 352.5 million under management as of the 31 December 2013. I also manage institutional mandates.

e-fundresearch.com: What is the total amount of assets you manage currently?

Eric Bouthillier: The total amounted to EUR 1.26 billion as of the end of December.

e-fundresearch.com: How long have you been in the business as a fund manager?

Eric Bouthillier: I have been a convertible bond portfolio manager for the past 23 years.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Eric Bouthillier: Our investment process follows five main steps:

Investment Universe Filter: The European convertible bond universe is screened for liquidity, credit, and currency criteria. I will pick from the resulting selection, the convertibles bonds best suited to implement the strategy.

Bottom-up analysis: I use expert in-house and external resources to assist us in filtering our investment universe and analysing companies. The bulk of performance is expected to come from bottom-up decisions. When necessary I use options and other derivatives to adjust the equity exposure.

Technical assessment of the convertible bond: I use specific software (Monis) to analyse this highly dynamic asset class affected by both credit and equity market events. This technical assessment is carried out at the single bond level and for the aggregated portfolio.

Portfolio construction and risk control: The portfolio reflects my bottom-up and top-down views. Risk guidelines are applied in terms of security and sector weight. I monitor convexity, delta and active exposures.

We believe our added value come from our:

Disciplined and structured investment process that combines both fundamental and quantitative designed to maximise added value at each stage:

- Credit analysis at the heart of the bond selection

- Bottom-up stock picking is used to identify companies with above-average growth potential

- Risk assessment minimising active risk leading to a risk adjusted security allocation

- State-of-the-art quantitative models valuing the universe on a real time basis

- Significant position of BNP Paribas Investment Partners in the convertible bond arena, putting our investment centre among the top tier managers and allowing us to leverage our counterpart relationships

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Eric Bouthillier: Our European small cap fund is really quite unique. There is no existing benchmark that reflects this universe. When we launched the fund, we decided to compare it to the UBS Convertible Europe Index, the broadest European benchmark available at UBS which provides benchmarks for all our convertible strategies.

Despite the difference in investment universe, the small cap convertible bond fund may be compared to its larger cap peers. Historically, small cap convertibles have shown less volatility during market corrections.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

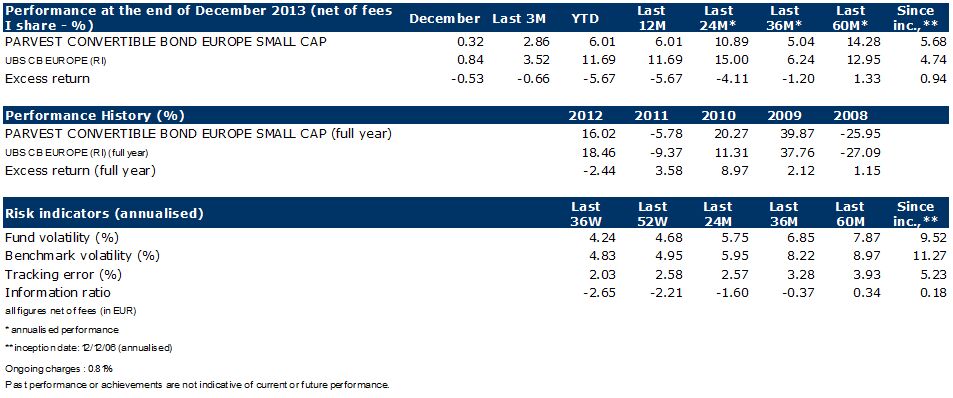

Eric Bouthillier: The fund performances are available in the tables below.

Over the past year (2013), the fund underperformed the reference index mainly due to its inability to invest in large cap convertibles. Indeed, large caps benefited from more richening than the small caps leading to better returns for the reference index.

Despite the recent outperformance of large cap convertibles, over a five-year period, the fund’s performance has been in line with the universe and has shown less volatility.

e-fundresearch.com: What motivates you in your job?

Eric Bouthillier: Convertible bonds are a unique asset class as they combine both bond and equity characteristics in ever-changing proportions, obliging me to look at them from a different standpoint almost each day. They are also influenced by many different factors, both micro and macro that make my work extremely interesting on a day to day basis.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Eric Bouthillier: I had initially thought of running a book store, but in the end I think I chose well given the decline in the bricks and mortar book trade!

e-fundresearch.com: Thank You very much!

Weitere beliebte Meldungen: