As we approach Election Day in the United States, polls and betting markets have seen some movement but the story is much the same: According to betting markets, Joe Biden has about a 60% chance of winning. If that result plays out, how will it affect our positioning?

While the presidency matters for certain things, many policies Biden is proposing—such as tax increases and government spending—require Congressional approval. The House is very likely to stay Democrat, but the Senate is a closer race; so we have been watching the Senate closely, and the betting markets are currently also giving Democrats about a 60% chance of taking control.

As we approach Election Day in the United States, polls and betting markets have seen some movement but the story is much the same: According to betting markets, Joe Biden has about a 60% chance of winning. If that result plays out, how will it affect our positioning?

While the presidency matters for certain things, many policies Biden is proposing—such as tax increases and government spending—require Congressional approval. The House is very likely to stay Democrat, but the Senate is a closer race; so we have been watching the Senate closely, and the betting markets are currently also giving Democrats about a 60% chance of taking control.

Implementing some of the more progressive policies would likely require Democrats to have a larger majority in the Senate.

As we think about the policy implications of such a change, what matters is not only which party has the majority, but how big the majority is.

Implementing some of the progressive policies that might affect markets—such as reversing the Trump tax cuts and implementing higher corporate tax rates—would likely require Democrats to have a larger majority than what is being anticipated. Some Democratic senators are moderate, so the party could lose a few votes on more extreme changes. With a smaller majority in the Senate, the Democrats would have to dampen their more progressive ambitions.

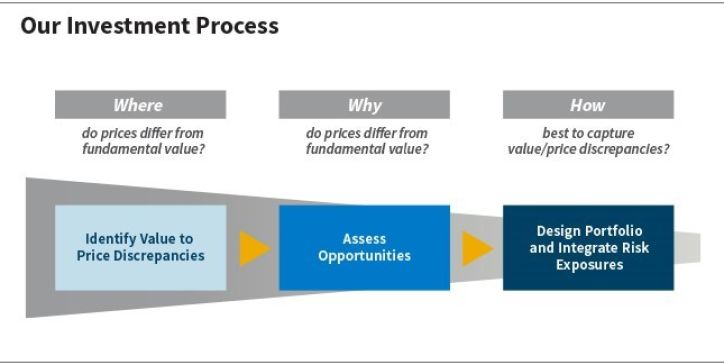

We looked at all possible scenarios, asking how each election outcome would impact the Where, Why, and How stages of our investment process. We found two likely impacts.

Our Investment Process

We believe a blue sweep is negative for our Where stage in U.S. equities because of its antibusiness policies, but that negativity is offset somewhat in the Why stage because of its ability to usher through more fiscal stimulus measures.

The first, which affects the Where stage (fundamental value), is a Democratic sweep, with any size majority in the Senate. Such a sweep could affect the corporate tax rate.

It is essentially the reverse of what happened when President Trump was elected. In 2017, as President Trump was implementing tax cuts, we increased the fundamental value of U.S. equity; now, if we think it is likely that those tax cuts could be reversed, our U.S. equity valuation would change in the opposite direction (though perhaps only by a few percentage points).

The second impact of a Democratic sweep would be felt in our Why stage. Such a sweep would help with the implementation of fiscal policy, which is important as the COVID-19 pandemic once again forces communities into lockdowns and potentially slows the economy. New fiscal stimulus measures have stalled over the last few months as negotiations between Nancy Pelosi and the White House have repeatedly failed. If Democrats win the presidency, Senate, and House of Representatives, it will undoubtedly help the party implement additional stimulus.

Overall, a blue sweep has offsetting effects. We believe a blue sweep would be a headwind for U.S. equities based on our Where stage because of corporate tax changes and potential increases in regulation, but would be beneficial for U.S. equities in the short term based on our Why stage because of the likelihood of additional near-term fiscal stimulus.

Currently, we do not have any exposures in the portfolio explicitly tied to a view of the U.S. election outcome, but we will continue to monitor the races. We will especially be looking for an overreaction if Biden wins the presidency but the Senate remains in Republican control.