Harnessing technology to solve known problems in healthcare and food is something we’ve been exploring in depth. In the first installment of our Convergence series, which examines five growth themes that are shaping the future of investing, Hugo Scott-Gall spoke with Global Research Analysts Tommy Sternberg and Ben Loss to discuss aspects of what we call “EditGenetics.”

Comments are edited excerpts from our podcast, which you can listen to in full below.

Tommy, you’ve spent a lot of time talking about the role of gene therapy in health and wellbeing. What is it? Why is it important?

Tommy: Gene therapy modifies existing genes or introduces new genes into a patient’s body, potentially leading to cures for genetic conditions. It’s being investigated for use in sickle cell disease, hemophilia, muscular dystrophy, and even congenital deafness. And it’s potentially curative. You’re not just treating the symptoms; you’re addressing the underlying cause of a particular disease—a specific genetic defect.

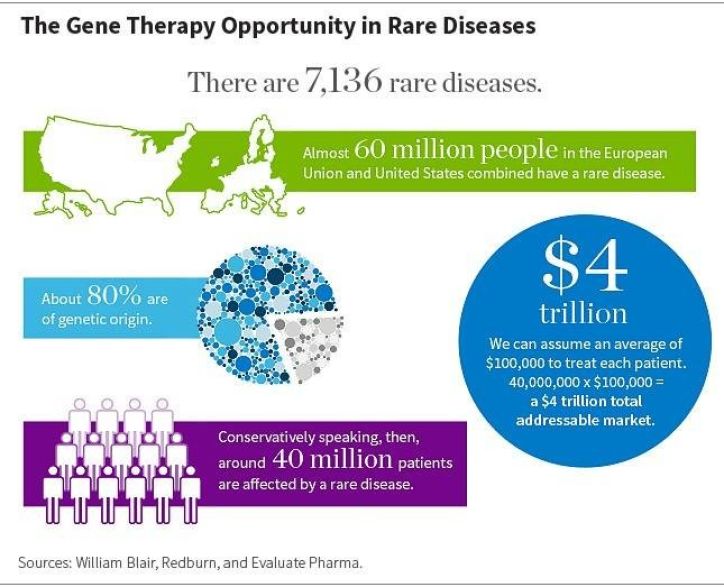

What is the potential total addressable market (TAM)?

Tommy: There are about 40 million people across the United States and Europe that have a rare genetic disease, and treatments come with very high price points, in some cases north of $1 million. But assuming a cost of $100,000 per patient, that’s a TAM of $4 trillion, which is almost unheard of.

How close are we to developing gene therapies?

Tommy: The development path for gene therapy as a whole is not linear, and that’s to be expected. But the promise is there, and there’s plenty of investment behind the opportunity. While there are only two approved gene therapies on the market, momentum continues to skyrocket. At the beginning of 2020 there were more than 900 ongoing gene therapy trials in the United States, so we’re likely to be well north of 1,000 today.

At the beginning of 2020 there were more than 900 ongoing gene therapy trials in the United States, so we’re likely to be well north of 1,000 today.

What stands in the way?

Tommy: We were surprised by just how much manufacturing space is needed to produce the raw material for gene therapies, the viral vectors. And in recent months, there have been some high-profile discontinuations of clinical trials, some because patients died. So we need to be mindful of the risks.

What do you think people would find surprising about the gene therapy opportunity?

Tommy: One less obvious insight is that it’s not just the biotech companies that stand to profit from development in this area, but companies that partner with the biotech companies in terms of research and development (R&D) and manufacturing.

You’ve also talked about liquid biopsy. What is it?

Tommy: Liquid biopsy is a simple, blood-based test that could detect whether you might have early-stage cancer. There are three primary applications.

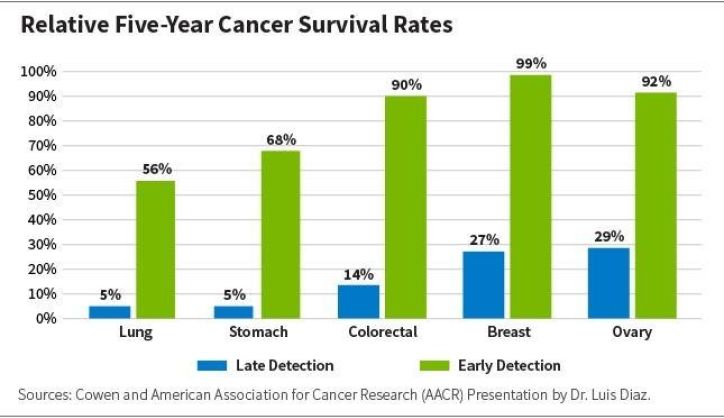

The biggest is early detection or screening. Most cancers are simply detected too late. Early detection can increase survival rates, perhaps by 3 to 12 times, depending on when cancer is first detected. However, for an otherwise healthy patient, it’s not medically justified or cost effective to perform a tissue-based organ biopsy.

There’s also therapy selection—detecting a specific type of mutation in a tumor to determine which drug might be most effective in treating it.

Early detection can increase survival rates, perhaps by 3 to 12 times, depending on when cancer is first detected.

The third application is recurrence monitoring. That’s actually a pretty big deal. It’s easier to monitor recurrence with a blood-based test than a tissue biopsy. You get more of a real-time longitudinal view of whether the cancer is recurring.

How close are we to seeing liquid biopsy become a reality?

Tommy: I understand if there might be a bit of skepticism here, particularly for anyone who’s familiar with the Theranos story. But we’re actually closer to this becoming a reality than most people think. The first liquid biopsy test was approved in 2016, and while we don’t have an approved test for early screening, we’re very close. One of the largest companies in the space is expected to have a test available on the market in 2021.

How big is the opportunity?

Tommy: We think it has a TAM of $50 billion, and it’s about 1% penetrated. And it’s already growing pretty fast. We see a five-year compound annual growth rate (CAGR) around 40% or so, and that’s without having tapped into the largest segment, early detection.

Moving on, why is food production a particularly interesting growth area?

Ben: Since the 1800s we’ve added about 7 billion people to the planet. And it’s still increasing: we’ve added two-thirds of that since 1950. But in those 50 years we’ve seen land use for agriculture decrease, by roughly 12 percentage points in the United States.

You look at those two things and ask, “How do you reconcile this?” You reconcile it by the fact that we’ve seen a 70% increase in farm productivity on a cumulative basis since the 1950s. We added fertilizers and agricultural chemicals.

But that had costs, both health and environmental, and we’re looking to rectify some of those problems. At the same time, we need to ensure that we have food for a global population. This has created a dual mandate: increase productivity, but in a healthier way for people and the planet.

Since the 1800s we’ve added about 7 billion people to the planet. And it’s still increasing: we’ve added two-thirds of that since 1950. But in those 50 years we’ve seen land use for agriculture decrease, by roughly 12 percentage points in the United States.

Running in conjunction with this, nature isn’t standing still. Organisms have developed resistance to a lot of the products that have enabled explosive yield growth, and we need to combat that somehow.

What are some areas of opportunity?

Ben: One area is biologic alternatives, such as coatings on seeds. These can protect crops from insects or disease, require fewer chemicals, and enhance nutrient uptake to lessen the need for fertilizers (which increases yields and helps the planet because the production of fertilizers generates a lot of CO2 emissions).

How big is the opportunity?

Ben: We think it’s a $5 trillion TAM.

What are the impediments to genuine penetration?

Ben: We generally have one growing season a year, outside select markets. And farmers are a conservative group, and it takes time to convince them to use new solutions. But now that we’re seeing more crop resistance and legislation to combat the use of harmful chemicals, we could be at an inflection point. Companies that are well positioned with products in these areas could do well; however, it’s not enough to know that there’s a useful microbe, you have to consistently produce scalable quantities—and that’s hard.

Is synthetic protein a part of this? What is stopping it from becoming more mainstream?

Ben: Consumer taste plays a role, and a lot of scientific breakthroughs have yet to occur. I think we have a sense of how the muscle component of growing meat works, but it’s tricky to replicate the bone and other structures we see within an organism. And it will require resources to figure out how to properly do that.

Are there any interesting developments?

Ben: One area—and this ties into some of what Tommy was talking about—is biologics as it relates to seeds and CRISPR technology. I’ll spare you what the acronym actually means because I oftentimes forget myself.

But CRISPR is a tool for basically doing what we’ve been doing for generations, which is naturally selecting for the traits that we see as desirable, and speeding up that process, taking millions of years and condensing it down into very short periods.

Several thousands of years ago the strawberry or the stalk of corn would be unrecognizable. This has all been done by generations of us selecting for traits that are optimal for what we’re trying to achieve. CRISPR is doing the same thing, faster.

Is it similar to genetically modified organisms (GMOs)?

Ben: It’s more about the removal of genes from the existing organism rather than inserting new ones in, which is what much of the GMO debate has been about.

What are the high-impact but low-probability things that could happen in your respective industries—the moonshots, so to speak?

Tommy: One area that I’m interested in is longevity—the use of artificial intelligence and machine learning combined with the raw power of genome sequencing to slow the aging process.

But CRISPR is a tool for basically doing what we’ve been doing for generations, which is naturally selecting for the traits that we see as desirable, and speeding up that process, taking millions of years and condensing it down into very short periods.

Ben: One of my moonshots is vertical farming to complement the biologics revolution. This is also interesting from a big data perspective because it requires advanced materials and sensors. A lot of innovation needs to happen there, and it’s not going to overtake traditional agriculture, but it’s certainly an area to watch.

Why aren’t we doing more vertical farming now?

Ben: Because it costs a lot of money to replicate the sun, which is free when you’re outside. But as renewable energy costs come down, vertical farms get closer and closer to being “in the money.”

Anything else?

Ben: I actually have two more. One is robotics. Nature fights back against the things that we try to do. This will be as true on the synthetic side as it has been on the biologic side. But it would be hard for weeds to evolve a way to get around a metal fork that’s walking through rows of plants and spearing the weeds. It’s a way to get us to organic farming with less cost.

And your third moonshot?

Ben: We’ve talked a lot about the use of microbes on animals and plants, but they also have potential on the human side—bugs as drugs. This could be a next frontier in medicine, where we finish the human genome: the human microbiome.

Convergence Series: 5 Growth Themes Shaping the Future

Theme 1: EditGenetics: Improving Lives

Theme 2: Connected Commerce

Theme 3: Exploring the Metaverse

Theme 4: Conservation Capitalism

Theme 5: The Future of Manufacturing