e-fundresearch.com: Mr Nicolas Walewski, you are the fund manager of the Alken Fund - European Opportunities-R fund (ISIN: LU0235308482). Since when are your responsible for the fund management?

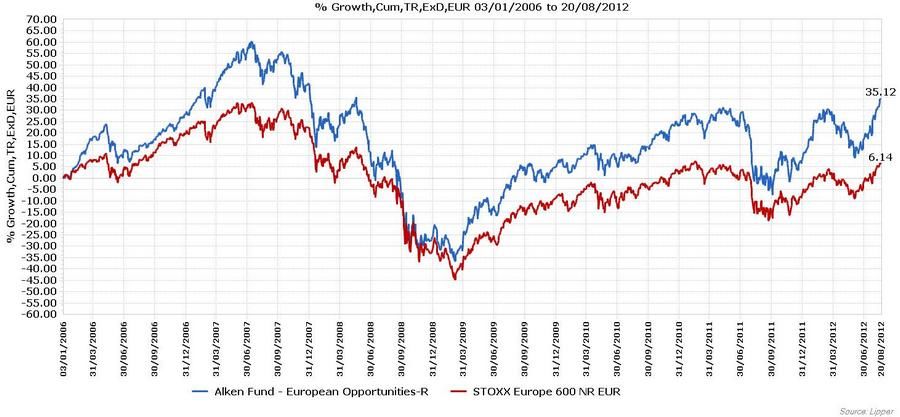

Walewski: Since inception, which was January 3rd 2006.

e-fundresearch.com: Which benchmark do you adhere to?

Walewski: The Dow Jones Euro Stoxx 600 (SXXR).

e-fundresearch.com: Are you also responsible for other funds at the moment?

Walewski: Yes –the AEO fund is a sub-fund of the Alken Fund Sicav, the other sub-funds of which are the Alken Small Cap Europe Fund and the Alken Absolute Return Europe Fund. We also manage a number of segregated mandates and a SIF, the Alken Capital One Fund.

e-fundresearch.com: What is the total volume that you manage in all your funds?

Walewski: Alken currently manages 2.9bn EUR

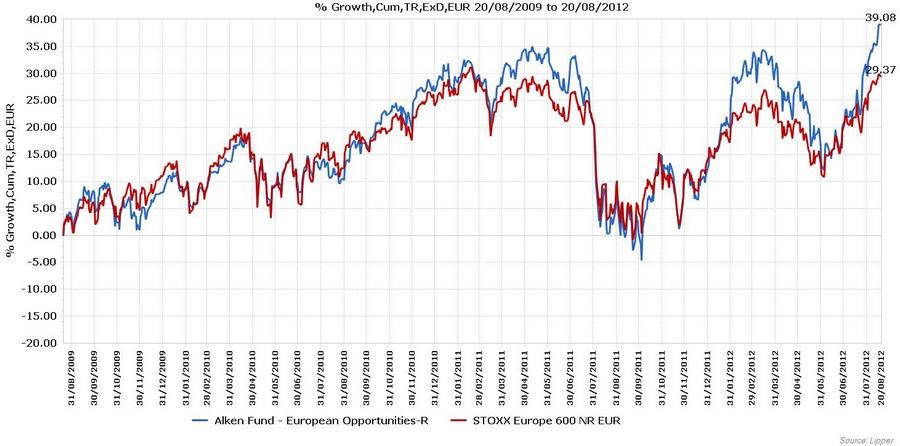

e-fundresearch.com: Regarding the performance: which performance did you achieve since the beginning of the year and in the years 2007-2011? Absolutely and relatively to the relevant benchmark?

e-fundresearch.com: How content are you with your own performance in the last years and this year?

Walewski: We aim to outperform the benchmark by 5% per annum. Year To Date we are outperforming by over 7% so we are on target. We had a very strong Q1, whereas Q2 proved a bit more difficult with the macro uncertainty but we have started Q3 very well so we are making up the performance lost in Q2.

e-fundresearch.com: How are you able to deliver added value for your investors with your performance?

Walewski: We believe our competitive advantages are:

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...- A business focused on European equities: An unparalleled understanding of European industry and a unique appreciation of key economic, financial, and regulatory drivers in Europe.

- A research approach focused on fundamentals: Our investment decisions are driven by tangible facts and data, not personal opinion or market momentum. Valuation is absolute, not relative; we consider company valuation as a potential owner of the business in perpetuity.

- A portfolio focused on best opportunities: We generate superior returns by concentrating our portfolio on a limited number of high-conviction opportunities. We maximise returns rather than the number of good ideas.

- A team focused on long-term results: It enables us to take advantage of short-term market opportunities and deliver superior returns over the long-term.

e-fundresearch.com: How long have you been a fund manager already?

Walewski: For 14 years.

e-fundresearch.com: What were your biggest successes and your biggest disappointments in your career as fund manager?

Walewski: Biggest success has been the founding of Alken Asset Management and its continued development into a solid and successful business. The track record of the Alken European Opportunities fund has been a key result of a hard working team at Alken. Biggest disappointment has been underperformaning the benchmark in 2008, when we didn’t have a clear macro view, then again not many people did! We have since then adopted a complementary macro overlay to all our predominant bottom-up analysis.

e-fundresearch.com: What kind of capital market situation do we have at the moment? How do you act in this environment?

Walewski: Our macro view has not changed, we remain cautious and believe that as long as European policymakers do not find a convincing way to reflate the economy the environment will remain volatile. As such we have not made any major changes within the portfolios we manage.

e-fundresearch.com: What are the special challenges in this environment?

Walewski: Visibility in the markets – until the macro situation in Europe is fully and solidly resolved for the long-term it will remain volatile. This volatility itself presents a challenge also.

e-fundresearch.com: What objectives do you have till the end of the year and in the mid term for the upcoming 3 to 5 years?

Walewski: We aim to continue to outperform the benchmark and deliver positive returns for our investors. Looking further ahead, we aim to grow assets at Alken in a controlled and structured way and continue to outperform in our relative performance fee funds and in absolute terms for the directional long-short and hedge funds.

e-fundresearch.com: Do you model yourself on someone? Any ideals?

Walewski: No.

e-fundresearch.com: What motivates you in your job?

Walewski: A passion for investing and bottom-up research, a dedication to fundamental analysis, and delivering positive returns to investors who support us.

e-fundresearch.com: Many Thanks!