e-fundresearch.com: Mr. Siddle, you are the fund manager of the Fidelity European Growth Fund (ISIN: LU0048578792). When did you take over the responsibility of managing this fund?

Matthew Siddle: I was appointed to the fund on 1 July 2012.

e-fundresearch.com: What is the current size of the fund?

Matthew Siddle: The fund size currently is €6.9 billion (31 January 2013).

e-fundresearch.com: Do you also manage other funds or mandates?

Matthew Siddle: Yes, I am also responsible for the Fidelity Funds European Larger Companies Fund.

e-fundresearch.com: What is the total amount of assets you manage currently?

Matthew Siddle: I am currently managing approximately €7.5 billion.

e-fundresearch.com: How long have you been in the business as a fund manager?

Matthew Siddle: I started my career at Fidelity in 1999 as a research analyst before moving on to the role of Assistant Portfolio Manager for FF - European Growth Fund in 2004. I managed this fund until 2006. During this time, I also became the Director of Research, a position that I maintained from September 2005 to December 2006. I started managing funds for an internal unconstrained UK Pilot fund in 2007. In 2008, I started managing two UK retail funds and moved to the European Equity Team in November 2009. After a short adjustment period, I began managing a European Equity Pilot Fund in April 2010 before taking over responsibility for the FF European Larger Companies Fund in October 2010.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

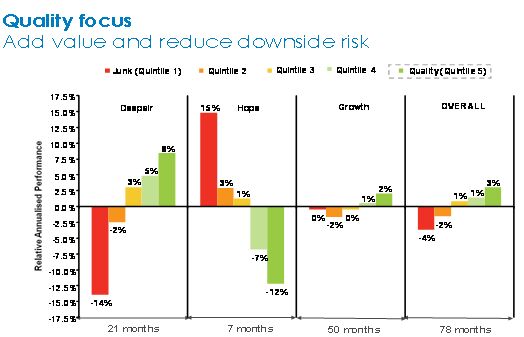

Matthew Siddle: My investment philosophy can be summed up as “looking for quality companies at the right price”. Essentially, I aim to buy strong, well-managed businesses with high and sustainable returns on capital at attractive valuations on a cross-cycle basis. The return on capital should be high enough to generate significant cashflow, allowing the company to re-invest a portion of the funds back into growing the business, with the rest returned to shareholders. All holdings are given a quality and valuation score of between 1 and 5, derived from quantitative inputs and qualitative judgments based on fundamental research. The trade-off between quality and value for each stock is then considered. Momentum is used as a crosscheck on the idea and to build conviction.

The chart below illustrates how I approach investing as a whole. It shows quality running along the x-axis and valuations along the y-axis. The point it makes is that investing is not just about buying the best quality businesses, but is about buying them at attractive valuations on a cross-cycle basis. This is what I consider the sweet spot, which is represented in the bottom-right of this grid.

My disciplined and consistent investment process is backed by the Fidelity research team, external resources and company meetings. I also use quantitative inputs from my powerful spreadsheet framework that enables me to identify, compare and monitor ideas consistently. I believe that my focus on “quality at an attractive price” provides me with a competitive edge as higher quality companies tend to outperform the market over the long run and provide less volatile absolute performance as well.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Matthew Siddle: I am an active investor and I do not try to replicate the index as my main focus is to find quality stocks at an attractive price. Position sizes typically range from 0.5% to 5% and depend on the conviction level and liquidity. If a position accounts for more than 10% of the fund’s total tracking error, I look to reduce it. That said, it may be appropriate for investors to compare the fund against its peer group and the comparative index, which is the FTSE World Europe Index. The MSCI Europe Index works as well as there is a significant overlap between the two indices.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

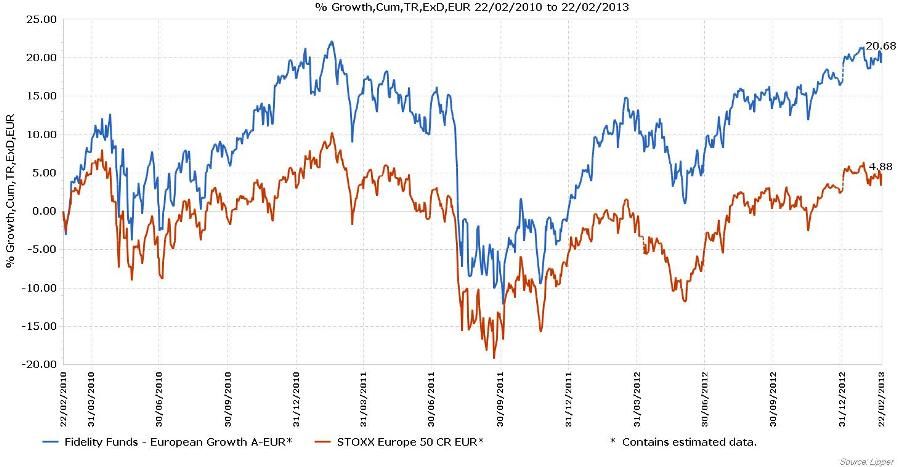

Matthew Siddle: The fund’s year-to-date cumulative growth is 2.6% (as at 18 February 2013) compared to a benchmark growth of 3.8%. The fund returned 11.4% against the index return of 15.6% over my tenure (since 1 July 2012), which is too short a period to review performance. During this period, I have been buying and selling stocks in order to transition the portfolio to reflect my investment process whilst acting in the best interest of shareholders. A better representative of my track record would be the performance of the FF European Larger Companies Fund, which returned 29.3% over my tenure from October 2010 to January 2013, outperforming the index return of 17.9%, and is ranked 6 out of 228 funds in the Europe Large-Cap Blend Equity sector.

e-fundresearch.com: What motivates you in your job?

Matthew Siddle: Understanding the world we live in and trying to use that insight to help make money for our clients is an immensely fascinating activity. The intellectual challenge of learning about how different industries work, how the companies involved are positioned, understanding the likely evolvement of this over time has been an enriching experience for me. It is interesting to apply all of this knowledge to make a decision about where the best investment opportunities are given the prices that you are offered the companies at.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Matthew Siddle: Before I entered the financial industry, I worked as a sports coach. While I was a student, I coached at a local primary school, I taught the junior teams at our local cricket club and worked as a travelling coach for the county cricket board visiting schools across the county. It was very satisfying to take your own understanding of the sport and technique and then work out how to communicate this best to children and see them blossom as players.

e-fundresearch.com: Many Thanks!

3-year development