e-fundresearch.com: Mr. Marc Bataillon, you are the fund manager of the LO Funds – Europe High Conviction fund (ISIN: LU0049412769). When did you take over the responsibility of managing this fund?

Marc Bataillon: 15 November 2010

e-fundresearch.com: What is the current size of the fund?

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...Marc Bataillon: Approximately EUR 400 million as of 28 February 2013.

e-fundresearch.com: Do you also manage other funds or mandates?

Marc Bataillon: Yes, in addition to the LO – Funds – Europe High Conviction fund, we also run a European equity long/short fund, as well as the European equity long/short book of the firm’s market neutral, multi-portfolio manager hedge fund.

e-fundresearch.com: What is the total amount of assets you manage currently?

Marc Bataillon: In total, our team manages approximately EUR 640 million as of 28 February 2013.

e-fundresearch.com: How long have you been in the business as a fund manager?

Marc Bataillon: I have 23 years of industry experience in total, of which 11 have been in the fund management business.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Marc Bataillon: Our fund follows a structured investment strategy that uses tiered portfolio construction to focus on performance throughout the business cycle. A constant eye on investment discipline mitigates the risk of style drift, ensuring we follow our distinctive approach.

The portfolio is built in 3 distinct categories, so as to enable the fund to navigate through any economic or market cycle:

- High-quality companies: mostly acyclical businesses which should outperform significantly in down markets

- Corporate event candidates: these businesses may also be fund in a more cyclical spectrum and should benefit from potential take-over or other special events (e.g., exceptional dividend, break-up, etc.)

- High growth companies: these companies should benefit from innovative products, market share gains, emerging market exposure.

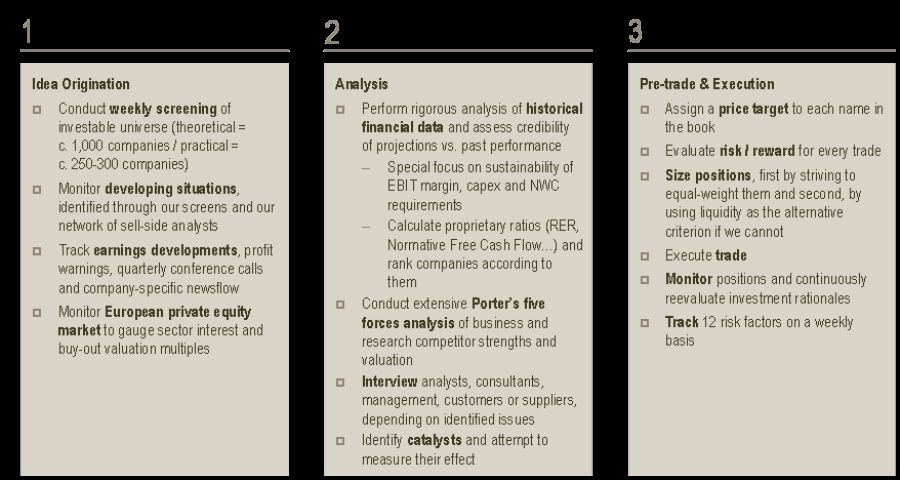

This tiered portfolio construction creates a strong discipline: investments not fitting in one of three buckets are discarded. Thus, we focus on a subset of opportunities, building depth of knowledge rather than stretching ourselves too thin over a broad universe of stocks. The fund’s portfolio is the result of fundamental analysis performed by our team, following a three-step qualitative process:

We believe this clear and disciplined portfolio construction process built on 3 distinct tiers, enabling our fund to perform in both bull and bear markets is our key competitive edge to adding value for investors.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Marc Bataillon: MSCI indices are the most commonly used ones when it comes to Equities funds, so we have chosen MSCI Europe Net Dividends as the benchmark for our fund, as we believe it is a good representative of the European equity market. Our portfolio is managed to beat the MSCI Europe index over the long term and not to track the index over the short term.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Marc Bataillon: The following figures are annualized and gross of fees:

- Our fund’s performance YTD as of 28 February 2013 was 5.28% (benchmark: 3.79%).

- The performance of the fund over the past five calendar years (2008-2012) was 1.69% (benchmark: -2.34%), however, please note that we have only been managing the fund since November 2010.

- Since our team took over management of the fund in November 2010, the fund has achieved 16.33% performance (benchmark: 7.51%).

The following chart depicts the fund’s performance since our team took over in November 2010.

e-fundresearch.com: Many Thanks!