e-fundresearch.com: Mr. Maximilian Anderl, you are the fund manager of the UBS (Lux) Equity Sicav – European Opportunity Unconstrained P-acc fund (ISIN: LU0723564463). When did you take over the responsibility of managing this fund?

Maximilian Anderl: Since the inception of the fund, 31/05/2007

e-fundresearch.com: What is the current size of the fund?

Maximilian Anderl: EUR 41.8million as at end February 2013.

e-fundresearch.com: Do you also manage other funds or mandates?

Maximilian Anderl: Yes, Global and European equity funds, long only and long short. Various retail and segregated accounts.

e-fundresearch.com: What is the total amount of assets you manage currently?

Maximilian Anderl: EUR3.2 billion

e-fundresearch.com: How long have you been in the business as a fund manager?

Maximilian Anderl: 13 years - all at UBS Global Asset Management.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Maximilian Anderl: The Concentrated Alpha investment process is a bottom-up stock selection process focused around our “three circle” approach. This has been in use since inception and is based on fundamental, quantitative and qualitative sources of information that have proven their value over time. We buy stocks that look attractive on these measures and short stocks that are unattractive. The importance of these sources of information can vary over time depending on the market environment.

The weighting of a stock in the portfolio is benchmark-agnostic and is determined by the upside versus downside potential. This results in portfolios with high active share, relative to its benchmark. Risk management is of fundamental importance to our approach and we use multiple quantitative models as well as non-quantitative measures to measure and monitor risk.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

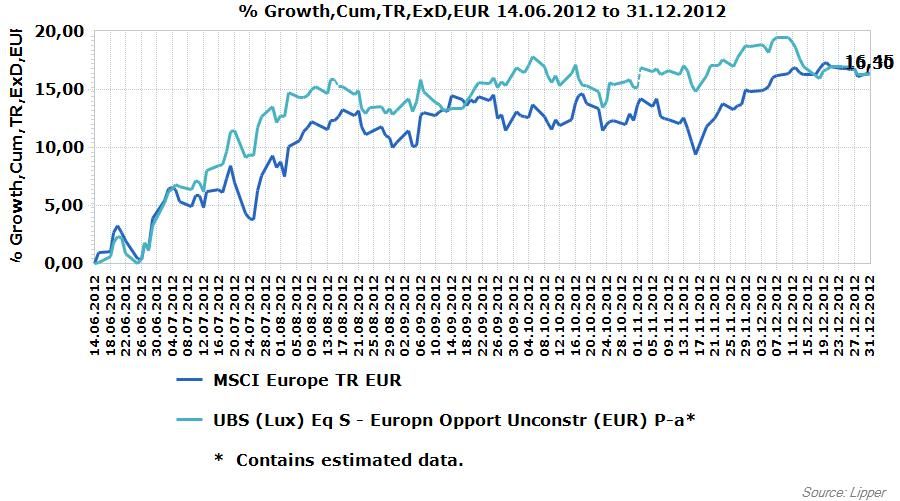

Maximilian Anderl: MSCI Europe. We have outperformed the benchmark year-to-date and over the past five years, achieving a top quartile ranking relative to peers.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...Maximilian Anderl:

YTD to end-Feb 2013:

| Fund: |

8.7% | |

|

|

| Benchmark: | ____4.1% | |||

| +4.6% (relative) |

Figures are gross-of-fees and cumulative.

2012: 2011:

| Fund: | 25.0% |

|

Fund: |

0.7% | |

| Benchmark: |

___16.9% |

Benchmark: |

___-8.5% | ||

| +8.1% (relative) |

+9.2% (relative) |

Figures are gross-of-fees and cumulative. Figures are gross-of-fees and cumulative.

2010: 2009:

| Fund: | 13.7% |

|

Fund: | 44.3% |

| Benchmark: |

___11.6% |

Benchmark: | __31.2% | |

| +2.1% (relative) |

+13.1% (relative) |

Figures are gross-of-fees and cumulative. Figures are gross-of-fees and cumulative.

2008:

| Fund: |

-40.7% | |

|

|

| Benchmark: | ___-43.7% |

|

|

|

| +2.9% (relative) |

Figures are gross-of-fees and cumulative.

Maximilian Anderl: One spends a lot of time at work. It is therefore of crucial importance ones likes his/her job. The job of a portfolio manager involves new challenges every day which keeps our work varied and interesting. The last 5 years particularly, has offered a lot of "entertainment" value.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Maximilian Anderl: I studied biochemistry and initially worked in the pharmaceuticals industry. I am still interested in science but I prefer the day to day work of picking stocks, to my work of chemical experiments in the past.

e-fundresearch.com: Many Thanks!

UBS reserves the right to retain all messages. Messages are protected and accessed only in legally justified cases.

Deutsch/Francais/Italiano: http://www.ubs.com/1/e/index/legalinfo2/privacy.html.