e-fundresearch.com: Mr David Roberts you are the fund manager of the Kames Strategic Global Bond fund (ISIN: IE00B296YK09). When did you take over the responsibility of managing this fund?

David Roberts: I’ve co managed it with my colleague Phil Milburn since its launch in November 2007.

e-fundresearch.com: What is the current size of the fund?

David Roberts: $550.07million (at 28th February 13)

e-fundresearch.com: Do you also manage other funds or mandates?

David Roberts: I manage and co-manage a number of mutual funds registered in Dublin and the United Kingdom.

e-fundresearch.com: What is the total amount of assets you manage currently?

David Roberts: I am the joint head of fixed income at Kames Capital so I have overall joint responsibility for our €35.1billion fixed income assets under management – Kames Capital’s overall assets under management is €64.2 billion (at 31 December 12)

e-fundresearch.com: How long have you been in the business as a fund manager?

David Roberts: I joined Kames Capital in 2004 from Britannic Asset Management where I was Head of Credit, and I have 24 years’ industry experience. I studied Economics and Industrial Relations at the University of Strathclyde and I have an MSc in Investment Analysis.

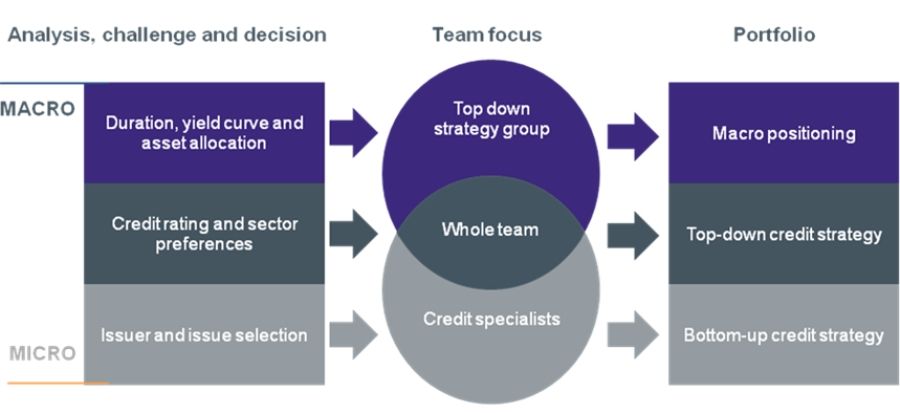

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

David Roberts: We employ a team of experienced, skilled professionals who follow a process which ensures ideas are consistently analysed and rigorously debated. We believe much of our competitive advantage lies in the results of this team and its processes. In particular, our experience and analytical skills give us the confidence to manage relatively concentrated portfolios of our best investment ideas. We do so on a benchmark agnostic basis seeking to add value from positive stock selection, ie identifying and exploiting undervalued companies' bonds, and through negative stock selection, ie avoiding credit blowups, the more traditional driver of fixed income managers' stock selection.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

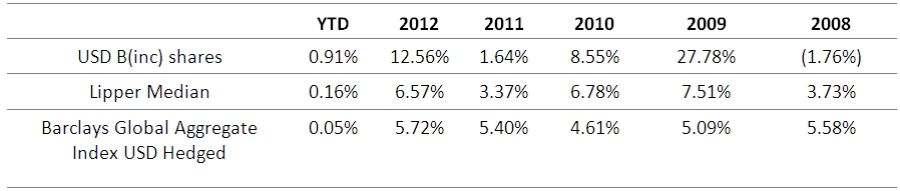

David Roberts: Primary performance target is second quartile over rolling 12 months and top quartile over a rolling 3 year period in the Lipper global - bond global sector. Secondary performance target is to outperform the Barclays Capital Global Aggregate Index by +2% p.a. over rolling 3 year periods. It is a Morningstar OBSR Silver-rated fund.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...e-fundresearch.com: What motivates you in your job?

David Roberts: I am a competitive person who was never particularly good at sport. I enjoy the day to day challenge of performing better than peers or indices to build a long term track record; it is an intellectual competition where a combination of a little skill and a lot of hard work can make a difference to client wealth. Bond markets are multi dimensional and constantly throw up new challenges - I love the need to rise to overcome those challenges.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

David Roberts: I spent 10 years in the banking industry prior to becoming a fund manager, working my way from running back office functions to trading FX. That gave me a good understanding of markets, but also importantly an understanding of some of the administrative challenges that face clients on a daily basis. My first job, during University vacation, was as a school janitor. If you need someone to change a light bulb or stoke a boiler, let me know.

e-fundresearch.com: Many Thanks!

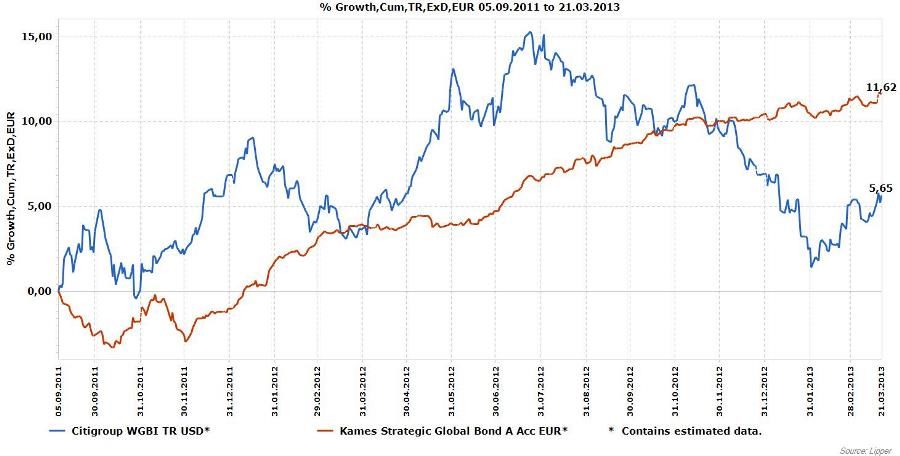

Fund development since launch