e-fundresearch.com: Mr Simon Lue-Fong you are the fund manager of the Pictet-Global Emerging Debt-P USD fund (ISIN: LU0128467544). When did you take over the responsibility of managing this fund?

Simon Lue-Fong: Since November 2005.

e-fundresearch.com: What is the current size of the fund?

Simon Lue-Fong: USD 6.100 Mio. as at 30-Apr-13

e-fundresearch.com: Do you also manage other funds or mandates?

Simon Lue-Fong: Yes.

e-fundresearch.com: What is the total amount of assets you manage currently?

Simon Lue-Fong: USD 31.200 Mio. as at 30-Apr-13

e-fundresearch.com:How long have you been in the business as a fund manager?

Simon Lue-Fong: 22 years

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Simon Lue-Fong: As an active benchmark manager, we first optimally replicate the benchmark exposure and return to ensure we respect the asset allocation decision of the client. Then we look to generate alpha over the benchmark by 1% to 3% per annum in both up and down market environments. The alpha generation stage involves putting an equal emphasis on the top-down assessment of the global risk environment and bottom-up assessment of country fundamentals. The top-down view enables us to assess how attractive the conditions are for taking risk. This is important because global factors have a significant influence on emerging market returns and macro risk sentiment can often outweigh country-specific fundamentals.

There are several key criteria for assessing country fundamentals and these include; external financing (i.e. external debt/GDP), public finances, the economic environment (i.e. specific sources of inflation), the political environment, structural strength and the financial system. We also use proprietary models which can include approximately 40 sub factors which are additional tools that act as a check and balance on our views, but they are not a trading tool. In furtherance, we undertake a significant number country due diligence trips where we meet with government officials, local investors and traders in order to obtain on the ground intelligence as part of our country fundamental analysis."

Our competitive edge can be summarised as follows:

• Pictet Asset Management is a pioneer and leader in the emerging debt asset class having invested in emerging markets since 1989 and having launched our first emerging debt strategy, a global USD denominated debt portfolio, in 1998.

• We are an active benchmark manager and aim to provide strategic index exposure and positive incremental returns over the benchmark so as not to override the asset allocation decision of the client with an attention to downside risk such as 2008.

• We have a large and well-resourced investment team with extensive experience in both developed and emerging debt markets based out of London and Singapore. Our team in Singapore provides a key local perspective on the Asian region, given its uniqueness and time difference.

• We aim to deliver performance above the JP Morgan EMBI Global Diversified index. This can be either, duration, curve, country and instrument selection such as quasi-sovereign bonds. To a lesser extent the fund may also take off‐benchmark positions, such as countries that are not in the benchmark, emerging corporate credit and emerging market local currencies and local interest rates.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Simon Lue-Fong: The benchmark is the JP Morgan EMBI Global Diversified which has exposure to almost 60 different countries and is largely considered to be the leading benchmark given its history, transparency, good construction and diversification. Investors should consider the different styles and philosophies to investing in the asset class. Many of our peers take a ‘high beta’ approach where the benchmark may not be very relevant to portfolio construction. This approach may generate strong outperformance during upmarket years, but in many cases these managers tend to underperform during down market cycles such as 2008. Our approach aims to provide a more consistent return profile with an element of predictability and no surprises.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

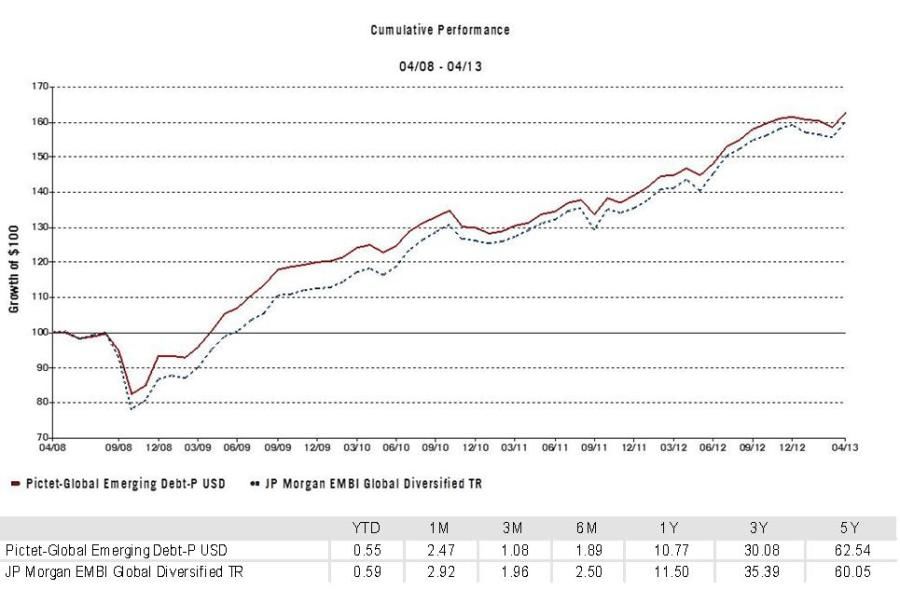

Simon Lue-Fong: Over the past 5 years (to 30-Apr-13, ‘P’ share class net in USD), the fund returned a cumulative 62.5% versus a benchmark return of 60.0%. The fund has performed well in various market conditions. For example, the fund strongly outperformed the benchmark in 2008 when the benchmark was down -12% while the fund was down -5.6% for that calendar year. This is an example of our attention to downside risk and aiming to provide protection during these types of market conditions. Year to date to 30-Apr-13, the fund’s performance was relatively flat to the benchmark after fees as we have been a bit more cautious recently given some periods of negative returns seen so far this year and the overall global risk sentiment.

Past performance is neither guarantee nor a reliable indicator of future results. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

e-fundresearch.com: What motivates you in your job?

Simon Lue-Fong: Leading a successful and large team and business, focussing on delivering performance and interacting with clients, but every day is different and markets can be humbling.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Simon Lue-Fong: A veterinarian, I like to help animals.

e-fundresearch.com: Many Thanks!

Weitere beliebte Meldungen: