e-fundresearch.com: Mr. Aaron Grehan, you are the fund manager of the Aviva Investors Emerging Markets Bond Fund (ISIN: LU0180621947). When did you take over the responsibility of managing this fund?

AVIVA Investors: Aaron has been back up manager for the fund since 2010 and took over lead management responsibility at the start of June 2013.

e-fundresearch.com: What is the current size of the fund?

AVIVA Investors: The fund has assets of $1,652m as at 31 May 2013.

e-fundresearch.com: Do you also manage other funds or mandates?

AVIVA Investors: Yes, Aaron is also responsible for the Aviva Investors Emerging Markets Corporate Bond Fund

e-fundresearch.com: What is the total amount of assets you manage currently?

AVIVA Investors: Across all our hard currency EM sovereign and corporate bond strategies, we manage c$2.5bn

e-fundresearch.com: How long have you been in the business as a fund manager?

AVIVA Investors: Aaron joined the investment industry in 2000 and became a fund manager in 2004.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Our investment process is designed to capture investment opportunities while offering downside protection. Our process is simple, disciplined and transparent. It is organised around four stages:

1)idea generation

2)central investment themes

3)short term positioning

4)ongoing monitoring

1)Ideas are driven by three areas of analysis:

- Fundamentals consider the key characteristics of an issuer that determine its creditworthiness. For a sovereign, this could be fiscal metrics or political stability. For a corporate borrower we might consider capital structure or key business risks.

- Technical analysis seeks to identify opportunities to add value based on the likely behaviour of other market participants. This can include supply and demand dynamics, or anticipating regulatory or benchmark changes.

- Valuations: determine whether current prices reflect our view of an issuer’s credit quality. This uses quantitative analysis and yield comparisons to rate bonds against peers, historical values and other asset classes.

2) Central themes: the aim of the central continuous interaction and discussion within the emerging market debt team is to formulate high conviction themes which will shape our medium and long term portfolio positions.

3) Portfolio construction: includes decisions on security selection across yield curves and the best way to reflect the central themes in each portfolio.

4) Ongoing monitoring: the choice of investment instruments for implementing an investment theme and the position size is driven by this stage.

The conservative nature of our strategy represents our key competitive edge. The nature of the asset class means that avoiding default scenarios and negative shocks is the key to delivering sustainable outperformance in EMD.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

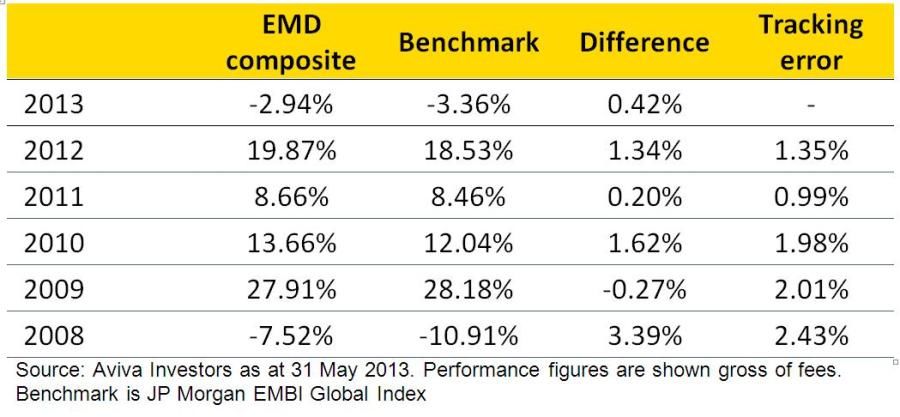

AVIVA Investors: Our strategy is benchmarked against the JP Morgan EMBI Global Index – performance against this index is most relevant.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Weitere beliebte Meldungen: