e-fundresearch.com: Mrs. Ece Ugurtas, you are the fund manager of the Baring High Yield Bond Fund (ISIN: IE0004851808). When did you take over the responsibility of managing this fund?

Ece Ugurtas: I have been working on the Fund since October 2003 and was officially named co-manager in 2005 and became lead manager in 2007

e-fundresearch.com: What is the current size of the fund?

Ece Ugurtas: $1,178,294,005 (as at 30th June 2013)

e-fundresearch.com: Do you also manage other funds or mandates? What is the total amount of assets you manage currently?

Ece Ugurtas: Yes, $1,714,256,426 (as at 30th June 2013).

e-fundresearch.com: How long have you been in the business as a fund manager?

Ece Ugurtas: I have 15 years’ investment experience and chair the Credit Portfolio Construction Group and am responsible for all Global High Yield portfolios at Barings. I am the manager of the Baring High Yield Bond Fund and a member of the Scenario Team responsible for modeling the outlook for the global economy and also have extensive experience managing EM debt and currency portfolios. I joined Baring Asset Management as a Fund Manager in 2003 and previously worked at M&G Investment Management as a Director of Fixed Interest Portfolio Management, managing gilt portfolios and emerging market debt funds. I have an MSc in Economics from the London School of Economics and a BSc in Economics and Politics from Bristol University and was awarded the CFA designation in 2000. I speak Turkish and German fluently.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Ece Ugurtas: Our investment process for selecting potential investments in a credit portfolio starts with fundamental top down and bottom up research, which is the key to our credit allocation decisions. Additionally, the Quantitative Research Team is responsible for developing and maintaining quantitative tools used by the Investment Teams. The team provides quantitative research and support which entails risk tools and data screening.

Our credit analysts use a scoring system to systematically evaluate individual countries and corporate bonds. In addition to scoring corporate issuers ourselves, we also receive documentation direct from ratings agencies Moody`s and S&P. In selecting individual issuers, we seek out companies with sound fundamentals, for example, issuers with appropriate capital structures and with the potential to improve their credit strength over time. The analysts aim to identify individual credits which offer superior value and/or improving credit characteristics whilst ensuring the issue is liquid. The Credit Committee which meets once a month approves investments in all directly invested high yield issues and monitors potential upgrades and downgrades across the credit spectrum.

Both country and sector allocation decisions are made on a top down basis. Our process relies on “top down” scenario analysis to model possible market responses to a variety of economic outcomes. We populate each scenario with macroeconomic forecasts, enabling us to develop forecasts for bond yield curves, currencies, swap spreads and credit spreads. By comparing the range of forecasts across scenarios with actual market levels, we can judge whether a particular asset is currently cheap or expensive given the potential scenarios that the market may move towards over the next few months.

The selection of potential credit investments is a “bottom up” process where our credit analysts use a scoring system to evaluate individual corporate bonds as shown in the following diagram:

In selecting individual issuers, we seek out companies with sound fundamentals, for example, issuers with appropriate capital structures and with the potential to improve their credit strength over time. Our analysts aim to identify individual credits that offer superior value and/or improving credit characteristics whilst ensuring the issue is liquid.

The Credit Portfolio Construction Group which meets once a month approves investments in all directly invested high yield issues and monitors potential upgrades and downgrades across the credit spectrum. The Credit Committee consists of seven members – Ece Ugurtas, Sunita Kara, Atish Suchak, Alex Stephansen, Sean Chang, Gabriel Yu and Faisal Ali.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Ece Ugurtas: The fund is measured within the Morningstar GIFS Fixed Income Global High Yield Peer Group. The fund is not measured relative to a benchmark index.

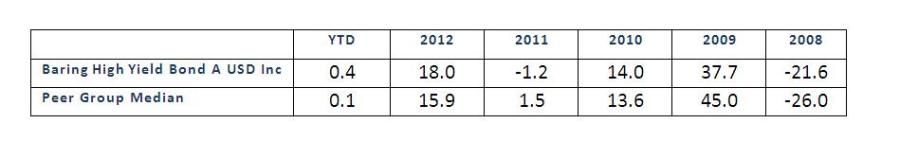

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Ece Ugurtas:

e-fundresearch.com: Many Thanks!

Weitere beliebte Meldungen: