e-fundresearch.com: Mr. Srivastava, you are co-portfolio manager on the BNY Mellon Euroland Bond Fund (ISIN Code: IE0032722484). When did you take over the responsibility of managing this fund?

Raman Srivastava: The fund has been managed by Standish’s dedicated Global Fixed Income investment team on a ‘team-approach’ basis since inception (September 2001).

e-fundresearch.com: What is the current size of the fund?

Raman Srivastava: € 2,288.25million (as at 30th September 2013).

e-fundresearch.com: Do you also manage other funds or mandates?

Raman Srivastava: Yes.

e-fundresearch.com: What is the total amount of assets you manage currently?

Raman Srivastava: Standish’s Global Fixed Income Investment team manages approximately US$ 13.5 billion in Global and European fixed income strategy assets. I am also co-PM on our Opportunistic Fixed Income accounts, along with Standish’s Chief Investment Officer (David Leduc) and fellow co-Deputy CIO (David Horsfall). Our Opportunistic Fixed Income product is an unconstrained, absolute return-oriented strategy.

e-fundresearch.com: How long have you been in the business as a fund manager?

Raman Srivastava: I have been in the investment management industry for over 16 years.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Raman Srivastava: At Standish, we believe that consistent outperformance requires both top-down and bottom-up expertise. Further, that a broader opportunity set results in better returns – i.e. that a portfolio’s risk-adjusted performance improves with an increase in the number of strategies employed in its management.

We have a deep and experienced group of investment professionals at Standish, many of whom have been with the firm for many years. We believe our experience allows us to understand markets better and develop the convictions necessary to make good investments and effectively manage risk. We believe our clients benefit from the pooled resources of all Standish sector teams and their best investment ideas.

Our investment process incorporates our internally developed forecasts for the macroeconomic drivers in countries and regions across the globe and evaluates them versus market consensus. We believe it is crucial to look at the fixed income markets from a global perspective even when managing European portfolios as often developments outside of Europe can affect the pricing of securities within Europe. Our global macroeconomic assessment is then used to shape our relative value decisions across sectors and industries where our analysts conduct extensive research. Security selection opportunities are a critical component to our outperformance over time.

Lastly, we believe that we are a ‘right-sized firm’, with a large enough asset-base to devote significant resources to research, risk management, trading and portfolio management, yet we are small enough that security selection decisions have a material impact on returns.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Raman Srivastava: The most relevant reference benchmark for the fund is the Barclays Euro Aggregate Bond Index. The fund employs the Standish European Core Plus investment strategy and falls within the Lipper Global - Bond EUR Sector.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

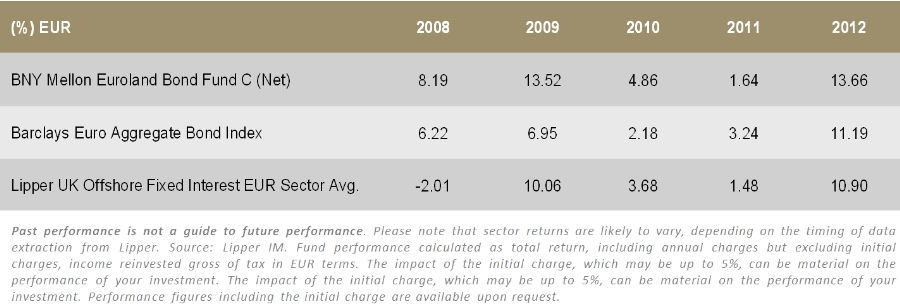

Raman Srivastava:

BNY Mellon Euroland Bond Fund: 5 Year Calendar Year Performance:BNY Mellon Euroland Bond Fund: YTD 2013 Performance:

Year to date 2013 (through 16th October), the fund has slightly underperformed the Barclays Euro Aggregate Bond Index, returning +0.68% versus +1.17% for the reference index.

e-fundresearch.com: What motivates you in your job?

Raman Srivastava: It may be surprising to hear that I find the fixed income markets extremely exciting and interesting. Uncovering bonds which are relatively inexpensive with solid to improving fundamentals is a basic philosophy, but one which is challenging to execute, but can be very rewarding if done well.

e-fundresearch.com: Thank you!

Anmerkung der Redaktion: Raman Srivastava und sein BNY Mellon Euroland Bond Fund konnten im letzten "Die besten EURO-Anleihenfonds" - Ranking den vierten Platz (von 212 Fonds) auf Basis 5-Jahres Sharpe-Ratio belegen.

Weitere beliebte Meldungen: