e-fundresearch.com: Mr. Louis N. Cohen, CFA, you are the fund manager at MacKay Shields for the Nordea 1 – US Corporate Bond Fund.

ISIN: LU0458979746 (BP – USD). When did you take over the responsibility of managing this fund?

Louis N. Cohen: MacKay Shields has managed the Nordea 1 - US Corporate Bond Fund since its launch on 1/14/2010. Gary Goodenough, the former Head of Investment Grade Fixed Income, was the original lead portfolio manager for the fund. In February 2011, Gary Goodenough announced his decision to retire from MacKay by the end of 2012. As part of the succession plan, the firm elected to combine the Investment Grade Fixed Income team with the High Yield Active Core Team. With this transition, my colleagues (Dan Roberts, Michael Kimble and Taylor Wagenseil) and I became the lead portfolio managers for the Fund in February 2011.

e-fundresearch.com: What is the current size of the fund?

Louis N. Cohen: As of October 31, 2013, the fund AuM was USD 2,468 million.

e-fundresearch.com: Do you also manage other funds or mandates?

Louis N. Cohen: Yes. Dan Roberts, the Chief Investment Officer for the Global Fixed Income (GFI) Division, along with Michael Kimble, Taylor Wagenseil and I, jointly manage over 200 portfolios.

The GFI Team also manages the following Nordea-1 Funds:

• Nordea 1 – US High Yield Bond Fund (BP-USD ISIN LU0278531610)

• Nordea 1 – Low Duration US High Yield Bond Fund (BP-USD LU0602537069)

• Nordea 1 – Global High Yield Bond Fund (BP-USD ISIN LU0476539324)

• Nordea 1 – Unconstrained Bond Fund

The funds have assets of USD 1,534 million; USD 1,086 million; and USD 676 million; (as of 10/31/2013). The Nordea 1 – Unconstrained Bond Fund was just launched on November 5th, 2013.

e-fundresearch.com: What is the total amount of assets you manage currently?

Louis N. Cohen: As of September 30th, the AUM for the GFI team is $47.6 Billion.

e-fundresearch.com: How long have you been in the business as a fund manager?

Louis N. Cohen: My credit experience began at Bankers Trust in 1978 in the firm’s Commercial Banking Department. In 1981, I moved to Kidder Peabody as a fixed income Credit Analyst. In the years that followed, I served as a fixed income credit manager at several notable Wall Street firms, including Shearson, Drexel Burnham Lambert and Paine Webber. In 1991, I joined Dan Roberts’ team at UBS Asset Management as a Core/Core Plus portfolio manager, where I also served as Director of Research and co-chaired the Credit Committee. Following our time at UBS, the team went to Pareto Partners and we then joined MacKay Shields in 2004.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Louis N. Cohen: Our philosophy is rooted in the belief that the bond markets do not reward for inappropriately high levels of risk, and therefore, strong risk-adjusted investment returns can be achieved by employing a strategy of eliminating uncompensated risk.

With every bond we analyze for possible inclusion into a client portfolio, we look to accomplish two important goals: 1) quantify the downside risk and 2) quantify the upside potential. Our basic tenet is that bonds have limited upside (mature at par), but significant downside potential (default with no recovery). By eliminating or reducing the far left tail of a payoff distribution (below), the mean return shifts to the right. Stated simply, the probability of generating higher returns typically increases while the volatility of the portfolio decreases.

Our investment process marries a fundamental and rigorous bottom-up investment approach with a top-down macroeconomic overlay, while a robust risk assessment informs the process. The risk assessment incorporates four critical dimensions: 1) credit risk, 2) interest rate risk, 3) structure risk, and 4) liquidity risk. The marginal risk in each category is thoroughly analyzed and understood in order to quantify the downside from each and every investment eligible for a client portfolio. While particular emphasis is also given to correlations and systematic risk inherent in the markets, unsystematic risk that fails to offer adequate compensation is rigorously screened out at the beginning stages of the process.

We believe our process adds value by adhering to fundamental investment approaches and not market timing strategies. Discipline to the process is important, especially during volatile market conditions. Fear and emotion will dictate market flows and pricing in the near term, and while opportunities can present themselves, our process prevents us from employing “knee jerk” reactions in our client portfolios. Daily, weekly, monthly and even quarterly performance can be considered random outcomes, at times. Our philosophy and process are rooted in longer-term market trends whereby themes play out.

The product’s key strength is that it has a clearly articulated philosophy that the same team has successfully implemented for many years.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Louis N. Cohen: The benchmark for the Nordea 1 - US Corporate Bond Fund is the Barclays Capital US Credit Index. The fund uses its reference index as a tool for performance comparison purposes.

The objective of the fund is to achieve risk-adjusted returns by eliminating uncompensated risk. The fund managers’ constant quest for undervalued securities within bond markets lies on the principle that fixed income markets are highly inefficient and therefore offer attractive investment opportunities.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

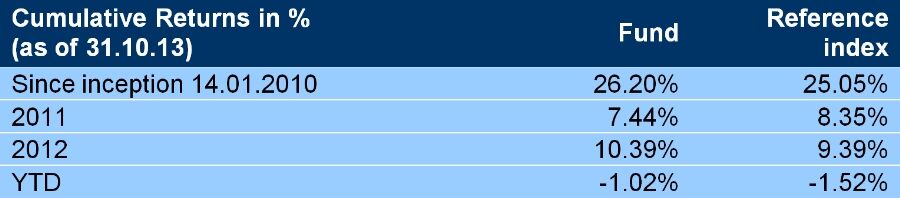

Louis N. Cohen: The Nordea 1 - US Corporate Bond Fund BP-USD achieved a YTD absolute performance (per 31/10/2013) of -1.02% (net of fees), outperforming the benchmark by +0.50% YTD.

The Barclays Capital US Credit Index does not incur management fees, transaction costs or other operating expenses. Investments cannot be made directly into an index. The Index is referred to for comparative purposes only and is not intended to parallel the risk or investment style of the Fund. Past performance is not indicative of future results.

e-fundresearch.com: What motivates you in your job?

Louis N. Cohen: What I think most people in this business would agree on is that no matter how long you're in this business, the real fun and natural motivation comes from getting a new puzzle to solve every day. What makes it all the more special for me is getting to do it with a great team of colleagues.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Louis N. Cohen: At the start of my career in banking, portfolio management was always the one thing I aspired to do. Now looking back I consider myself incredibly lucky in that I simply couldn't imagine doing anything else.

e-fundresearch.com: Thank you!

Weitere beliebte Meldungen: