e-fundresearch.com: Mr. Francois Theret, you are the fund manager of the Absolute Asia AM Pacific Rim Equities Fund (ISIN: I/A(USD) - LU0103015219) and Absolute Asia AM Emerging Asia Fund (ISIN: I/A (USD) LU0095830419). When did you take over the responsibility of managing this fund?

Francois Theret: I, Francois Theret, CIO, have taken over the responsibility of managing both the Absolute Asia AM Pacific Rim Equities Fund and Absolute Asia AM Emerging Asia Fund, effectively as of 26 September 2013.

e-fundresearch.com: What is the current size of the fund?

Francois Theret: Fund Size (as of end Oct 2013):

Absolute Asia AM Pacific Rim Equities Fund: US$ 288.30m

Absolute Asia AM Emerging Asia Fund: US$ 170.92m

e-fundresearch.com: Do you also manage other funds or mandates?

Francois Theret: I also manage the Natixis Global Emerging Equity Fund and other mandates, focusing on the Asia Pacific ex Japan region.

e-fundresearch.com: What is the total amount of assets you manage currently?

Francois Theret: US$ 887.56 m, as of end Oct 2013.

e-fundresearch.com: How long have you been in the business as a fund manager?

Francois Theret: I have been a fund manager since 2007 but prior to being a PM, I have worked as a financial analyst in the AM business for almost 10 years.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

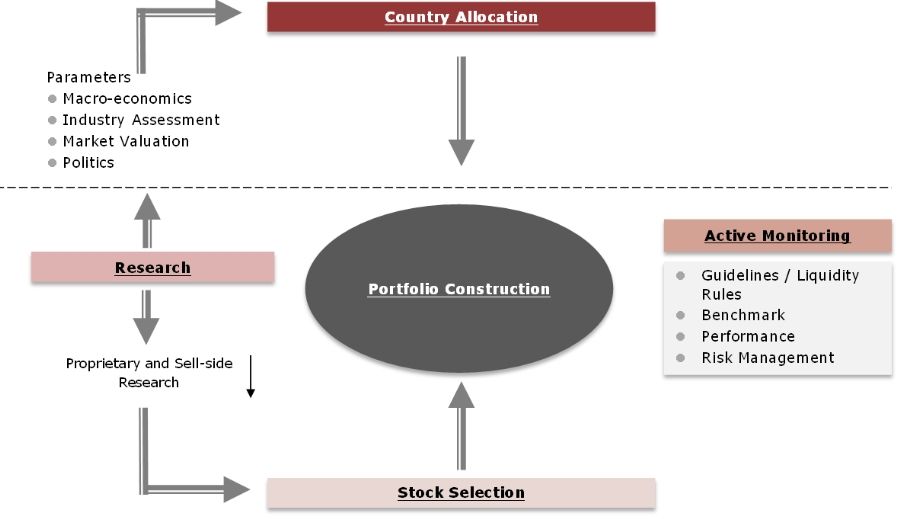

Francois Theret: Our investment process combines country allocation with stock selection. The process is for all market capitalization and is not constrained by a growth or value bias. The portfolio is relatively concentrated to maximize potential from all investment ideas.

Figure 1: Investment Process

Our Funds offers a compelling combination of disciplines and expertise to ensure the broadest possible universe for idea identification. The competitive strengths are summarized below:

a. The Absolute Asia investment team is highly experienced in the management of Asia ex Japan mandates. Francois Theret, our CIO, has over 16 years’ experience in investments. Prior to joining Absolute Asia AM in Sep 2013, Francois was the Head of Global Emerging Equities at Natixis Asset Management. Joyce has been with Absolute Asia AM for 13 years and has 16 years in the finance industry.

b. We focus on the two main drivers of strong returns, country allocation and stock selection. These factors are important for our market, where analysis of demographic, economic, and political developments can yield opportunities. The investment team’s understanding of the Asian markets is the result of many years of investing in the region as well as being locally based. As such, the team has become adept at identifying investment ideas for the portfolios. The process’ focus on the interrelatedness of companies, industries, and countries is critical to understanding how growth in one part of the investment universe has implications elsewhere.

c. The approach is opportunistic and investments are not artificially limited by style or market capitalization considerations. The team’s “market oriented” approach recognizes that potential performance can come from many sources and the team seeks to leverage all of those sources, including value unlocked in financial transactions, such as mergers, acquisitions, and capital restructuring.

d. Additionally, although, we believe that long term share prices are driven by company fundamentals, another source of market inefficiency arises during periods of short term volatility, which also provides attractive investment opportunities that we can take advantage of through our strong research capabilities.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Francois Theret:

o Benchmark for the Absolute Asia AM Pacific Rim Equities Fund: MSCI Pacific free ex Japan

o Benchmark for the Absolute Asia AM Emerging Asia Fund: MSCI Emerging Markets Asia

Investors should compare the fund vs. Benchmarks for both the funds.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Francois Theret: As mentioned earlier, I started managing the funds since 26 Sep 2013 with my co-manager Joyce Toh. I believe this question may not be applicable at this point.

e-fundresearch.com: What motivates you in your job?

Francois Theret: Knowing that every day brings something different from the previous day, sharing opinions and views with industry experts and investment specialists from around the world, generating investment ideas… Dealing with Emerging Markets keeps your intellectual curiosity intact. Understanding and monitoring global politics, demographics, specificities of consumption habits and cultural aspects are at least as important as analyzing P&L and Balance sheets statements.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Francois Theret: Maybe a medical professional. But I broke the family tradition.

e-fundresearch.com: Thank you!

Weitere beliebte Meldungen: