e-fundresearch.com: Mr. Russ Oxley, you are Head of Rates and the fund manager of the Ignis Absolute Return Government Bond Fund (ISIN: LU0866993628). When did you take over the responsibility of managing this fund?

Russ Oxley: I have been managing the fund since it launched on 31 March 2011

e-fundresearch.com: What is the current size of the fund?

Russ Oxley: Approximately €2.7bn

e-fundresearch.com: Do you also manage other funds or mandates?

Russ Oxley: Yes. As Head of Rates I also manage life assurance assets on behalf of Ignis’ parent company, Phoenix Group.

e-fundresearch.com: What is the total amount of assets you manage currently?

Russ Oxley: I am responsible for the management of approximately €22bn of assets in total.

e-fundresearch.com: How long have you been in the business as a fund manager?

Russ Oxley: I began my fund management career at Investec Asset Management in 1997 and I have been managing funds at Ignis since 2004.

e-fundresearch.com: What are the main steps in your investment process and what is your competitive edge to add value for investors?

Russ Oxley: There are five key stages to our investment process 1) the identification of key macroeconomic themes 2) analysis of forward curves using proprietary software to find the optimal expression of our view 3) the expression of our macro view through multiple positions to increase diversification and reduce idiosyncratic risk 4) The allocate to key themes depending on short-term conviction 5) monitoring intraday P&L and dynamically hedging as needed.

There are a number of factors that we believe sets the Ignis Absolute Return Bond Fund apart from its peers and adds value for clients including: our highly experienced nine-strong team; our innovative approach to markets based on forward rate analysis using proprietary software, our focus not just on performance but also on carefully managing the risk within the fund, our focus on high quality, highly liquid assets allowing effective risk management even in times of market stress and the scale of our fixed income operation, which, as one of the largest and most active fixed income teams trading in the UK, gives us access to all the major trading desks and various central banks and monetary authorities. This market information and access gives us a significant competitive advantage.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Russ Oxley:The fund aims to generate positive returns in excess of cash on a 12 month rolling basis irrespective of market direction and with a low level of volatility. We do not benchmark the fund against a specific peer group.

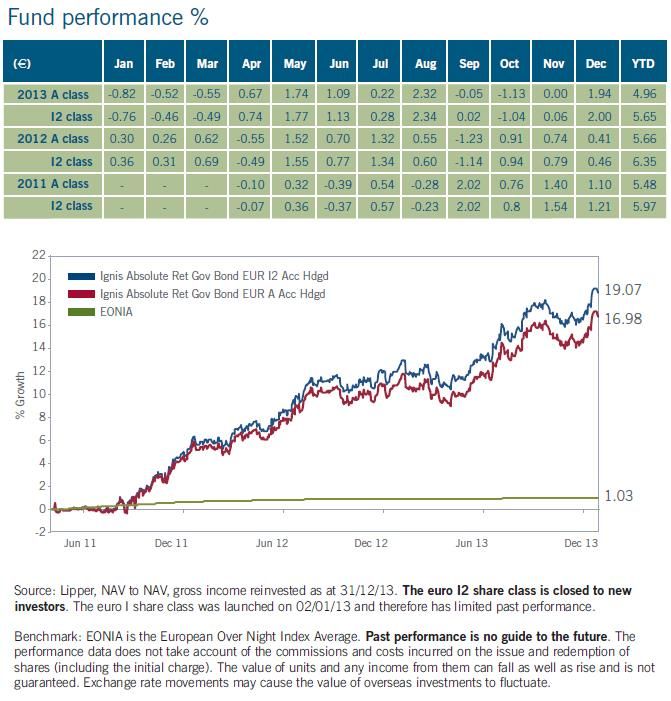

e-fundresearch.com: What performance did you achieve for the fund YTD and over the past five calendar years and relative to benchmark or other reference indices?

Russ Oxley: The fund returned 6.03% in 2013 and 6.78% in 2012 and has delivered a total return of 19.72% since launch on 31 March 2011. It has produced an annualized return of 6.75% since launch, comfortably beating cash and inflation. Most importantly, the fund has achieved its returns in various market conditions while running a very low level of risk. Since launch, the fund has achieved its return with a standard deviation of just 3.35% and an information ratio of 1.9.

e-fundresearch.com: Many thanks!

Weitere beliebte Meldungen: