e-fundresearch.com: Mrs. Sylvie Séjournet, you are the fund manager of the Pictet-Digital Communication fund (ISIN:LU0101692753). When did you take over the responsibility of managing this fund?

Sylvie Séjournet: I have been managing the fund since 2008.

e-fundresearch.com: What is the current size of the fund?

Sylvie Séjournet: As at January 2014, the Pictet-Digital Communication fund had assets totalling USD 637 million and we reached USD 926 mio of AUM for the overall strategy.

e-fundresearch.com: Do you also manage other funds or mandates?

Sylvie Séjournet: I am fully dedicated to the management of this fund which is part of the overall Sector & Theme Unit.

e-fundresearch.com: What is the total amount of assets you manage currently?

Sylvie Séjournet: As at December 2013, the overall Sector & Theme Unit at Pictet Asset Management had USD 23.5billion in assets under management. The Digital Communication reached USD 926 mio as end of January 2014.

e-fundresearch.com: How long have you been in the business as a fund manager?

Sylvie Séjournet: I joined Pictet Asset Management in 2005 and I am a Senior Investment Manager in the Sector & Theme Funds team. After completing an industrial placement in the Finance Department of the TF1 group, I spent eight years as a Media sell-side analyst at Fortis Bank in Paris. In 2000, I was nominated for the Agefi Award for best junior analyst and in 2004, I won the AQ Award for best analyst, based on the recommendations for 537 mid-cap stocks.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Sylvie Séjournet: We aim at constructing a well-diversified portfolio, investing on interactive business models or services that are conducted online and filtering only qualitative companies with web-based business model (e-commerce, digital content, cloud computing, software as a service, online advertising). Digital Communication is about technology with an innovation angle and a qualitative angle (we do not invest in some of the traditional technology segments that are affected by this transition - like pure manufacturers, pure telecom equipment, pure hardware). This is the big cycle of the Consumerism in IT that is taking place and that the fund is capturing, offering spectacular growth to investors. The investment universe is not limited to a specific geographical zone.

We build an active portfolio from bottom-up stock selection. Unlike many managers we do not begin with a decision about a region or country. We believe that it is very difficult to predict the relative performance of these factors and prefer instead to concentrate on analysing and finding promising companies.

Our portfolio construction process begins with an equal starting weight for each stock in the universe. The size of each individual position is adjusted by a risk management approach which consists of discounting the volatility and liquidity risk of each individual stock versus the overall universe to get to our “initial” portfolio weights.

We therefore determine the portfolio weight of each stock and adjust the initial weight of the stock through active management factors. These active management factors comprise various components that reflect our opinion in terms of fundamentals and valuation of the stocks. This step is qualitative and consists of pricing company factor by adding or removing premium or discount from the initial weight. These company adjustment factors depend on 4 scores: management scores, business franchise, equity attractiveness (valuation), industry factors (country risk, specific debt issues, regulation risks).

OUR COMPETITIVE ADVANTAGE

Benefit from a powerful global trend

The internet and mobile technology are dramatically changing the way we work, shop, play and communicate, as our lives increasingly move online. Our Digital Communication Fund invests in leading companies able to profit from this transformation focusing on digital transition and technological innovation.

Get exposed to excellent growth prospects

In the years ahead, the momentum in this sector looks set to remain strong. The upside is big as Digital Communication industry is far from being mature. Penetration rate are still very low and should continue to offer secular growth for investors. There is plenty of scope for growth especially considering internet services and virtualisation process are cheaper for consumers and cost efficient for Enterprise given more accessible and widespread infrastructure. The next decade will continue to see a major transformation of our businesses, offering plenty scope of growth – Unprecedented opportunities are happening and will support demand for current and new internet services.

Growth in digital communication, driven by major structural shifts should be therefore less affected by the difficulties affecting the wider global economy. From an investment perspective, we believe this growth pattern should help shares in this sector to outperform the wider stock market, with lower volatility.

Unlike many other Technology funds, Digital communication, does not invest in semi- conductors (more replacement cycle), or in pure hardware companies (commoditized) but focus on companies with business model that are conducted online. This thematic philosophy combined with a strict investment process, using a bottom-up approach based on quantitative and qualitative screenings make Digital Communication a unique product. Taking market conditions into account, the portfolio is constructed by efficiently combining strong-growth securities (communication devices, digital services, content, e-commerce) with more valuation-oriented securities (network operators). The fund has a concentrated portfolio of 51 stocks, and is well diversified both geographically and in the market capitalisation spectrum.

Invest in innovation

The fund invests in growing businesses that fully understand their customers. The USD 1 trillion sector includes: e-commerce; online content and advertising, online gaming, data analysis and data management system such as cloud computing and business intelligence/application software, interactive devices, online payment solution, cable, telecoms and satellite networks.

We offer a Global approach

We pursue opportunities wherever they exist, from the developed nations of North America, Europe and Japan to the emerging markets of Asia and the rest of the world.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

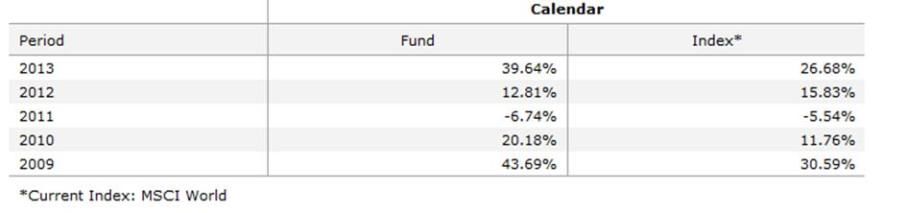

Sylvie Séjournet: We adopt a non-benchmark style. We construct our portfolio exploiting the predictive characteristics of investment theme driven by secular growth trends. Our allocation is the aggregation of a bottom up approach based on a quantitative and qualitative analysis as described above. However, for the sake of performance comparison we use the MSCI World Index as a benchmark for the Pictet-Digital Communication fund.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Sylvie Séjournet: We have provided below the performance returns over the past five years to December 2013. Please note, returns are provided net of fees for the P USD share class (Source : Pictet Fundcenter).

Sylvie Séjournet: Meeting companies and their managers, understanding their business model. Discovering new business models that are sustainable as making life easier for consumers and enterprises. Trying to identify companies with valuation that seems to be mispriced.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Sylvie Séjournet: I would have loved running an internet company in the field of the education.

e-fundresearch.com: Thank You very much!

Weitere beliebte Meldungen: