e-fundresearch.com: Mr. Pakenham, Jerry Samet is the fund manager of the HSBC GIF Global High Income Bond Fund (ISIN: LU0524291613). When did he take over the responsibility of managing this fund?

Marcus Pakenham: 1 September 2012

e-fundresearch.com: What is the current size of the fund?

Marcus Pakenham: USD 1,555 million (31 January 2014)

e-fundresearch.com: Does he also manage other funds or mandates?

Marcus Pakenham: Yes, another 8 credit portfolios.

e-fundresearch.com: What is the total amount of assets he manages currently?

Marcus Pakenham: USD 4,660 million

e-fundresearch.com: How long has he been in the business as a fund manager?

Marcus Pakenham: He has been a fund manager for 26 years.

e-fundresearch.com: What are the main steps in his investment process and in which area is his competitive edge to add value to investors?

Marcus Pakenham: Our process has four main steps, risk budgeting, opportunity assessment, portfolio construction and risk management. The main investment risk is the selection of the issuers and our main competitive advantage is our global team of 40 dedicated credit analysts. He works with these analysts very closely in the identification of attractive bonds and in monitoring the fundamental health of issuers and the valuation of individual bonds.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Marcus Pakenham: The fund benchmark has an interesting construction with broadly equal components of emerging market bonds, developed market USD bonds and developed market Euro bonds. The rating of the universe encompasses both investment grade and high yield with the main ratings of BBB at 51% and BB at 33%. The fund can be compared against a broad global bond group or against the fund benchmark.

e-fundresearch.com: Which performance did he achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

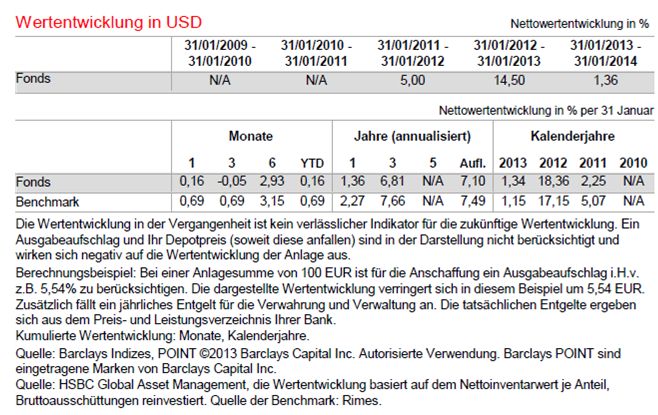

Marcus Pakenham: In 2013 the AC share class rose 1.3% while the reference benchmark rose 1.2%. Since inception (the first price has been calculated in 2010), the fund has risen 7.1% annualized while the reference benchmark is up 7.5%. (Past perforemance is not a reliable indicator for future performance)

e-fundresearch.com: Thank you!

All winners of the Lipper Fund Awards Austria 2014

Weitere beliebte Meldungen: