e-fundresearch.com: Mr. Eric Fine, you are the fund manager of the Van Eck – Unconstrained Emerging Markets Bond UCITS (ISIN: LU0935021328 and LU0935021591). When did you take over the responsibility of managing this fund?

Eric Fine: On August 20, 2013, Van Eck launched the Van Eck – Unconstrained Emerging Markets Bond UCITS (“UEMB UCITS” or the “Fund”) (available to non-U.S. investors), managed akin to the U.S. mutual fund – the Unconstrained Emerging Markets Bond Fund (“UEMB”) of which I am portfolio manager, which launched in July 2012. I have been portfolio manager of UEMB UCITS since its launch.

e-fundresearch.com: What is the current size of the fund?

Eric Fine: As of December 31, 2013, approximately USD 10 million assets UEMB UCITS fund and approximately USD 222 million in the strategy.

e-fundresearch.com: Do you also manage other funds or mandates?

Eric Fine: Yes. The Emerging Markets (EM) Bond investment team manages all of Van Eck’s actively managed EM Bond funds including UEMB, the Van Eck VIP Unconstrained Emerging Markets Bond Fund, and UEMB UCITS.

e-fundresearch.com: What is the total amount of assets you manage currently?

Eric Fine: As of December 31, 2013, approximately USD 222 million.

e-fundresearch.com: How long have you been in the business as a fund manager?

Eric Fine: I joined Van Eck in 2009 and serve as a portfolio manager for all of its actively managed EM Bond funds. I have been conducting business in emerging markets for nearly 25 years, working both as a strategist and portfolio manager. I was a Managing Director at Morgan Stanley, where I worked for 14 years. I founded and ran Morgan Stanley’s Emerging Markets Proprietary Trading group from 2004 to 2008. For the 10 years prior to this, I ran EMEA Economics and Fixed Income Strategy for 6 years (1994 to 2000), and then Global EM Economics and Fixed Income Strategy for 4 years (2000 to 2004). In this capacity, I won numerous awards and outperformed indices. I joined Morgan Stanley in 1994 after starting and leading a telecommunications company in Russia that built the country’s first clearing system.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Eric Fine: The fund’s investment philosophy is to invest in emerging markets fixed income securities where asset-pricing is undervalued relative to the country’s fundamentals.

The Fund’s investment process is bottom-up, and is ultimately based on deviations between the pricing of a country’s bonds relative to that country’s fundamentals.

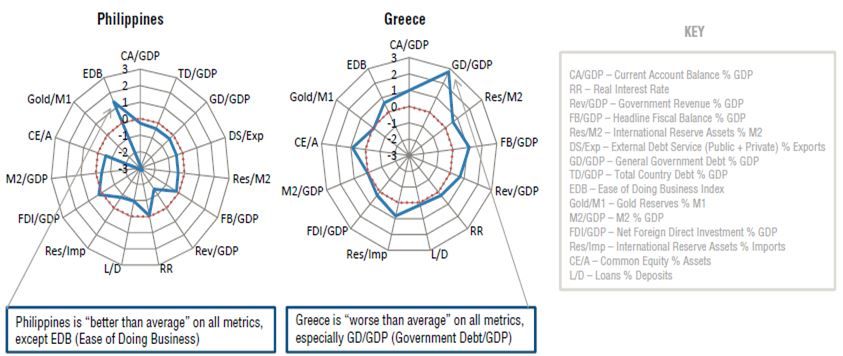

Step 1: Normalize Fundamentals

- Compare all countries using the same variables

- “Level the playing field” with respect to a country’s fundamentals

Step 2: Compare Fundamentals to Asset Prices

The second step of the process is comparing these countries with normalized fundamentals to the risk premia that exist in the fixed income instruments. Specifically, each country is given a z-score that is an average of their scores on all of the variables listed above. That country score (the z-score) is then compared to what one gets paid on the country’s bonds. In particular, the investment team looks at the country score against hard-currency credit spreads, and the country score against local-currency real yields. Other comparisons are also conducted, such as country score against real effective exchange rate richness/cheapness, and other valuation metrics. However, the main valuation metrics are hard-currency credit spreads and local-currency real yields.

Once this step has highlighted countries whose asset prices deviate significantly from their fundamentals, the Team conducts scenario analyses to generate expected values for each country’s bond market. These expected values generate position sizing guidelines. All things equal, the highest expected value receives the highest investment allocation.

Of course, there are quantitative and logical constraints on this. If a particular expected value has tail risks that are too fat, the Team takes that into consideration, usually adjusting sizing downward or sometimes eliminating the investment altogether if the tail risk’s probability or price downside is significant. Also, the Team sometimes assigns low confidence intervals to certain expected values. In their experience, some countries are less “analyzable”, based on their history of unpredictability (in an area that affects bond prices, not simply unpredictable on other issues). The Team might reduce or eliminate positions based on this assessment.

Step 3: Refine Asset-Price Selection with Several Tests

After these first two steps, the Team conducts a range of tests of individual positions and the entire portfolio. For example, an external vulnerability ranking (a measure of vulnerability to global financial market instability) is established for each country. That ranking is compared to valuation to determine whether the test (in this example, external vulnerability) is already reflected in valuation, or not. Portfolio tests involve establishing the price changes in the current portfolio in around 10 different global/top-down scenarios (for example, the “euro crisis”). If these tests challenge either individual trades or the portfolio, the portfolio manager would consider changing the portfolio.

Competitive Advantage

- One of the first strategies to have an unconstrained mandate and to be able to actively invest in a blend of emerging markets local currency bonds, emerging markets hard currency bonds and emerging market corporate bonds.

- Given the Fund’s unconstrained nature, the team takes full advantage of the flexibility to allocate where ever they see opportunities in the space. This allows them to carefully select factor exposures and to optimize their country allocations.

- A multilayered and rigorous investment process that focuses on standardizing country fundamentals using a proprietary technique, identifying mispricings in valuations and finally conducting multiple tests in an attempt to understand all potential risks of each country and security.

- Deep investment team that includes an economist, traders, country and corporate analysts and an asset class strategist that have a combined 75 plus years of experience.

- The Fund is not benchmark-driven as we believe that the emerging market debt benchmarks are not a good representation of the opportunity set in the asset class. If, for example, the valuation of a certain country in the benchmark is not attractive, the team will just not own it.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Eric Fine: For performance purposes, the Fund uses the JPMorgan Government Bond Index-Emerging Markets Global Diversified Index (GBI-EM Global Div.) as its performance benchmark. However, the Investment Team also believes that an important performance benchmark is a split between the GBI-EM Global Div. and the JP Morgan Emerging Markets Bonds Index EMBI Global Diversified

Because the Fund is unconstrained the Team takes maximum advantage of this flexibility to perform in a range of market environments. Allocations to local-currency or hard-currency vary mostly due to bottom-up factors, but sometimes due to top-down or thematic factors. As a result, there are a number of environments in which the Fund may outperform its benchmark. However, once again, we do not manage to the benchmark.

Our broad peer group would be the offshore funds in the Morningstar Emerging Market Debt universe. We use this broad universe because there are not many unconstrained or blended emerging markets debt portfolios out there.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Eric Fine: The Van Eck – Unconstrained Emerging Markets Bond Fund seeks to outperform a blend of the JPM GBI EM Global Diversified and JPM EMBI Global Diversified indices using an unconstrained approach that allows the strategy the flexibility to find the best opportunities in all sub-asset classes of the Emerging Markets debt space.

As of 12/31/2013

The tables present past performance which is no guarantee of future results and which may be lower or higher than current performance. Returns reflect applicable fee waivers and/or expense reimburse. Had the Fund incurred all expenses and fees investment returns would have been reduced. Investment returns and Fund share values will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Index returns assume that dividends of the Index constituents in the Index have been reinvested.

J.P. Morgan Government Bond Index-Emerging Markets Global Diversified (GBI-EM) tracks local currency bonds issued by Emerging Markets governments. The index spans over 15 countries

J.P. Morgan Emerging Markets Bond Index Global Diversified (EMBI) tracks returns for actively traded external debt instruments in emerging markets, and is also J.P. Morgan’s most liquid U.S-dollar emerging markets debt benchmark

e-fundresearch.com: What motivates you in your job?

Eric Fine: Aligning countries that deserve credit with investors who need to invest in credit.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Eric Fine: A composer.

e-fundresearch.com: Thank you!

Van Eck - Unconstrained Emerging Markets Bond UCITS - Factsheet

Van Eck - Unconstrained Emerging Markets Bond UCITS - Manager Commentary

Weitere beliebte Meldungen: