e-fundresearch.com: Mr. Olivier de Larouziere, you are the fund manager of the NATIXIS SOUVERAINS EURO fund (ISIN:FR0010655456). When did you take over the responsibility of managing this fund?

Olivier de Larouziere: I began managing this fund in 2007.

e-fundresearch.com: What is the current size of the fund?

Olivier de Larouziere: As at 06.05.2014, assets in the Natixis Souverains Euro fund total EUR 1,044 billion.

e-fundresearch.com: Do you also manage other funds or mandates? What is the total amount of assets you manage currently?

Olivier de Larouziere: Yes, I am also in charge of managing other funds and institutional mandates. The total amount of assets I currently manage is EUR 1,736 billion.

e-fundresearch.com: How long have you been in the business as a fund manager?

Olivier de Larouziere: I have been managing portfolios since 1994.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

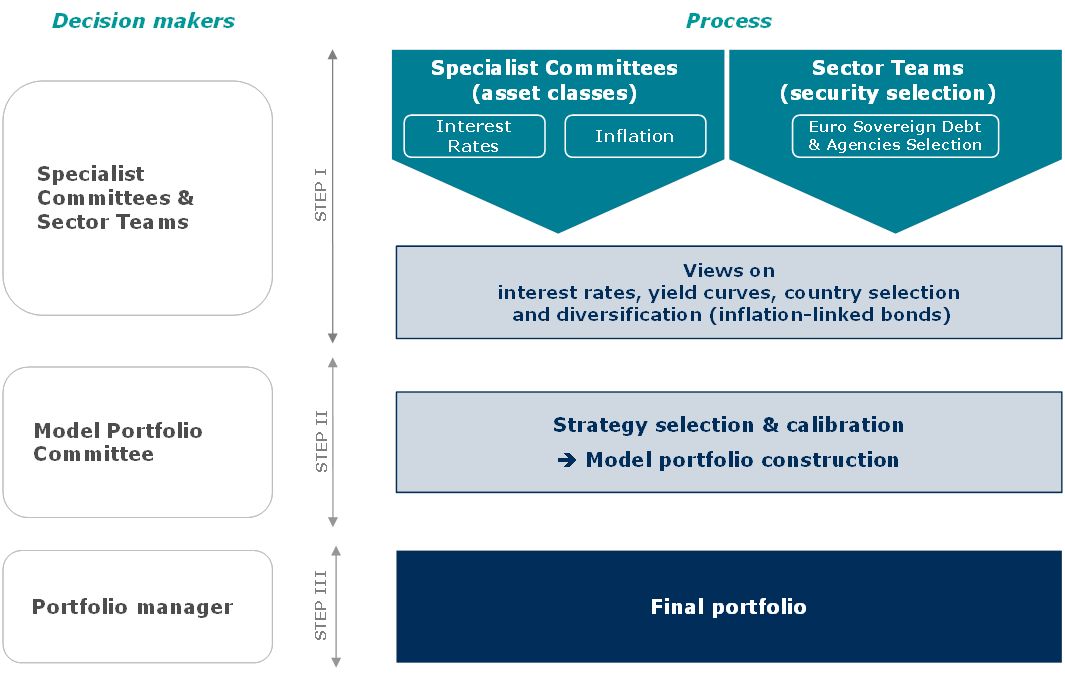

Olivier de Larouziere: The backbone of our Euro Sovereign debt process is our conviction-based management combining top-down approach and bottom-up approaches. Experienced government bond portfolio managers and other fixed income professionals collaborate through Specialist Committees and Sector Teams to identify high potential return investment ideas in the euro government bond market, and in related markets.

1. Idea generation: The first step of the investment process is based on in-house macroeconomic scenarios and technical recommendations issued by the economic research and fixed income strategy teams, expert groups performing in-depth research aiming to deliver highly specialized views. Portfolio managers, research analysts and strategists are integrated into the investment process through Specialist Committees and Sector Teams. Specialist Committees provide top-down analysis of fixed income markets (macro & micro fundamentals, market conditions, index performance and technical analysis). Sector Teams provide bottom-up inputs specialized by Fixed Income sub-markets.

2. Strategy selection and calibration: The second step aims at defining which strategies will be implemented in the model portfolio, based on recommendations expressed in the previous stage of the process. Strategies are thus calibrated iteratively within a defined risk budget.

3. Final portfolio construction: This final step aims at implementing the previously-defined strategies in the portfolio via bond selection in compliance with portfolio guidelines. The final step of the investment process leads to a conviction-based portfolio in line with the decisions made during the model portfolio construction step. The ultimate objective is to achieve performance within a defined risk framework. The portfolio manager uses his leeway to select the final holdings of the portfolio and defines the best association of selected strategies and performance-enhancing tactical options, with respect to the fund’s specific investment guidelines. The portfolio manager takes into account current market conditions and data to set up the real portfolio.

The incorporation of bottom-up, country level selection in a government bond portfolio constitutes our main competitive edge. Indeed, the Euro-debt crisis has underscored investors’ needs to incorporate such an approach in their bond portfolios. Thanks to its highly-experienced team of country and interest rate specialists, Natixis AM is among the first government bond managers to adopt such an approach in Natixis Souverains Euro investment process thanks to our highly-experienced team of country and interest rate specialists. Beyond country allocation, skilled managers can draw upon a broad opportunity set of bottom-up and top-down strategies. Natixis Souverains Euro also applies a unique process to blend subjective judgement with internally-developed tools to support decision making today.

Natixis Souverains Euro – illustration of the investment process

e-fundresearch.com: How many positions does the portfolio usually contain and what is the average holding period of an investment?

Olivier de Larouziere: The portfolio usually contains between 40 and 70 positions. For the year ended March 31, 2014, the turnover* for Natixis Souverains Euro averaged 42%. This figure reflects a longer horizon for active country allocation versus tactical duration management (which was the main performance driver prior to 2008). However, turnover remains in line with the fund’s three year investment horizon.

*Note: Turnover is defined as = [(buy + sell) – (contribution + withdrawals)] / average net assets

e-fundresearch.com: To which extent does fund size impact the efficiency and effectiveness of your investment strategy?

Olivier de Larouziere: We estimate that the fund’s current capacity is EUR 20 billion. A fund size beyond that amount could impact the implementation of the investment strategy.

e-fundresearch.com: In which market environment does your investment strategy deliver the best (relative) results?

Olivier de Larouziere: In the case of a stable or strongly-performing euro sovereign market, the fund manager would focus on relative performance in order to deliver the best outperformance. During bear markets, the fund manager would use the flexibility afforded by the investment process to reduce duration and protect the fund. He would also take advantage of the high volatility likely to be found in country spreads in an aim to add value vs. the benchmark.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Olivier de Larouziere: The JP Morgan EMU Global all maturities index is the most relevant index investors could compare with. We consider this index as the most appropriate to represent the performance of Eurozone sovereign debts of all maturities.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Olivier de Larouziere: Please refer to the table below for a performance recap through April 30, 2014:

Annual Performance of Natixis Souverains Euro, gross of fees* – as of 30.04.2014

|

|

Natixis Souverains Euro |

JP Morgan EMU global all maturities |

difference |

|

Year to date |

5.74% |

5.08% |

0.66% |

|

2013 |

2.77% |

2.38% |

0.39% |

|

2012 |

11.75% |

11.42% |

0.34% |

|

2011 |

5.11% |

1.78% |

3.33% |

|

2010 |

2.49% |

1.17% |

1.32% |

|

2009 |

5.44% |

4.32% |

1.12% |

* Management fees for Natixis Souverains Euro (I share): 0.43%

Natixis Souverains Euro – Evolution of the performance vs. benchmark over the past 5 years (gross of fees)

e-fundresearch.com: Thank You!