e-fundresearch.com: Mr Emmanuel Chapuis, you are the fund manager of the ODDO GENERATION EUROPE ESG fund (ISIN : FR0000991960 / FR0010461301). When did you take over the responsibility of managing this fund?

Emmanuel Chapuis: In charge as of 01/01/2007

e-fundresearch.com: What is the current size of the fund?

Emmanuel Chapuis: AuM 84M€

e-fundresearch.com: Do you also manage other funds or mandates? What is the total amount of assets you manage currently?

Emmanuel Chapuis: Other funds under management :

- Oddo Génération : AuM 305M€

- Oddo Funds Large Cap Europe : AuM 95M€

- Oddo Proactif Europe : AuM 645M€

- Large Caps Mandates : AuM 850M€ (mainly Euro Zone)

e-fundresearch.com: How long have you been in the business as a fund manager?

Emmanuel Chapuis: Since 1999

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Emmanuel Chapuis:

Investment Process

Our rigorous investment process breaks down into 5 stages and leads to a concentrated portfolio of around 40 to 50 holdings. Our stock selection process is based on deep fundamental analysis of companies:

Stage 1: quantitative filter

Within the investment universe, we focus on global leading companies, i.e. value creators able to preserve fair profitability and finance their long term development.

Within this screened investment universe, we select best companies according to an in-depth fundamental analysis.

Stage 2: Fundamental analysis (on around 250 companies)

We are carrying an in-depth fundamental analysis of stocks. Fundamental analysis of stocks lies at the heart of the investment process: it tends to verify that the fundamentals underpinning the company’s financial performance will be maintained or improved over the coming years. Stability or improvement in economic returns (ROCE > Cost of capital) represents the basic pre-requisite for continuation or even acceleration in the expansion and value creation process.

Stage 3: Valuation

Companies on which the portfolio management team issues a positive fundamental opinion are valued to set trading levels.

Portfolio managers quantify the risk / return profile of each company through valuation.

Our valuation method, based on best- and worst-case scenarios, determines our strict buy and sell discipline.

After completing the 3 investment process stages presented above (quantitative filter based on economic and financial performance, fundamental analysis and valuation) portfolio managers build a portfolio with around 40 to 50 holdings.

Stage 4 : Portfolio construction.

We check the cyclicality of the portfolio against its benchmark index. We ensure that the balance of cyclicals versus non-cyclicals is in line with the market to avoid macro bets.

Only stocks on which the portfolio management team has a strong conviction and has identified an attractive upside potential are implemented in the portfolio.

The portfolio management team determines the weightings of a new holding and adjusts the weighting of pre-existing holdings based on fundamentals and valuation (upside potential vs. downside risk).

In all cases, Oddo AM does not wish to hold over 5% of a company capital in order to diversify risk and to preserve the portfolio liquidity.

Competitive edge

Oddo AM has a strong recognized expertise in managing European equities, focusing on value creating companies over the long run.

Our strategy combines 5 key strengths:

- Strong convictions: our investment decisions are based on rigorous fundamental analysis. No style bias, no thematic bias, no macroeconomic bias.

- Value creators on the whole cycle: we invest in value creators on the full economic cycle operating in markets with high barrier to entry.

- European companies with a global reach, capturing growth wherever it is.

- We aim at a controlled level of volatility with an optimized risk/ratio and a preserved liquidity by investing on mid & large market capitalizations.

- We privilege a collective investment decision-making process in order to avoid individual appreciation biases and mistakes, and if any to limit capital loss risk.

e-fundresearch.com: How many positions does the portfolio usually contain and what is the average holding period of an investment?

Emmanuel Chapuis: Our rigorous investment process leads to a concentrated portfolio of around 40 to 50 holdings. The average holding period of an investment is 3 years.

e-fundresearch.com: To which extent does fund size impact the efficiency and effectiveness of your investment strategy?

Emmanuel Chapuis: As the weighted average market cap of the current portfolio is around 29bn€, we believe that the fund size is not a matter of concern.

e-fundresearch.com: In which market environment does your investment strategy deliver the best (relative) results?

Emmanuel Chapuis: Our investment process follows exclusively a bottom-up approach, without any style bias, that is based on our strong convictions: investment decisions are based on fundamental research and in-depth knowledge of companies’ business model. The only bias that might appear is the business generation of our companies: they are on average more international than the European companies in general.

Generally speaking, we strongly believe that given our philosophy to invest only in value creating companies with highly winning cash-generative business models, always at fair price (risk/reward is key), we should reasonably perform in up markets and outperform in bear markets. Fair also to say that in times during which the market will favour more local or highly leveraged business models (especially true during relief market rallies), we might experience periods of underperformance that should not be ever-lasting.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Emmanuel Chapuis: Our most relevant benchmark is the Dow Jone EuroStoxx Net Return (SXXT). We believe that investors should analyze the fund performance on a risk-adjusted basis.

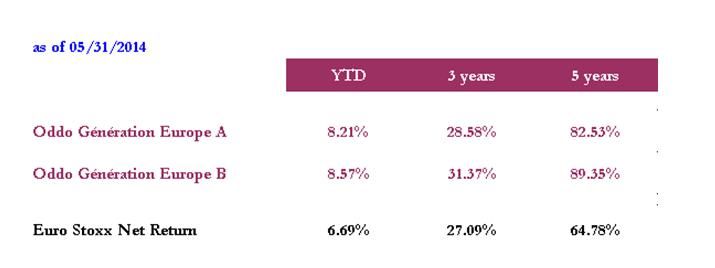

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Emmanuel Chapuis:

e-fundresearch.com: What motivates you in your job?

Emmanuel Chapuis:

Fantastic job that gives you a unique opportunity to deal with so many subjects : macroeconomics, financial analysis, valuation, behavioural finance, ESG matters, sector knowledge, new technological trends, breakthrough innovation … An excellent place to improve my general knowledge.

Strongly motivated by delivering good performance on a risk-adjusted basis over a 3-year timeframe, meeting customer risk/return objectives.

Being responsible @ 100% of the fund performance and continuously assessing the reward of our investment ideas

Managing in a collegial approach

Being able to assess our performance by analyzing Morningstar rankings

e-fundresearch.com: Thank You!

Weitere beliebte Meldungen: