e-fundresearch.com: What are your personal lessons learned from 2014 market developments?

Ariel Bezalel: Amid a challenging year for the flexible bond sector overall, the Jupiter Dynamic Bond SICAV returned 6.31% in 2014. For much of the year duration was at the shorter end of the scale and on the back of rising deflationary fears we aggressively increased duration in late Q3. This helped to boost performance in the final quarter.

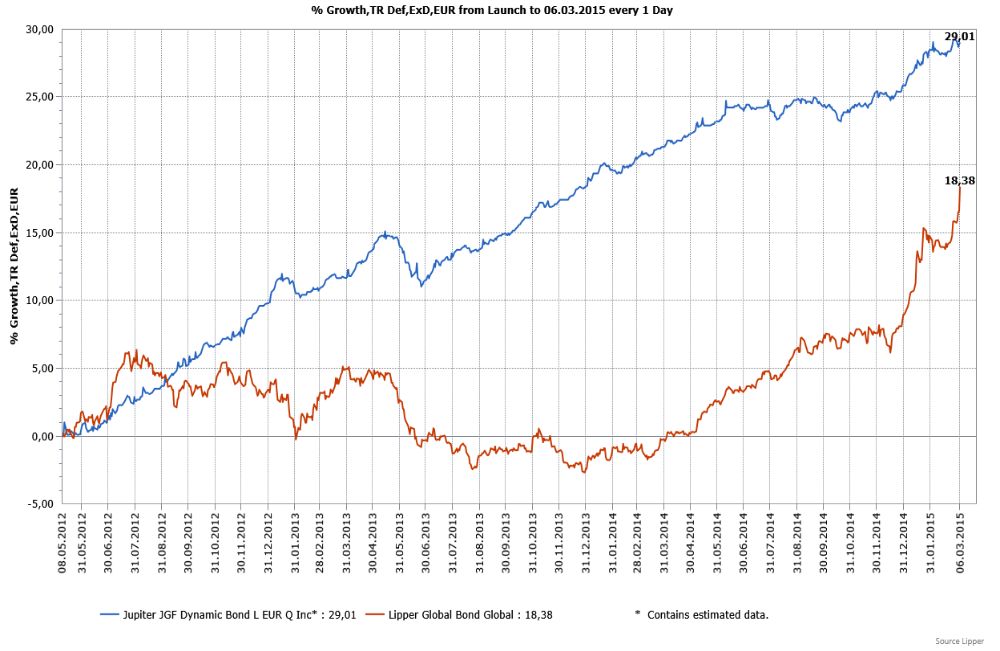

Chart: Jupiter Dynamic Bond SICAV seit Auflage

We came into the year expecting relatively modest gains, with coupon payments making up a larger chunk of investment returns. The Fed had started tapering and the US economy was showing increased signs of a self-sustained recovery. We were also concerned that the market was underestimating the pace of recovery in the US economy and therefore the potential pace at which the Federal Reserve might normalize policy. As a result, duration was kept at a low level of 2 years through hedges in 5-year US Treasury bonds and we have adopted strategies aimed at defending the fund against rising US rates (e.g. via yield to call and floating rate notes). Our view proved to be too bullish. The US suffered from a weather-related slowdown in Q1, while a combination of geopolitical and deflationary risks elsewhere in the world meant further Fed tightening might be delayed – a perfect storm in terms of our positioning. We closed out our US Treasury bond short in September and the position proved to be the largest negative contributor to performance during the year.

Weitere beliebte Meldungen: