e-fundresearch.com: Why should investors consider an increase in allocation to Japanese equities in 2015?

James Pulsford: As is the case with any stock market there are a mix of positive and negative factors that any investor needs to weigh up before deciding whether to invest. Recent economic growth has been poor and whether Abenomics is ultimately successful in restoring Japan to a path of sustainable growth remains an open question. That said we are encouraged by recent signs of a pick-up in wage growth and consumption, the manufacturing sector continues to perform very well and is increasing domestic capital spending; both these factors bode well for better economic growth in 2015. While it is not a new factor the fact that the Abe political administration and the Bank of Japan are working so closely together in a cooperative fashion clearly focusing on the economy and more efficient allocation of capital above all other considerations is an important point for investors. The introduction of the Stewardship Code, the Corporate Governance Code and the Nikkei 400 index has been driven by the administration and is leading corporate Japan to give more consideration to ROE and shareholder returns which we believe will continue to be a supportive for valuations for a while to come.

The above positive factors have been taken on board by domestic investors and it seems likely that the recent trend to allocate money away from bonds and into equities will continue for some time, also helped by the GPIF’s asset allocation change in the same direction which is increasingly replicated by regional pension funds as well as Japan Post which together amount to sizeable potential asset flows into equities.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

James Pulsford: We use a disciplined fundamental research approach to build detailed models of sales, profits, cash flows and balance sheets for the four hundred or so companies that we analyse and this provides a sound framework to value each business based upon trends in future investment and returns focusing on Cash Flow return upon Investment. This is supplemented by an active program of company meetings to enhance our understanding of what is happening in both specific industries within Japan and also of the wider economy. Portfolio construction is based around building a concentrated portfolio of 25-30 companies that offer good quality management, sound business prospects and an attractive valuation.

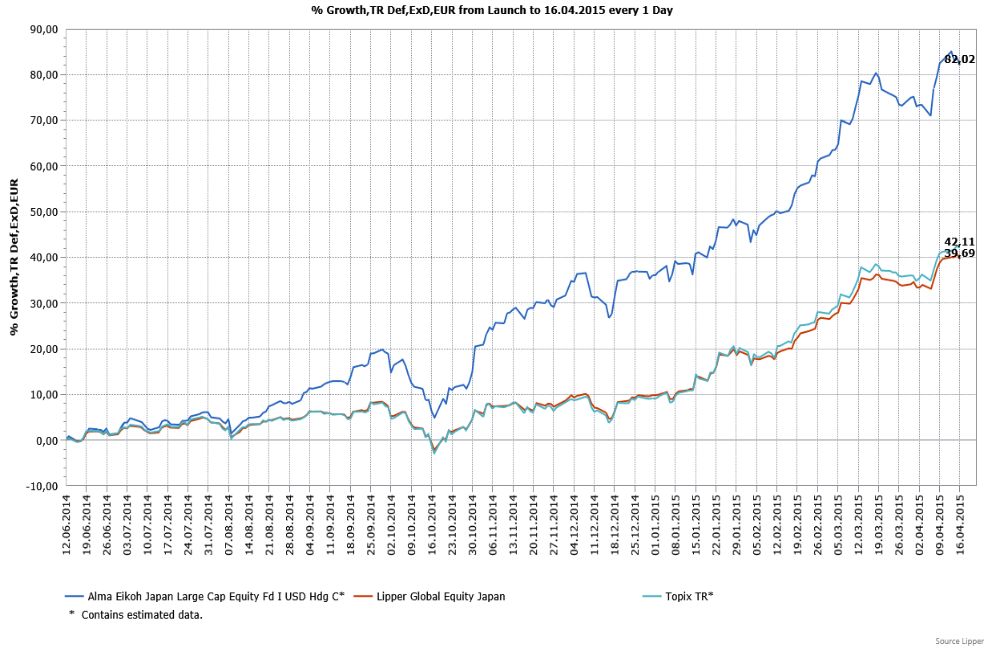

Chart: Alma Eikoh Japan Large Cap vs. Topix and Peer-Group Average

e-fundresearch.com: What is the background and motivation of the cooperation between Alma Capital and Eikoh Research?

James Pulsford: The logic behind the partnership between Alma and Eikoh is very straightforward. We spent some time looking at potential partners and were excited by the fact that Alma were as enthusiastic as we were about launching a high quality actively run Japanese fund. We were also impressed with their knowledge of the continental European market and felt sure that our fund management skills allied with their marketing reach would prove a successful combination.

e-fundresearch.com: In which market environment does your investment strategy deliver the best (relative) results?

James Pulsford: The investment strategy seeks to deliver long term capital appreciation through our bottom up focus on fundamental value through a variety of different market environments.

e-fundresearch.com: How optimistic is your view into the future and what obstacles and challenges should investors be prepared to overcome in 2015?

James Pulsford: Japan faces a number of challenges in 2015 and beyond as the political administration seeks to restore the country to a path of sustainable growth and fiscal rectitude; while the difficulty in achieving these twin aims should not be underestimated we are optimistic about the future. The Abe administration and the Bank of Japan have shown an unwavering commitment to restoring vitality to the economy over the past two years and the fruits of this are being seen as we enter 2015 in a brighter outlook for the economy and good stock market performance. With a stable and committed political administration we expect that the government will manage to maintain cordial relations with its neighbours and social cohesion at home while continuing to enact the sort of specific reform measures designed to enhance longer term prospects for growth.

e-fundresearch.com: Thank You!

Weitere beliebte Meldungen: