e-fundresearch.com: Mr Richard Klijnstra, you are the fund manager of the Kempen (Lux) Euro Credit Fund (ISIN:LU0630255346). When did you take over the responsibility of managing this fund?

Richard Klijnstra: Since inception of the fund in May 2008.

e-fundresearch.com: What is the current size of the fund?

Richard Klijnstra: The total Sicav fund size as per the end of March is EUR 928.5mln.

e-fundresearch.com: Do you also manage other funds or mandates? (If yes) What is the total amount of assets you manage currently?

Richard Klijnstra: The total size of the Euro Credit strategy is EUR 3bln. This includes (German) mandates, a non-Financial Credit, a Sustainable Credit, and a less-constrained Credit Plus strategy. The total assets managed by Kempen Capital Management are EUR 38.5bln.

e-fundresearch.com: How long have you been in the business as a fund manager?

Richard Klijnstra: I started working in the financial industry in 1996 at an insurance company and started as a portfolio manager in 2001 with a focus on CDO’s and credit portfolios.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

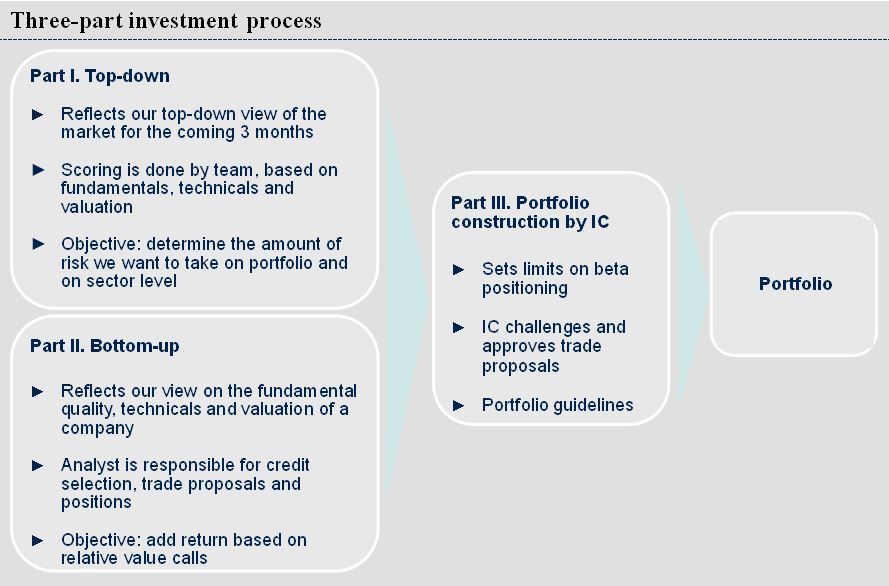

Richard Klijnstra: The investment process for the Euro Credit Strategy consists of 3 parts. Both top-down and bottom-up are equally important steps in our investment process.

2.) Bottom-up investment approach: our bottom-up investment approach consists of 5 steps starting with a quantitative screening of the Investment Grade and ABS universe. This limits the universe to approximately 300 issuers. Afterwards, we analyse credits by name in the sector and rank those names on credit quality.

3.) Portfolio construction: the portfolio construction is directed by the investment recommendations of the sector Analysts (bottom-up) and our market and sector view (top-down). The portfolio is constructed by determining a beta target and risk limits on a monthly basis. The most important metrics on which we manage the portfolio are beta, ex-ante tracking error and market weight on issuer and issue level.

Our competitive edge is the efficient combination of top-down and bottom-up analysis, the experience and proximity of the team, the risk control focus and the emphasis on beta, and our nimbleness.

e-fundresearch.com: How many positions does the portfolio usually contain and what is the average holding period of an investment?

Richard Klijnstra: The minimum number is 100 and the average is around 130 companies. The holding period of an investment ranges between a few days and a few years depending on the fundamental development of the company and the spread performance. The average holding period is 3 to 6 months.

e-fundresearch.com: To which extent does fund size impact the efficiency and effectiveness of your investment strategy?

Richard Klijnstra: Unfortunately, the underlying liquidity in Euro Credit markets is still relatively constrained. This means that any manager that becomes too large in terms of asset base faces a potentially negative impact from being active in the portfolio. We don’t want this to happen and have thus concluded that we need to limit the capacity in our Euro Credit strategy, even if this means we have to close to new entrants.

e-fundresearch.com: In which market environment does your investment strategy deliver the best (relative) results?

Richard Klijnstra: We focus on relative risks in comparison to the benchmark and have so far shown to deliver risk-controlled performance in both up- and downward markets. In general however, positive market momentum with tightening spreads and new issue activity is supportive to results. In the current market environment we see more potential value from our less-constrained Credit Plus strategy that offers more leeway and flexibility to invest.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

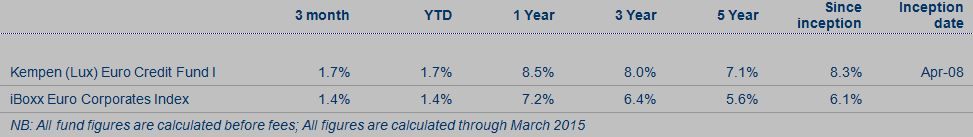

Richard Klijnstra: We use the iBoxx Euro Corporates Index as our benchmark. We believe any manager should be judged over a longer period of time, ideally up to 5 years, compared to its benchmark. Peer group comparisons are even more useful to judge the relative skillset but often lack direct comparability due to differences in underlying manager approaches. This should be used with caution therefore.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

e-fundresearch.com: What motivates you in your job?

Richard Klijnstra: What really motivates is to find companies with sound credit fundamentals at an attractive spread. We want to be selective in providing credit to companies and to outperform passive investments.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Richard Klijnstra: I would also have loved to be a family doctor.

e-fundresearch.com: Thank You!

3-Year Performance: Kempen (Lux) Euro Credit Fund vs. Peer-Group-Average

Weitere beliebte Meldungen: