e-fundresearch.com: To what extent does your investment strategy rely on external research and ratings?

Thierry Larose: The in-house SRI filter developed to assess the sustainability of states uses a number of external sources. Their reputation and reliability is crucial for a criterion to be taken into consideration. Sources that are typically used are the OECD, the World Bank, Eurostat, the International Labour Organisation, the World Health Organisation, Unesco, etc. In addition, some NGOs are also selected, provided they have an objective analysis on the matter. This implies that NGOs that might be too aggressive and that are prejudiced in analysing the data will not be used. The quality of the selected sources is reviewed every six months by the scientific committee in charge of implementing the model, the methodology and the final validation of the country ranking.

For the normative screening for Petercam L Bonds Emerging Markets Sustainable, we specially use the data from Freedom House and The Economist.

The portfolio manager, for the financial management, relies on internal research (strong interaction with the senior economist specialised in emerging markets), as well as external sources, of which field trips are very important as they enable the manager to assess the situation of a specific country.

e-fundresearch.com: A minimum of 70% of your portfolio is being invested in local currency bonds – in light of a potential rate hike in the US: Why should investors favour LC vs. HC in the current market environment?

Thierry Larose: History shows that high real interest offered on Emerging Market Debt compensate for the additional currency and interest rate risks taken by investors.

However, the decision to invest in LC debt should not be exclusively based on the carry trade opportunities only. Factors, like FX volatility, , external deficits, foreign participation in the public debt market and political stability are paramount when an investment in a LC market is being contemplated.

Opportunities in LC still exist even if normalization in US monetary policy will affect those markets that are more dependent on foreign portfolio flows to finance their external imbalances.

Attractive real yields

On average, 10-year real yields in the Emerging Markets universe is 4.25% higher than in the United States. That risk premium is approximately 0.25% higher than it was a year ago, and 1.03% more attractive than it was just before the taper tantrum sell-off began.

Looking at Emerging Markets currencies separately, there is a handful of cases where real yields look particularly attractive given implied and realized volatilities of the FX, shaping an efficiency frontier between real yields and volatilities: Thai baht, Indian rupee, Indonesian rupiah, Mexican peso, Brazilian real, Colombian peso, Romanian leu and Hungarian forint to name the ones with the best risk-adjusted real yields.

2014 performance

Another point of attractiveness is that EM currencies lost circa 12% in nominal terms vs the USD in 2014:

With the Fed slowly but surely moving in the direction of a first rate hike in 2015, some fear we could see a repeat of last year’s EM currency turmoil. However, those fears seem largely overdone. While it is quite possible that EM currencies see some further depreciation against the USD, they should hold up firmly against the EUR. Indeed, on current economic conditions and expectations of relative monetary policy, the EUR is set to depreciate further against the USD.

In addition, the BoJ and the ECB are more than ever in easing mode and therefore global liquidity is set to remain abundant.

Tailwinds for recipient countries

Currencies of recipient countries (i.e. countries with large current account deficits) are theoretically more fragile than others to a tightening in US monetary policy.

But given the recent collapse of oil prices, sharp nominal FX depreciations, higher real interest rates in general and the fact that the first rate hike in the US should now be widely anticipated (apart from the exact timing), we do not expect to see a repeat of the 2013 selloff anytime soon.

e-fundresearch.com: Many Investors are cautious with SRI-products as they are afraid of systematic performance disadvantages compared to conventional strategies. What is Petercam’s opinion on this issue? How does the sustainability focused strategy perform compared to traditional strategies?

Thierry Larose: The objective of the fund is to optimise the risk/return pair and to avoid tail risks linked to investing in unstable and unsustainable countries. The sustainability analysis, combining a norms-based screening based on democratic values with a best-in-class and best effort approach, has been able to avoid tail risks.

This fundamental analysis has given the portfolio management team the necessary tools to avoid the most volatile countries such as Russia or China, which do not meet minimum democratic requirements according to reputable sources. Instead, it enables them to concentrate on countries delivering a sustainable yield. Indeed, at least 40% of the portfolio must be invested in countries in the top quartile of the ESG ranking, bringing stability to the portfolio.

The portfolio can not invest more than 10% in countries in the bottom quartile of the ranking, where higher yielding opportunities can be found. This analysis, combined with the longstanding financial expertise, has allowed to avoid countries like Argentina, which defaulted for the second time in 2014, or Ukraine and Venezuela, which have not defaulted yet but are priced accordingly by the markets.

The sustainability filter has brought added value since inception, not only in terms of financial performance (alpha) but also in terms of volatility control (beta).

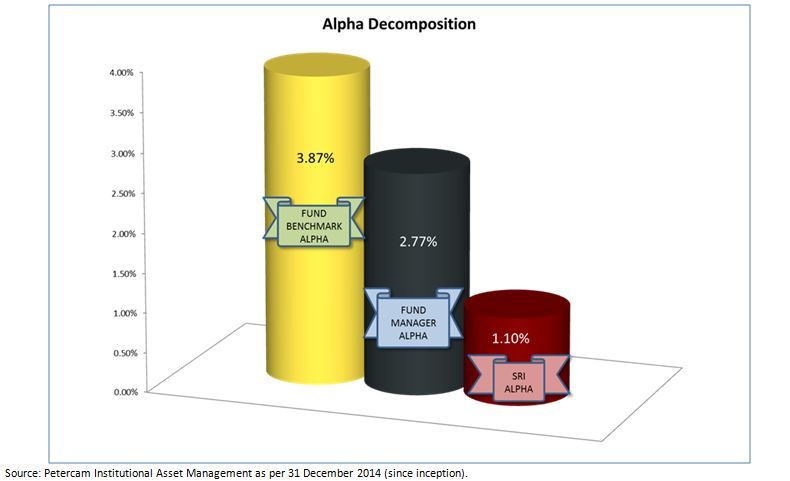

When comparing the performance of Petercam L Bonds Emerging Markets Sustainable since inception (March 18th 2013) until 31 December 2014 against a performance indicator composed of 75% local currency emerging market debt and 25% hard currency debt (Barclays indices), the results have been quite positive.

The sustainability screening[1] as such has returned a positive alpha of 1.1% annualised compared to the index, the active management style has added a further 2.77% to the outperformance, resulting in a compelling total alpha versus the reference index of 3.87%.

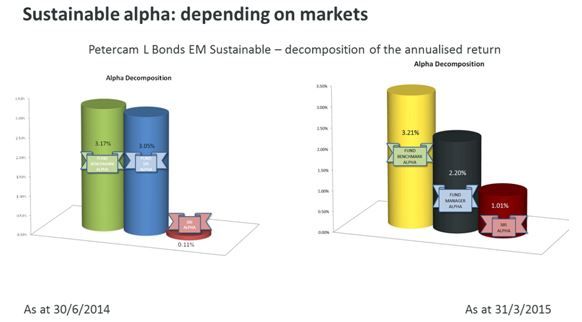

Thierry Larose: During periods of market turmoil, we see that the sustainability overlay adds value in the sense it lowers the volatility of the portfolio (quality bias).

We invest 40% in the top quartile, which are more developed and stable countries. Max 10% in the lowest quartile. When the markets are driven by a strong beta rally, we may underperform a bit (for instance when Russia and China would do very well).

But in period of rally, our performance testifies that the SRI overlay is not an hinder to participate in such rally as well.

e-fundresearch.com: What are the most significant challenges and opportunities EM debt investors will be facing in the remaining course of the year?

Thierry Larose: Our opinion is still that yields are going to stay lower for longer, with yield curves flattening further.

In the context of a world awash with cheap liquidity, we expect EM debt will continue to thrive on the hunt for yield, given its attractiveness in relative value terms. The risk to this scenario would be a pickup in US core inflation, which would derail our base scenario that the Fed is going to hike rates gradually. As always, our positioning in high beta countries will stay limited and opportunistic, as we prefer to look at them from a contrarian perspective.

Beyond our sustainability guidelines, we will also avoid ultra-high beta situations with too much idiosyncratic risk, due to a lack of political transparency, appropriate governance standards and accounting reliability.

e-fundresearch.com: Thank You!

Weitere beliebte Meldungen: