e-fundresearch.com: Eric Bendahan, you are the fund manager of the Eleva European Selection (ISIN: LU1111643042). When did you take over the responsibility of managing this fund and what is your overall experience in managing European equity strategies?

Eric Bendahan: The Eleva European Selection Fund has been launched on 26th of January 2015. Since then I´m managing the fund. Prior to setting up Eleva Capital I was at Banque Syz & Co. for 9 years until August 2014, responsible for EUR 2.5 bn in European Equities. And prior to that I managed EUR 2.5 bn in European Equities at AXA Investment Managers.

e-fundresearch.com: With Lipper for Investment Management currently listing more than 1.750 European equity strategies that are available to investors, competition is extremely tough. What was your motivation to launch a European equity strategy anyway and by what means do you plan to stand out from the crowd?

Eric Bendahan: It is clearly a competitive group. That said, we believe we can differentiate with a high alpha ( 90 pct active weight, 6 pct tracking error) active and opportunistic. We focus on 4 segments of the market:

-Family and foundation owned businesses. It gives these companies a competitive edge in our view because they can plan and think long term. These companies have on average materially outperformed the European equity indices over the long term.

-Differentiated business models in a mature industry. In our view a cheap way to get fantastic business models.

-We look for the message of the credit markets to draw equity investment decisions. It is useful to find turning points, and identify early potential balance sheet deterioration or improvements.

- We look for companies where major change is taking place; it can take the form of a management change or a consolidation in a difficult industry.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors? Which specific factors are triggering buy- and sell-decisions?

Eric Bendahan: We believe that our approach is fairly unique and allows us to focus in areas that the market misunderstands. For example most equity investors will not incorporate the credit market messages as they tend to be seen as different asset classes.

Once a company enters our radar screen, we will do a detailed review of its business model, and set a price target with a 2 year time horizon. It needs to be greater than 30 pct to justify an investment. If this price target is reached, we will make a decision on the presence of a company. Adversely it is open to keep an open mind, and constantly make sure that we did not get it wrong. Humility is in my view a key attribute in this industry!

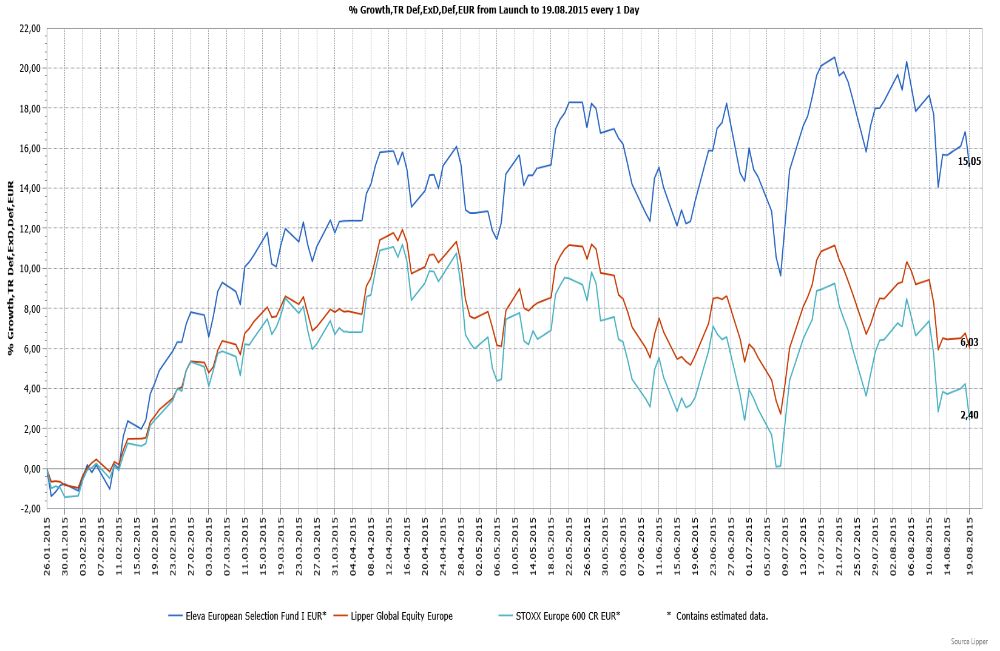

Eleva European Selection (LU1111643042): Performance since Launch

e-fundresearch.com: What is your approach to risk management?

Eric Bendahan: We run both a qualitative approach and a quantitative one. On the qualitative side, it is helpful to screen at the credit market for potential balance sheet deterioration. We also run all the risk report to ensure that liquidity metrics are under control and that upside on each stock is aligned with its risk metrics.

e-fundresearch.com: How many positions does the portfolio usually contain and what is the average holding period of an investment?

Eric Bendahan: 49-50 positions on average. Only active weight that explain the high active share at 90 pct. Holding periods vary but are typically 18 months.

e-fundresearch.com: Relative to competitors: In which market environment should your investment strategy be able to deliver superior results?

Eric Bendahan: Market with normal volatility patterns are typically good for our strategy.

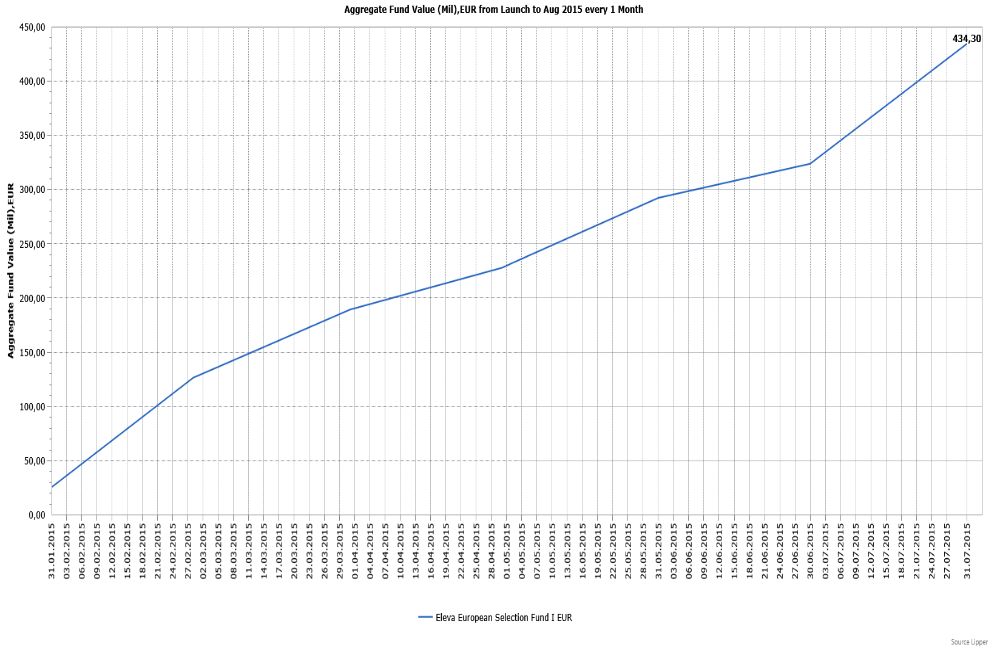

Eleva European Selection: Volume Development since Launch

e-fundresearch.com: Banks and Consumer Discretionaries are currently playing a major role in your portfolio – what is the rationale behind that?

Eric Bendahan: We particularly like banks at the moment. There is at the moment a unique combination : improving loan growth, commission income and credit quality at a time where costs are going down and regulatory constraints are easing. Banks have provided the best positive surprises so far this year and we expect it to continue.

e-fundresearch.com: What are your personal lessons learned from year-to-date market developments and what will be biggest challenges for your strategy going forward?

Eric Bendahan: Well it has been a busy time as we have launched the fund early this year. Even if from the outside it looked like a very macro driven market -QE, Greece, China- there has been a few stock picking oriented companies with more than 30 pct stock price performance. Our challenge is to continue to find them!

e-fundresearch.com: Thank you!

Weitere beliebte Meldungen: