e-fundresearch.com: Mr Charles F. Michaels, you are the fund manager of the Sierra Europe UCITS fund. ISIN: LU0929020484. When did you take over the responsibility of managing this fund and how long have you been in the business as a fund manager?

Charles F. Michaels: I am pleased to say, that I've been running the Sierra Europe fund for over 19 years, with the launch of the fund in October 1, 1996. I also have been running the UCITS fund for over 2 years, having launched this weekly liquidity product in June of 2013.

e-fundresearch.com: What is the current size of the fund?

Charles F. Michaels: The size of the UCITS fund is about USD 80m, as of 30 September.

e-fundreserach.com: Do you also manage other funds or mandates? (If yes) What is the total amount of assets you manage currently?

Charles F. Michaels: No, I am a dedicated European manager, with one strategy for the firm.

We have both an onshore and offshore fund, alongside the UCITS vehicle with total AuM’s of about USD 250m, as of 30 September.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Charles F. Michaels: Over the past 2 decades, we have established a proprietary watch list for long and short investments. The watchlist serves as a launchpad for identifying ideas that go into the portfolio. The long watchlist is comprised of value creating companies with long competitive advantage periods, while the short watchlist consists of names we feel destroy value and cannot adapt to a changing world. Using our internally created watchlists, we have a 2-step capital allocation process that enables us to create and manage an alpha generative portfolio. Our edge includes our process which was just described, our value oriented growth philosophy, and our unique perspective.

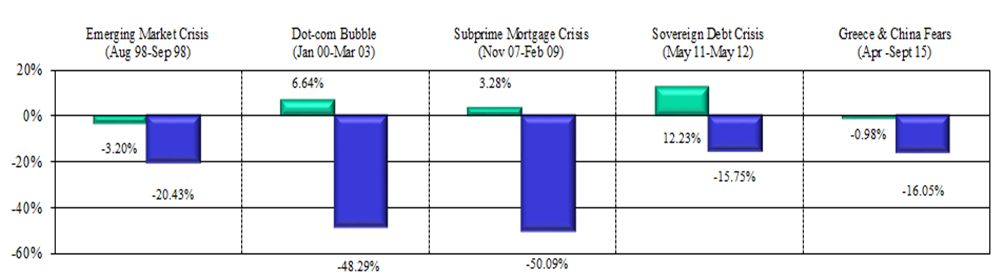

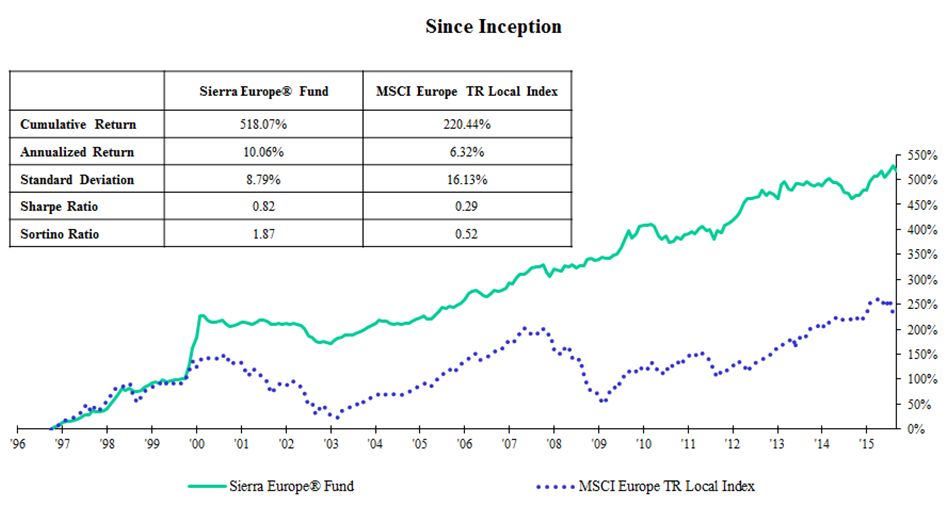

Another pillar of our investment-process is our approach towards risk-management. The Fund will generally target a net exposure ranging from 0-70% and a gross exposure ranging from 150-200%, subject to the Sub-Investment Manager’s discretion. This helped us in the past to avoid on an average 95% of the monthly index decline, while achieving over 10% net returns since the launch of the strategy.

This helped us as well to perform well in the worst times, i.e. the five 15% plus market drawdowns in the past 19 years.

e-fundresearch.com: How many positions does the portfolio usually contain and what is the average holding period of an investment?

Charles F. Michaels: The long and the short portfolio each typically includes 30-50 names.

We are generally long term investors, investing in longs from 1-5 years, and in shorts for less time, generally for 3 months to 2 years.

e-fundreserach.com: To what extent does fund size impact the efficiency and effectiveness of your investment strategy?

Charles F. Michaels: Because we hold a very liquid portfolio, we are nimble and can maneuver easily in volatile markets.

e-fundresearch.com: In which market environment does your investment strategy deliver the best (relative) results?

Charles F. Michaels: The best environment for our strategy is, when the markets focuses on company fundamentals, which fortunately, is most of the time.

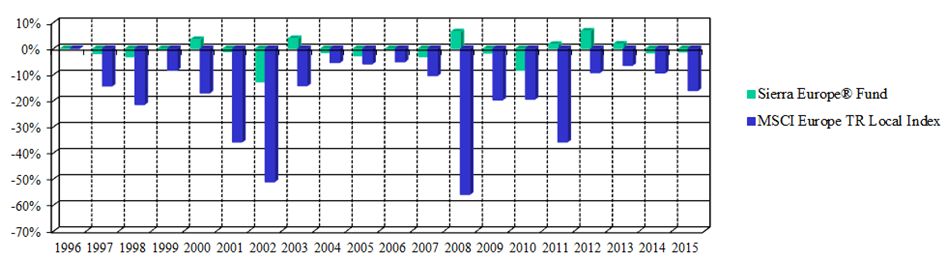

As our approach allows us to generate positive returns in both down and up-markets, we saw probably the best relative performance, when markets declined strongly. So we could for example generate positive returns in the strong downturns in 2008 (+8.01%) or 2011 (+4.56%).

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Charles F. Michaels: As we are an absolute return fund, it is important for us to generate an attractive return regardless of the market environment. As our approach is quite unique(different), we cannot be easily compared with other long/short-managers and consequently offer a low correlation to our peers (Europe long/short equity). However, for comparative measures, we show our returns vs. the MSCI Europe total return (NDDLE15 index) which we have beaten since inception (see chart).

e-fundresearch.com: Why is it time for asset allocators to put increased focus on long/short-strategies?

Charles F. Michaels: As equity and bond prices are elevated, investors in these asset classes are faced with higher potential risk. Therefore, a hedged L/S strategy should provide better risk adjusted returns in this environment.

e-fundresearch.com: What are your personal lessons learned from year-to-date market developments?

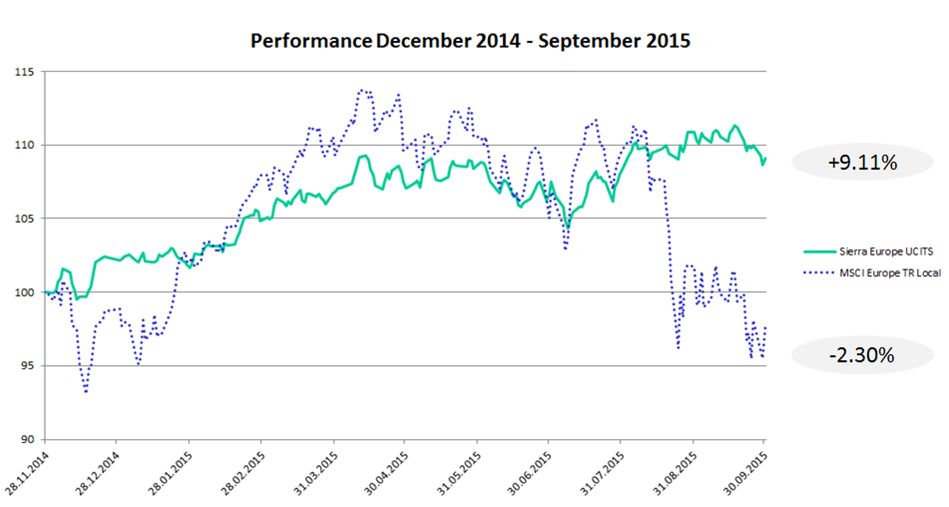

Charles F. Michaels: As seen this year and in years past, it is vital to portfolio management to be on constant alert for big "icebergs" of risk in the market. The example we highlight this year is the chinese RMB float, which caused the market to drop significantly in August over global slowdown fears; one had to be listening to the market indicators at this point to reduce risk appropriately, which we successfully executed by reducing the net-exposure in our portfolios.

e-fundresarch.com: To what extent has your portfolio been able to benefit from the increasing M&A activity in Europe?

Charles F. Michaels: We have seen as number of M&A benefits this year in our portfolio with consolidation and M&A in two sectors: European telecom and german property. Additionally, a UK software company we invested in benefited from a bid.

e-fundresearch.com: How optimistic is your view into the future and what obstacles and challenges should European equity investors be prepared to overcome going forward?

Charles F. Michaels: The numerous positive levers supporting the European markets, including quantitive easing, stabilizing earnings expectations, low energy prices, reasonable valuations, and a competitive currency continue to be very encouraging for European equity markets. However, risks to monitor now include U.S. Interest rates, a slowdown in China, plummeting emerging market currencies, and any new possible surprises that could come to the market.

e-fundresearch.com: Thank You!

Weitere beliebte Meldungen: