e-fundresearch.com: What lessons have you learned from 2015?

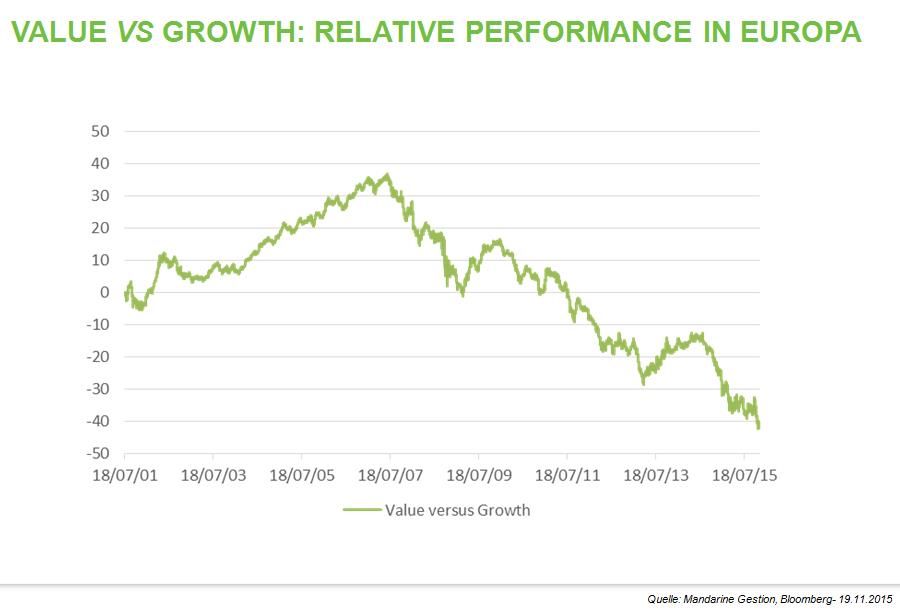

Marc Renaud: A few things: Quantitative easing is definitely the enemy of the value investment style. When a market is going up only because interest rates are going down in a low growth environment, investors are carrying on buying defensive growth stocks whatever the price.

Short-term investors are now dominant (hedge funds, long-short, speed traders…) which means that markets are more and more violent.

And a few other things.

Value-Manager hatten es nicht leicht....

e-fundresearch.com: To what extent has your strategy been able to benefit from this year's market environment and which particular investment themes have delivered the strongest performance contribution on a year-to-date perspective?

Marc Renaud: My strategy suffered a lot in this very adverse environment and only a few defensive stocks contributed positively to the performance (Veolia, Fresenius, Allianz…).

e-fundresearch.com: Are you more or less constructive than you were this time last year, and why?

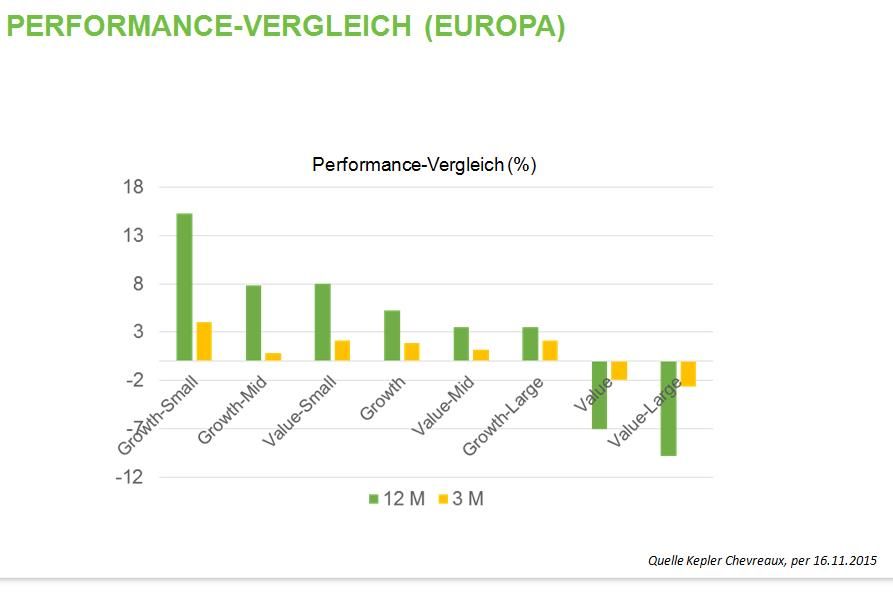

Marc Renaud: On the economy, I am less positive, US growth is fading, most of emerging markets are in trouble, Europe, still ok, might have difficulties to carry on alone. The US market is expensive, Europe can go up only if US markets do not fall. One piece of good news is that the market is split between growth stocks and small caps at high valuation levels on the one extreme and large value stocks at stupidly low prices on the other. For the past 2 to 3 months, the value style has started to outperform in the US (not yet in Europe), in the wake of Janet Yellen’s announcement that she was ready to increase interest rates.

e-fundresearch.com: What are the key themes likely to shape your strategy going forward and how are you likely to position your portfolios as a result?

Marc Renaud: I am ready for a positive and relative correction of value stocks (cyclicals, financials…), provided the increase in interest rates in the US turns out to be a sustainable trend.

Führt die US-Leitzinswende zur Value-Outperformance?

e-fundresearch.com: What obstacles and challenges should investors be prepared to overcome in 2016?

Marc Renaud: The end of QE in the US, a continuation of the slow-down in China at the current rhythm, the ability for Europe to be self-sufficient in a recovery and a few other things…

e-fundresearch.com: Thank You!

Weitere beliebte Meldungen: